This week, Sunpower attracts me due partly to the industry which it is in; the recent US$180m investments made by DCP and CDH into Sunpower whose market cap is only around US$206m, and the considerable 40% share price decline since hitting an intra-day high of $0.645 on 28 Jun 2018 to trade $0.385 today. Let’s take a look.

Description of Sunpower

Based on Sunpower’s description, it is an environmental protection solutions specialist in proprietary energy saving and clean power technologies. It has two main business segments, viz. Manufacturing & Services (“M&S”) and Green Investments (“GI”). M&S segment comprise of Environmental Equipment Manufacturing (“EEM”) and Engineering, Procurement and Construction Integrated Solutions (“EPC”). Notwithstanding the growth in M&S segment (Sunpower serves blue chip clients such as BASF, BP, Shell etc.), it plans to focus on its GI segment as it generates intrinsic value in the form of long-term, recurring and high-quality cash flows. Please refer to Chart 1 below and Sunpower’s company website HERE for more information.

Chart 1: Sunpower’s business segment

Source: Company

Investment merits

In an industry endorsed by China’s government policies

One of the most attractive aspects of Sunpower is the industry it is in. It is common knowledge that China places environmental protection as one of their utmost priorities. China’s 13th Five-Year Plan for National Eco-environmental Conservation and the enforcement of the Environmental Protection Tax are some examples that China is determined to reduce pollution in the long term. With reference to a July 2018 article by Reuters, China has established a new cross-ministerial leadership group (rather than just to leave solely to the Ministry of Ecology and Environment) to solve pollution in northern regions around Beijing. This also underscores the importance that China places on pollution. In view of these supportive policies, Sunpower seems to be in the right industry with sanguine prospects.

EEM and EPC segments illustrate Sunpower’s technology expertise

EEM segment comprise of design, R&D and manufacture of customised energy saving and environmental protection products with proprietary heat transfer technologies. Its products include heat exchangers and pressure vessels, and pipeline energy saving products. According to Sunpower’s annual report 2017, the heat-transfer rate of the Group’s heat pipes and heat pipe exchangers is 3,000 times faster than that of conventional products, and its heat exchangers are able to achieve energy savings of 30%-50%. This translates into significant cost reduction for customers. This may arguably be the reason why Sunpower has managed to secure a total of RMB150m from a single customer in U.S. and RMB 500m worth of contracts from GCL-Poly and other polysilicon companies.

For its EPC segment, one of the systems which Sunpower provides is the Flare and Flare Gas Recovery System. This is used to recover useful petrochemical by-products from flare or waste gas, reduce pollutant discharge into the atmosphere, lowering costs for customers. It is noteworthy that Sunpower is the only officially-appointed supplier of flare systems for Shell from Asia, and one of the three such suppliers for Shell in the world. It manages to secure a contract worth RMB107m with Zhejiang Petrochemical at the start of 2018. According to company, this is the largest flare gas recover system ever in China’s petrochemical industry which underscores Sunpower’s capability in managing EPC’s contracts.

Each business segment compliments one another

With Sunpower’s 20 years of track record in the EEM and EPC segments, it has progressed into its GI business with the ownership and operation of centralised steam, heat and electricity plants. These GI projects are built internally as Sunpower has the knowledge and capabilites to do so with its EEM and EPC business segments. Building in house allows Sunpower to have control over its costs and construction schedule, thereby increases its competitiveness against other players. Furthermore, its GI business naturally drives demand back to its EEM and EPC segments.

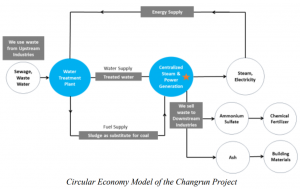

GI – interesting “circular economy” concept

Sunpower has brought recycling to the next level via this circular economy concept where the waste materials from one company or industry become the feedstock for another industry. For example, in Sunpower’s Changrun facility (see Chart 2 below), sludge and treated wastewater from a neighbouring water treatment plant are used as fuel and a clean water substitute to run its boilers. Sunpower also sells its own wastes such as ammonium nitrate and ash to fertiliser and building material factories. Overall, this reduces costs, provides an additional revenue source to Sunpower (by selling its waste products to another industry), and is in line with China’s environmental policies.

