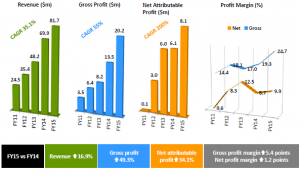

ISOTeam reported its FY15 results on 28 Aug 2015 before market. FY15 revenue and net profit surged 17% and 34% respectively to S$81.7m and S$8.1m respectively. Please see Table 1 for a summary of its results for the past five financial years.

Table 1: ISOTeam’s past five financial year performance

Source: Company

Highlights of FY15 results

1. Once off expenses amounting to a total of S$1.8m

In FY15, ISOTeam recorded some once off depreciation expenses amounting to S$1.5m. In addition, it also incurred professional fees due to legal costs and acquisitions of new subsidiaries amounting to S$0.3m. These S$1.8m expenses are unlikely to be incurred in FY16F.

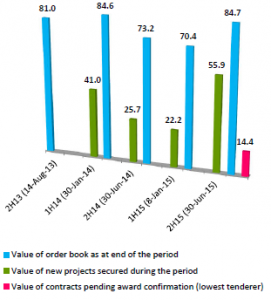

2. Record order book

Based on Table 2 below, ISOTeam is sitting on a record order book amounting to S$84.7m. It is currently the lowest tenderer for five projects pending tender award confirmation, worth S$14.4m.

Table 2: ISOTeam’s order book trend

Source: Company

3. Gross margins surged to 24.7% in FY15

With reference to Table 1 above, ISOTeam’s gross margins have surged to 24.7%, a record high for the past five financial years. This was achieved due to economies of scale and completion of higher margin R&R projects. Nevertheless, management believes that such high gross margins of 24.7% are unlikely to be sustainable. Management targets to maintain gross margins >=20%.

4. Burgeoning cash pile of S$32.3m

As on 30 Jun 2015, ISOTeam has a burgeoning cash pile of S$32.3m from its recent placements and positive cash flow from operations. Its market capitalization is around S$81.5m. Net cash is around S$28m or S$0.196 / share. In other words after stripping off its burgeoning cash, ISOTeam trades at 6.6x reported FY15 earnings.

Chart analysis

With reference to Chart 1 below, ISOTeam fell to an intraday low of S$0.485 on 24 Aug, Mon but closed at $0.570 last Fri. Chart looks bearish and its price should go above $0.590 in order to negate the bearishness in the chart.

Near term supports: 0.565 / 0.550 – 0.555

Near term resistances: $0.590 / 0.600

Chart 1: ISOTeam has to breach $0.590 to negate the bearishness

Source: CIMB chart as of 28 Aug 2015

Conclusion

ISOTeam continues to be in a sweet spot (possible election play) as demand is likely to stay robust for its R&R and A&A activities in view of the on going initiatives by the Singapore government to renew and rejuvenate mature and middle aged estates. Both UOB and DMG cover ISOTeam. If ISOTeam can continue to deliver on its results, it is likely to attract more analysts to take a closer look at them.

Readers can also read my previous writeup on ISOTeam here.

Disclaimer

Please refer to the disclaimer here http://ernest15percent.com/index.php/disclaimer/.

Hi Ernest, how do you view the recent proposed 1 for 1 bonus issue for isoteam?

HI Carson, thanks for visiting my blog. I view it positively as it increases the liquidity of ISOTeam’s shares.