Capital World (formerly known as Terratech Group Limited) has slumped a whopping 46% from its intraday high of $0.240 on 29 Mar 2017 to close $0.130 on 1 Jun 2017. What has happened to cause such a massive fall? Will it fall further?

Company description

Capital World is an innovative property developer that works with landowners on a joint venture basis to create value added property developments. Such joint venture requires minimal capital outlay and maximises investment returns. It is currently developing Project Capital City, an integrated property project comprising a retail mall, hotel and serviced suites and serviced apartments along Jalan Tampoi, Johor Bahru, Malaysia. The Group has also entered into joint venture agreements to develop Project Austin, an integrated development project which is expected to comprise a retail mall, office suites, hotel and serviced residential apartments, and Project Sitiawan Wellness Hub, a mixed development project focusing on providing health and wellness services.

The Group is also engaged in the production and sale of premium quality marble blocks and slabs, aggregates and calcium carbonate powder from its quarry in Kelantan, Malaysia.

What’s interesting about Capital World?

Attractive business model

The most attractive aspect of Capital World is its innovative business model. In Malaysia, there are numerous landowners who have sizeable plots of land (perhaps due to inheritance). Such plots of land are typically in mature estates where the landowners do not know how to best maximise the returns on the land. Capital World fills this niche by working with the landowners on a joint venture basis to create value added property developments.

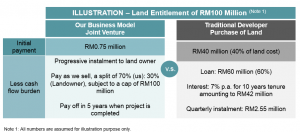

With reference to Figure 1 below, for a land entitlement of RM100m, there are several pertinent points.

a) Capital World puts in a fraction of the initial payment to start the project. Based on the numbers below, given RM40m of initial payment for a traditional developer, Capital World can theoretically scale up to do at least 50 projects of such size via its unique business model!

b) Due to the low capital outlay, Capital World does not need to borrow whereas a traditional developer may need to borrow RM60m with quarterly instalment of RM2.55m. Furthermore, Capital World pays the developer as it sells the properties. Thus, there is less pressure on cash flows.

c) It is noteworthy that Capital World will pay the land owner up to a cap of RM100m. i.e. it does not need to share the profits of the developments with the land owner.

d) Capital World typically targets land in mature estates where there is a sizeable catchment area which is ready for construction.

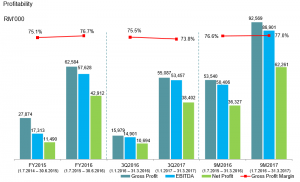

e) High margins for such business model as there are little or less interest costs. (See Figure 4)

Figure 1: Capital World’s business model

Source: Company

Good set of results

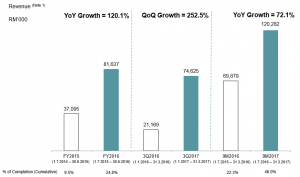

Capital World released a good set of results last Mon. With reference to Figures 2, 3 & 4, 3QFY17 revenue and net profit were RM75m and RM38m respectively which were almost on par with the revenue and net profit generated for the entire FY16! 9MFY17 revenue and net profit soared 72% and 71% to RM120m and RM62m respectively. Margins were robust with net margins holding steady above 50% since FY16.

In addition, typically at the start of the project, the percentage of completion is slowest as they do more foundation and piling works. Capital City (their current project) is now at the Mechanical and Electrical stage where the percentage of completion can be completed faster. This is corroborated from the percentage of completion where it has increased from 24.8% as of 30 Jun 2016 to 46.0% as of 31 Mar 2017. This percentage of completion is likely to trend towards 100% by around Jun 2018.

Figure 2: 3QFY17 revenue almost on par with FY16 revenue!

Source: Company

Figure 3: 3QFY17 net profit almost on par with FY16 net profit!

Source: Company

Figure 4: Impressive margins

Source: Company

Results briefing

During the results briefing on last Monday, I saw analysts from various houses such as CIMB, Daiwa, Jefferies, Lim & Tan and NRA etc. As of now, there are only unrated reports from Daiwa and Lim & Tan. If Capital World continues to deliver, it is likely to attract analysts’ attention.