Chart 2: Changrun circular economy model

Source: Company

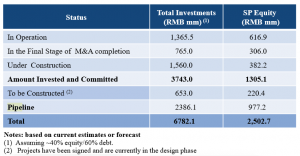

GI – clear pipeline of projects

Sunpower has laid out clearly to the investment community of its GI’s existing and planned projects. Such projects, if materialised and successfully executed, should bode well for the growth of their GI segment.

Table 1: GI’s project update and pipeline*

Source: Company

*The RMB765m investments in the final stage of M&A completion refers to Yongxing Thermal Power Plant has been completed and announced on 5 Sep 2018.

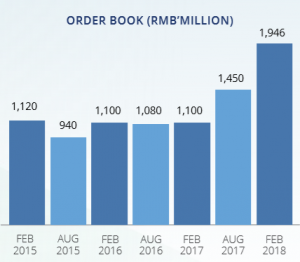

Sitting on record order books for its EEM & EPC segment

As of Jun 2018, Sunpower is sitting on a record order book of RMB2.0b even after delivering record 1HFY18 revenue. Although Sunpower has many repeat customers (in fact, 70% of their customers in EEM & EPC segments are repeat customers), Sunpower continues to expand into new areas and markets. The contract win amounting to a total RMB150m from a single customer in U.S. is a case in point.

Table 2: Record order book with 70% of customers being repeat customers

Source: Company

Strategic PE investors’ two consecutive rounds of investments lend vote of confidence

For Sunpower to build up its GI investments, it requires funding. Both DCP and CDH are private equity funds which have extensive experience in investing in China companies and have invested an aggregate US$180m into Sunpower. Some points worthy to highlight

-

DCP is founded by Mr. David Liu who was a Partner of KKR, Cohead of KKR Asia Private Equity and CEO of KKR Greater China. He has more than 25 years of experience and was responsible for a number of successful investments such as Ping An Insurance, Qingdao Haier Co, Belle International, etc. Mr. Liu currently serves as a non-executive director on the Board. One of the companies which KKR invested (when Mr Liu was at KKR) is in United Envirotech (currently known as Citic Envirotech). KKR started investing in United Envirotech in 2011 through the subscription of US$114m in convertible bonds. In 2013, it invested a further $40m in the form of equity investment into United Envirotech. In Nov 2014, KKR and Citic launched a joint takeover for United Envirotech;

-

Established in 2002, CDH is one of the leading private equity companies that focuses on growth capital and middle market buyout investments in Greater China. It manages five USD-denominated funds and two RMB-denominated funds, with cumulative assets under management in excess of USD 10.5b. Mr Li Lei is the Managing Director of CDH Investments Management (Hong Kong) Limited since January 2016 and he currently serves as a non-executive director on the Board. Website: http://www.cdhfund.com/index.php/a/lists/catid/169/

-

The above funds are extremely experienced in investing in Chinese companies. Both funds have invested an aggregate US$180m into Sunpower whose market cap is only US$206m (based on 24 Oct 2018 last traded price $0.385). It stands to reason that both funds would have done considerable due diligence before deciding to invest such a significant amount into Sunpower. This vote of confidence is assuring (at least) to me.

2HFY18 should be stronger than 1HFY18

According to company, 2HFY18 should be stronger than 1HFY18 due mainly to the following reasons:

a) Completion of Yongxin acquisition on 5 Sep 2018 which is expected to contribute immediately to top and bottom line;

b) 1st half is usually a seasonal slower period due partially to Chinese New Year. According to a Lim&Tan report, they estimate that 1st half typically comprise 30-40% of its entire full year results;

c) Ramp up of GI projects through new pipeline connections and new customers. Firstly, its GI investments can gain traction due to China’s mandatory closure of small “dirty” boilers in existing industrial parks and relocation of new factories into parks served by GI’s centralised boilers. Secondly, Changrun has successfully connected to the grid last month and electricity revenue will be another source of income from Sep 2018 onwards. Thirdly, Xinyuan should do better in terms of heating revenue as it is envisaged that more heat will be supplied in 2HFY18 where weather becomes colder in China.

