On 21 Feb, I have done a writeup on China Sunsine pointing that they may be on the cusp of a recovery

http://www.sharesinv.com/articles/2014/02/25/sunshine-michelin-tyres/. Since my writeup (Sunsine closed at $0.255 on 21 Feb), it has surged 36.7% (inclusive of a dividend of $0.01 during the period) to touch an intraday high of $0.335. It closed at $0.310 on last Friday.

Sunsine’s 1HFY14 net profit exceeds the entire net profit earned in FY13

Based on Table 1 below, Sunsine seems to be turning around with 2QFY14 sales and net profit up significantly from the previous few quarters and on a year on year comparison. What is interesting is that 1HFY14 net profit has exceeded the net profit earned in the entire 2013. This good set of results is on the back of the increase in ASP, as well as, sales volume.

Table 1: Sunsine’s results snapshot (Not able to post here due to formatting problems)

Source: Company & Ernest’s compilations *ASP may differ slightly with company’s reports due to rounding

3QFY14F looks bright on several aspects

The upcoming 3QFY14F looks bright on several aspects.

Firstly, according to brokerage 中信建投证券, the supply of MBT, an intermediate product necessary for the production of MBT based accelerators dropped more than 30% as some of the MBT producers were forced to close down or suspend production due to their inability to meet the environment standards set up by the Chinese authorities. As MBT prices rise, so does the MBT based accelerators. Although China Sunsine has their own factory for production of MBT, they have been compliant with the environment standards hence their production is not affected.

Secondly, the accelerators’ inventory levels in China have been reduced due to an increase in export of accelerators to overseas.

The above trend of relatively high prices of accelerators is unlikely to ease in the near term as companies take time to rebuild / improve their production facilities and comply with the environment standards. In addition, China is likely to maintain their resolve in reducing pollution especially with the upcoming APEC meeting in November.

Thirdly, raw material prices continue to be stable hence it is unlikely to have a significant adverse impact on its upcoming 3QFY14F results.

Sunsine has paid $0.01 / share as dividends for seven consecutive years

For seven consecutive years, Sunsine has paid $0.01 / share as dividends. At Friday’s closing price of $0.310, this represents a dividend yield of 3.2%. There may be scope for higher dividends as Sunsine 1HFY14 net profit eclipses that of FY13.

Stark discount to its Chinese peers

Sunsine trades at 0.8x P/BV and annualised 2014F PE of around 4.3x. Net asset value per share is around $0.380. On a historical basis, Sunsine trades at an average P/BV and P/E of around 1.0x and 7.3x respectively.

With reference to Figure 1 below, it is noteworthy that its peer Shandong Yanggu Huatai Chemical (“YGHT”) trades at 35x FY14F PE and 4.6x FY14F P/BV. Furthermore, YGHT’s estimated FY14F revenue and net profit are lower than Sunsine’s 1HFY14 figures.

Figure 1: Analysts’ estimates of YGHT’s financials in the next 3 years

Source: Bloomberg as of 25 Aug 14

As with all investments, there are naturally risks and noteworthy points to be aware of.

Investment risks

Illiquidity

Average 30D and 100D volume amount to 1.3m and 557K shares respectively. Although this is still pretty illiquid, it has improved from my last writeup where the average 30D and 100D volumes amount to 1.19m shares and 422K shares respectively. Based on its annual report 2013, the top twenty shareholders have about 83.7% of Sunsine’s outstanding shares. Thus, there is little free float which results in its illiquidity. This is not a liquid company where investors can enter or exit quickly.

S chip risk

This is a Chinese company helmed by Chinese management hence the usual S chip risk applies.

No analyst coverage

According to Bloomberg, there is currently no rated analyst coverage on this stock. It is reasonable to say that the investment community is not familiar with Sunsine yet. However, there seems to be more interest in this counter as I have started seeing unrated reports on Sunsine and online forums where they talk more about Sunsine than before.

Exposed to the vagaries of the automotive industry cycle

As Sunsine’s products are used mainly by the tyre manufacturers, Sunsine is exposed to the vagaries of the automotive industry cycle in China. For 1H2014, China’s auto sales rose 11% on a year on year comparison to 9.1m. A significant slowdown in the China’s automotive market is likely to have an adverse impact on Sunsine.

Margins dependent on raw material cost

Most of its cost of sales came from direct raw material costs, namely Aniline. According to Sunsine’s AR2013, ceteris paribus, every 10% increase / decrease in the prices for Aniline would have the effect of decreasing / increasing the net profit by RMB30.1m in FY13. As such, raw material costs do play a significant aspect in Sunsine’s profitability. As mentioned above, Aniline prices have remained pretty stable since the start of the year.

Other developments

Sunsine is on track to complete its new heating plant by 3QFY2014. This may incur some additional costs but it is likely to be an interesting cash flow generating investment over the medium term. See my previous writeup for more information on this.

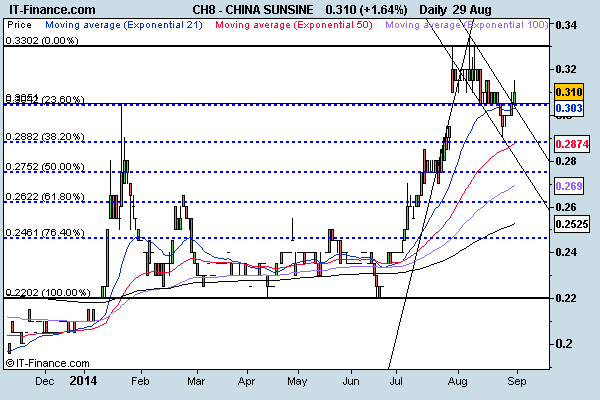

Sunsine’s chart analysis

Since my writeup (Sunsine closed at $0.255 on 21 Feb), it has surged 36.7% (inclusive of a dividend of

$0.01 during the period) to touch an intraday high of $0.335. It closed at $0.310 on last Friday. Based on Chart 1 below, Sunsine has closed the gap around $0.290 – 0.310 as it weakens from $0.335 on 7 Aug. It seems to have just formed an upside break in the flag formation. However, we have to monitor how the price performs in the next few days. A sustainable upside breakout above $0.305 with volume points to a measured eventual technical target of around $0.365.

Supports and resistances are as follows

Supports:

$0.300 / 0.290 / 0.275

Resistances:

$0.320 / 0.330 – 0.335 / 0.350

Chart 1: Seems to have staged a flag breakout

on the upside

Source: CIMB chart as of 28 Aug 2014

Conclusion – FY14F likely to be a record year for Sunsine

Sunsine seems to be in a sweet spot at the moment and FY14F may well be a record year for Sunsine. Nevertheless, as there is no rated analyst coverage on this stock, it may take time for the market to appreciate it. Notwithstanding the potential positive points about Sunsine, readers should note that this is an S chip which is subject to S chip risk, fluctuations in raw material prices and the vagaries of the automotive industry cycle in China.

Disclaimer

The information contained herein is the writer’s personal opinion and provided to you for information only, and is not intended to, or nor will it create/induce the creation of any binding legal relations. The information or opinions provided herein do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or invest in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein are suitable for you. The writer will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials appended herein. The information and/or materials are provided “as is” without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Wow, incredible weblog layout! How lengthy have you been running

a blog for? you make blogging glance easy. The whole glance of your website is excellent, as smartly as the content!

You can see similar here dobry sklep