Project Austin and Project Sitiawan in the pipeline

Besides focusing on delivery of Capital City, Capital World targets to launch Project Austin at the end of the year, or early 2018 subject to government approvals. It also has another Project Sitiawan Wellness Hub to be launched in the medium term. Given their current project pipeline, they seem to have enough business on hand even if it does not get any new projects in the next one year.

Chart analysis

Based on Chart 1 below, the recent incessant selling has already pushed Capital World to trade at prices lower than the price when it first proposed the RTO on 9 Jun 2016 (price was S$0.204 on 9 Jun 2016). Price seems entrenched in a strong downtrend. However, there seems to be a bullish harami formation on 31 May 2017, coupled with a (bullish) gravestone doji formation on 1 June 2017. In addition, indicators such as RSI and MACD are oversold and exhibit bullish divergences. ADX is at an unsustainable level 50.9.

Given the current chart development, it is likely that Capital World should have limited near term downside with good supports at $0.120 – 0.130. However, it is noteworthy that a) we require a strong bullish candle or a gap in the next few days to confirm that selling has ended for the near term; b) The price continues to be entrenched in a medium-term downtrend until it makes a sustained close above $0.192.

Chart 1: Possible bullish harami formation and gravestone doji, coupled with bullish divergence

Source: Chartnexus 1 Jun 17

Near term supports: $0.130 / 0.128 / 0.124 / 0.120

Near term resistances: $0.138 / 0.145 / 0.148 / 0.151

Noteworthy points

Management will focus on realising synergies between marble and property business

Excluding the RTO expenses, Capital World’s marble business (i.e. Terratech) is still losing around S$4.2m for FY17 (FY16 lost S$3.6m). Management is aware and definitely plans to reduce the losses from the marble business. It is the midst of doing an in-depth review of Terratech’s business to see how best to derive synergies. However, as the RTO was only completed on 4 May 2017, it is natural that management needs some time to resolve this.

RTO expenses unlikely to be huge

Based on the RTO circular, Capital World has estimated RTO expenses of around S$3.3m, of which approximately S$2.0m have been booked in Terratech’s latest results. In other words, there is approximately another S$1m+ expenses to be booked in the subsequent quarter. However, it is noteworthy that their RTO expenses will not be as significant as the RM87.8m expenses (approximately S$28m+ expenses) booked by the likes of Hatten Land.

Conclusion / personal opinion

As Capital World continues to deliver and complete its Capital City project, it is likely that its results should be positive in the next few quarters. Based on an annualised FY17 earnings on Capital City (RM62.3m / 3 quarters x 4 quarters / SGDRM 3.1) and coupled with an estimated loss of S$6.8m core numbers (i.e. excluding non-recurring expenses, just a number plucked from the sky but it seems conservative), Capital World trades at an undemanding 8.2x FY17F PE as compared to the average FY17F PE of 20x for Malaysia developers.

P.S: As with all investments (most investments carry at least some degree of risk), readers should carefully evaluate each investment decision with care. I wish to emphasise that as I am not an analyst, the above annualised PE is just a simple back of the envelope calculation which may not be accurate. This is merely an introduction of Capital World. Readers should refer to SGX for more information and the unrated analyst reports from Daiwa and Lim & Tan.