Chart analysis

Sunpower has dropped 40% from an intra-day high of $0.645 on 28 Jun 2018 to trade $0.385 on 24 Oct 2018. The decline in the past three days has been accompanied with above average volume. Based on Chart 3 below, Sunpower has been on a long term uptrend since 2016 but has breached this uptrend line yesterday. Amid the sharp fall in the past three days, ADX has risen from a low level from 12.8 on 22 Oct 2018 to trade 19.2 with negatively placed directional indicators. Indicators are oversold. For example, MFI is around 5 (lowest level it can reach is 0) and RSI last trades 19.2. Since 2005, there were only five occassions where RSI is lower than now with the lowest RSI at 16.6. Although the stock price is near a two year low, OBV is still at a rather elevated level.

On balance, chart looks bearish for Sunpower especially after it breached the uptrend line with volume expansion. However, oversold pressures have built with the 27% decline in the past three days. Nevertheless, it is noteworthy that Sunpower’s illiquidity makes chart reading tricky.

Near term supports: $0.375 – 0.380 / 0.360 / 0.350

Near term resistances: $0.440 / 0.460 / 0.480 / 0.495 – 0.510

Chart 3: Sunpower has slumped 40% since hitting a year to date high of $0.645

Source: InvestingNote 24 Oct 18

Risks

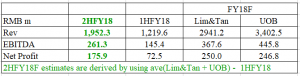

Analysts’ aggressive estimates for FY18F

Based on Table 3 below, analysts are projecting Sunpower to post strong 2HFY18F results of EBITDA and net profit of around RMB261m and RMB176m respectively. It is noteworthy that Sunpower posted 1HFY18 EBITDA and net profit of around RMB145m and RMB73m respectively. Thus, based on visual comparison, it seems to be challenging. Nevertheless, analysts are positive due to the aforementioned reasons (see above “2HFY18 should be stronger than 1HFY18”) Lim & Tan and UOB ascribe target prices $0.95 and $0.76 respectively.

Table 3: Analysts’ estimates for Sunpower’s FY18F results

Source: Ernest’s compilations

Convertible bonds cloud the net profit picture

If readers refer to Sunpower’s 1HFY18 net profit attributable to shareholders, you may get a shock to see that it only registered RMB1.4m net profit. This “low profit” is due to the effects of the convertible bonds which it issued to DCP and CDH. To reflect its true operating performance, company has put in another line called “underlying net profit” in their 1HFY18 results press release. 1HFY18 underlying net profit jumped 25% to RMB72.5m vis-a-vis 1HFY17.

Execution & project management are key

Based on Table 1 above, Sunpower has invested and committed RMB1.3b equity into GI projects. If everything goes according to plan, it may invest and commit another RMB1.2b into new projects. As of now, Sunpower has six GI plants (including Yongxin). Thus, it may still be too early to assess whether Sunpower can effectively execute its strategy of acquiring and operating the GI plants effectively and according to project schedule.

Higher raw material prices affected 1HFY18 gross margins

Sunpower’s gross margins declined from 23.8% in 1HFY17 to 20.1% in 1HFY18 due to a rise in raw material prices. Company has carried out cost control initiatives which should help to combat the rise in raw material prices to some extent.

Leverage to rise with more GI plants

It is noteworthy that Sunpower plans to finance the GI plants with 60% debt and 40% equity. Thus, its debt is likely to increase over time. Nevertheless, this may be “good debt” as a) according to company, the internal rate of return for such projects is around 15% per annum, thus it seems financially sound to finance partially via debt; b) the cashflows generated by GI are long term, high quality, recurring in nature and subject to less volatility which should be able to easily pay off interest expenses etc (barring unforeseen business failure of one or a number of major user factories)

Lack of liquidity

Although Sunpower’s liquidity has improved this year vis-à-vis last year, its average 30D volume is still around 185K shares per day. This is not a liquid company where investors with meaningful positions can enter or exit quickly.

No direct access to management

I have no direct access to management and am not extremely familiar with the company. This is my first write-up on the company and I am still trying to understand more about the company. Readers who wish to know more about Sunpower can refer to the company website HERE and analyst reports HERE for more information.