Disclaimer

Please refer to the disclaimer HERE

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

WHAT ARE CBD GUMMIES? CBD Gummies are the most effective, delicious and convenient way to take your daily dose of CBD. Each delicious, calming, vegan gummy contains only 15 calories and helps you so support stress and anxiety throughout the day.CBD is short for Cannabidiol – one of over 120 known compounds found in the cannabis/hemp plant (Cannabis Sativa L.) while Gummies are delicious, sweet cubes of delight that can be taken anywhere and offer the perfect way to get all the benefits of CBD while on the move. CBD is the second most prevalent compound in the plant, is non-intoxicating and has been shown to help ease anxiety, improve sleep and promote muscle recovery by supporting the body’s natural endocannabinoid system. The role of the endocannabinoid system (ECS) is to maintain homeostasis (balance) across all of the vital systems within the human body. CBD interacts with the ECS receptors distributed throughout our brains and nervous systems, helping to regulate functions including appetite, sleep, inflammation and pain response.How long before I feel the effects of a CBD Gummy? The average time from eating a gummy to feeling the effects is around 30 minutes and the daily recommended dose is 70mg which leaves room for a morning, noon and evening treat. Embrace the art of relaxation everyday.HOW MANY AND WHEN DO I TAKE CBD GUMMIES?There is no right or wrong answer. If you are using CBD for pre-work anxiety, take one when you wake up. If you are looking to stay composed before a presentation, take one at the office. If you are searching for a more refined sleeping pattern, consider having your gummies up to an hour before you go to bed.Our CBD Gummies are contained in a compact tub and box so you can take your CBD with you wherever you go. Our packaging is also fully recyclable.Goodrays UK CBD gummies are packed with 25mg of premium quality CBD. Most consumers feel the full benefits of CBD after a 25mg dose while other more experienced users may require more. Each pack contains 30 gummies designed to last you between 2 weeks and a month, depending on your preferred daily dosage. While CBD is non-toxic, we recommend you don’t exceed 70mg per day as a general rule. Check out our 5 star reviews on the product page to see what our customers have to say!WHAT ARE CBD GUMMIES? CBD Gummies are a delicious compact and discrete way to consumer CBD. The CBD is infused with delicious, natural jellies for maximum enjoyment. WHAT ARE THE BENEFITS OF CBD GUMMIES? Every consumer is different but CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. ARE CBD GUMMIES AS EFFECTIVE AS OTHER CBD PRODUCTS? Yes CBD gummies are effective as other CBD products but for the fastest effects we always recommend CBD oils, taken sublingually so they can be absorbed quicker WHAT EFFECTS SHOULD I EXPECT FROM CBD GUMMIES? CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. HOW MANY CBD GUMMIES SHOULD I EAT? Between 2 – 3 gummies per day. HOW LONG DO THE EFFECTS OF CBD GUMMIES LAST? The effects of CBD last a few hours but for the best long-term affects we recommend that consumers use CBD daily to support the body’s natural Endocannabinoid System. DO CBD GUMMIES CONTAIN THC? No, all our products contain 0 THC ARE CBD EDIBLES EGAL? Yes, CBD oil is legal. Approved products are listed under the FSA’s Public List of Novel Food products which can be found here: https://data.food.gov.uk/cbd-products.

Because what could be simpler than chewing CBD sweets? Our CBD Gummies give you the most premium CBD extract in chewable form, so you can enjoy them anytime, anywhere. Inside each gummy, you get a 10mg dose in our 300mg strength or a 30mg dose in our 900mg strength, so we recommend chewing two CBD gummies per day for a fruity CBD serving that delivers. They’re a staple on our desks at Cannaray HQ. 2. They make CBD juicy and fruity At Cannaray, we’re big on fresh flavours that make your daily dose of CBD a joy. That’s why we’ve juiced up the CBD Gummies with orange extracts that are just the right level of zesty. Your only challenge? Trying not to eat them all in one go. (We recommend no more than 70mg of CBD per day.) 3. They’re 100 vegan and THC-free Enjoy your CBD gummies safe in the knowledge that they contain 100 vegan CBD. They’re also free of GMOs, sulphates and THC. Now you can chew with confidence. The rate of uptake for CBD varies, depending on a few factors, such as age, weight, metabolism, and the type of product you use. CBD gummies have medium absorption, meaning they are typically felt after 20-30 minutes. Each person reacts differently to CBD, so you may find it can take shorter or longer for the CBD to be absorbed into your system. The rate of uptake for CBD varies, depending on a few factors, such as age, weight, metabolism, and the type of product you use. CBD gummies have medium absorption, meaning they are typically felt after 20-30 minutes. Each person reacts differently to CBD, so you may find it can take shorter or longer for the CBD to be absorbed into your system.We recommend up to 3 gummies per day for the 300mg regular strength jar or 2 gummies per day for the 900mg high strength jar. Depending on the strength you choose, you can expect the following doses per gummy:Regular Strength CBD Gummies, 300mg: each CBD Gummy is 10mg CBD.High Strength CBD Gummies, 900mg: each CBD Gummy is 30mg CBD.Our CBD Gummies can be enjoyed alone or they’re great to mix and match with our CBD Oils and CBD Capsules.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