Recent selling is accompanied with volume

Recent selling has been fierce and accompanied with above average volume. It is possible that there may be some news known to the market but unknown to me on Sunpower which may explain why the share price dropped so much in the past three days.

Volatile due in part to its illiquidity

As Sunpower is pretty illiquid, it can be quite volatile at times. Average daily range can easily be $0.020 (without any particular news), translating to 5% of share price movement. Thus, it may not be suitable to most people.

Conclusion

Notwithstanding the sharp sell off in the share price, I like the industry which Sunpower is in. Furthermore, their GI investments and the entry of the CDH and DCP seem to bolster confidence. Importantly, readers should do their own due diligence (especially taking into account of the recent fierce sell off without any news) as this is just my introductory write-up in Sunpower. I am still learning about the company.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

P.S: I am vested in Sunpower. Do note that as I am a full time remisier, I can change my trading plan fast to capitalize on the markets’ movements.

Disclaimer

Please refer to the disclaimer HERE

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

How delicious are our CBD gummies? Don’t just take our word for it, professional football player, John Hartson, said “I take the 4800mg gummies and I love them. I don’t have to worry about missing my CBD, all I do is put the tub in my gym bag and I can take it in between sessions. I can already feel the benefits and the flavours are great”. If that’s still not enough, just check out our amazing 5 star reviews on Trustpilot from over 3000 testimonials from happy customers across the UK. Join the SupremeCBD family today to start benefiting from our incredible edibles. Free UK Delivery on All Orders Over £50 Enjoy FREE UK delivery on all orders of £50 or more. Don’t miss out on this amazing offer and make the most of your CBD experience with our delicious gummies, delivered straight to your door! Shop now and unlock the power of CBD Gummies in the UK

CBD GUMMIES Our CBD Gummies give you a flavourful blast of wellness-boosting CBD, with a wide variety of formulations to choose from. Our gummies have been formulated for everything from sleep and superfood supplements to multivitamins, diet aids, and more! If you’re looking for a CBD product that’s sweet on the taste buds and potent enough to serve your wellness needs — no matter what those needs are — we’ve got just the gummy for you! CBD is a great natural wellness product, due to the way it interacts with the body’s endocannabinoid system, which helps the body maintain homeostasis (balance) in several of its key functions, including mood, memory, sleep, appetite, pain and inflammation, motor control, and more. Because it’s sort of a Swiss Army knife when it comes to overall wellness, CBD is an ideal compound to match with other vitamins and nutrients to make a more robust wellness aid. CBDfx’s gummy collection gives a wide range of products, from the original mixed-berry CBD-only gummies to multivitamins for men and women to superfoods, like turmeric and spirulina, to an apple cider vinegar gummy, to a restful sleep formulation, and a biotin gummy for hair and nails. All of these gummies have great nutrient profiles and are a healthy way to add pure, natural CBD to your daily regimen. And as gummies, they taste great, too!! CBD Gummies: A Delicious Way to Enjoy CBDWhat Are CBD Gummies?CBD gummies are edible products that contain hemp-derived CBD. These small, round chewables look and taste much like the sweets that are so loved for their burst of flavour and chewability — only our gummies pack a CBD punch! Our CBD gummies not only contain organic broad spectrum CBD, but also other all-natural ingredients. These ingredients give you delicious flavour and delightful texture, plus additional benefits to help you maximise your CBD experience. Our CBD Sleep Gummies contain restful passion flower and chamomile. We have other CBD gummy formulations that make use of a variety of essential nutrients. Our Turmeric and Spirulina CBD Gummies harness the antioxidant and wellness benefits of two powerful superfoods. Our Apple Cider Vinegar CBD Gummies are great for dieting and gut health. And our Multivitamin CBD Gummies give you your daily dose of vitamins and minerals, plus the added wellness benefits of CBD. Whatever your wellness needs, we have a tasty, chewy CBD gummy for you!The Benefits of CBD GummiesWellness Benefits: CBD itself is one of the most popular wellness products on the market today. This is due, in large part, to the effect of CBD on the body’s endocannabinoid system. CBD and other cannabinoids mimic the body’s own endocannabinoids, which interact with receptors in a variety of organs and systems throughout the body, allowing them to maintain homeostasis (or balance). This helps the body to regulate such crucial functions as sleep, appetite, mood, motor control, memory, pain management, immune function, stress management, and much more. It’s these wellness benefits that make a CBD product like our gummies such a great health supplement to have around the house, whether it’s for a morning nutrition boost or a great night’s sleep.Convenience: CBD-infused gummies are a convenient (and tasty!) way to get a daily wellness blast of CBD. Gummies are also easy to use. There’s no measuring hemp oil or filling a CBD vapouriser. You simply eat them! Just remember that our gummies are not your traditional sweets, and you should adhere to our recommended dosage.Consistent Dosage: With consistent dosage in every chewable gummy, these popular products give you the peace of mind of knowing exactly how much CBD you’re taking with every one of our sweets.Delicious Flavour: Every gummy in our CBD Gummies collection has delicious natural fruit flavour, making them an absolute treat to eat — with no additives or preservatives!Non-Intoxicating: All of our gummies adhere to UK CBD legislation and are under the legal threshold of less than 0.01 THC.Nutritional Information: While our gummies come in a variety of formulations, they all have certain nutritional information in commonHow Many CBD Gummies Should I Eat?All of our vegan CBD gummies have a recommended serving size of two gummies (25 mg CBD each, 50 mg CBD per serving). That said, if this is your first time taking CBD, we recommend beginning with one gummy to see how you react to the CBD. If you seem to be getting all the CBD effects you desire, stop there. If you feel like you need more, then the next time you take CBD gummies, go ahead and try two.CBD Gummies for Pain, Sleep & StressIn addition to its many wellness benefits, CBD can also have a calming effect on the mind and body. In daily wellness products, such as CBD Multivitamin Gummies, the complementary ingredients make use of those calming properties to give mental focus without physical sluggishness. But with CBD Sleep Gummies, the additional ingredients intensify those calming effects and help the body prepare for sleep. As a result, CBD sleep products are quite effective in helping you not only fall asleep quickly, but also to sleep uninterrupted through the night.Many adults take CBD for minor pain, and it’s worth trying CBD if you’re experiencing minor muscle and joint pain. Likewise, CBD has many calming qualities that many find useful in combating stress. Many people find CBD Gummies particularly convenient for keeping in a handbag or backpack, just in case their nerves start kicking in. Gummies are a quick, convenient way to experience the calming effects of CBD.Why Buy CBDfx’s Gummies?All of our CBD gummies contain naturally grown CBD and all-natural ingredients (no GMOs or pesticides!). We also use safe extraction processes, so you never have to worry about solvent residues, as in cheaper CBD products. The result is a pure, safe, and potent CBD experience. This purity and potency can be verified by lab reports created by independent, third-party laboratories (called a Certificate of Analysis, or COA), which are available on our website. Your safety and satisfaction is our primary concern at CBDfx!Are CBDfx’s CBD Gummies Vegan?Yes! We only use natural vegetable-based ingredients in our CBD oil gummies, so you can rest assured that your gummy isn’t just organically grown — it’s also vegan!How Long Do CBD Gummies Last?CBD gummies are considered CBD edibles, which means the CBD is absorbed into the bloodstream through your digestive tract. While this takes the CBD a bit longer to kick in than, say, a sublingual CBD oil, the benefit is that the effects can last as long as six to eight hours. But be patient, CBD gummies, pills and other edibles can take 30 minutes to two hours to fully kick in, depending on bioavailability factors.CBD Gummies Vs CBD Oil Drops: What’s The Difference?As noted above, CBD gummies are considered edibles. That means the CBD is absorbed into your bloodstream through your digestive system, which can take between 30 minutes and two hours, depending on bioavailability factors (height, weight, body mass, and other variables). Once the CBD effects kick in, though, they can last as long as six to eight hours.CBD oil tinctures are absorbed through the capillaries under the tongue. This allows the CBD to enter your bloodstream much quicker (sometimes as quickly as 15 minutes). But the effects of a sublingual CBD oil typically last from two to six hours — less than the effects of CBD edibles.Can CBD Gummy Products Get You High?The oil we use in our CBD sweets is extracted from hemp, the low-THC form of cannabis. And CBD, itself, is non-intoxicating. So, our CBD gummies can’t get you high. All of our CBD products are formulated for wellness and fall within the UK legal threshold of less than 0.01 THC.Can You Take CBD Edibles For Sleep?In addition to its many wellness benefits, CBD can also have a calming effect on the mind and body. Blended with other effective ingredients, as in our CBD Sleep Gummies, CBD can be ncredibly beneficial as a sleep aid.Can You Take CBD Edibles For Pain?CBD can be taken for relief from minor pain.Can You Take CBD Edibles For Stress?CBD has calming properties that people find useful for easing stress.Can CBD Gummies Make You Fail A Drug Test In The UK?Our CBD gummies are all made with broad spectrum CBD, which has all detectable amounts of THC removed (THC being the cannabinoid most drug tests scan for). You should be okay using CBD gummies, however CBD can build up, over time, in your system. So, there is a small chance for a false positive result for people who regularly take CBD gummies. Here’s a handy guide to CBD and drug tests.I’ve Never Tried CBD Gummies. What Can I Expect?

Getting your daily dose of CBD has just got even easier with SupremeCBD thanks to our range of mouth watering CBD Gummies. Our CBD Gummies are designed to be easy to take, easy to store, and easy to have while you’re out and about. All you have to do is simply pop your grab bag or tub in your bag for easy reach when you need them most. And because our gummies are the size of most jelly sweets, they’re the perfect addition to your morning routine and easy to take. CBD Gummies are also one of the best ways to take your CBD safe in the knowledge that they’ll be working their magic and providing beneficial goodness for hours. Our Grab Bags Are Perfect For Taking CBD Gummies On The Go If you have a busy lifestyle – family, work, kids – it’s easy to forget about taking your CBD when you need it, which is why we have you covered. To make it easy to get your regular dose of CBD you can now buy our CBD gummies in handy grab-bags, as well as our recyclable tubs. And not only that, we now offer an amazing variety of delicious flavours and shapes, ranging from worms and strawberries, to our mouth watering cherries and bears. So now you never need a reason to miss your CBD, all you have to do is pop them in your hand bag, gym bag, or even pop them in your pocket and you’ll always have them within reach, ensuring you never miss your dose. How Many Gummies Can You Take? This is a question we get asked a lot. Understanding the right amount of CBD gummies you should take depends on a couple of factors, 1) Your desired effect 2) your individual tolerance and body weight. At SupremeCBD we understand that everyone’s needs and preferences are unique which is why we put together this handy blog: “how many gummies should I eat?”. But if you’re looking for a quick answer, we recommend starting with one gummy and waiting for about an hour to see how it affects you. If you feel the need to increase your dosage try taking another edible until you find an amount that works for you. One thing you can be sure of is that each of our CBD gummies are carefully made to offer you a delicious, and enjoyable way to maintain your overall physical and mental well-being. If you have any questions feel fee to contact our team. Alternatively you can always consult with a healthcare professional if you have any concerns or are unsure about the right dosage for you. 100 Gluten Free and Vegan CBD Gummies Did we forget to mention that our CBD edibles can be enjoyed by all? Whether you have an intolerance to gluten or you are vegan, we have made sure you can still enjoy our delicious range of CBD gummies. All of our gummies are 100 gluten-free and vegan, making them a perfect choice if you have specific dietary requirements. Looking after all of our customers is important to us which is why we have meticulously crafted our edibles to provide you with a guilt-free way to enjoy the benefits of CBD everyday. Our Customers and Ambassadors Love Our CBD Gummies

Your CBD experience will rely greatly on a number of factors. These include personal bioavailability factors (such as height, weight, and body mass), the strength of your CBD oil product, and the supporting ingredients. In general, CBD has a gentle calming effect for the mind and body. In CBD oil sweets, containing ingredients to boost energy or nutrition, that calming effect can help to focus the mind. In relaxation-based products, that calming effect can be more pronounced — especially CBD products formulated for sleep.Is CBD Legal In The UK?Yes! CBD is legal in the UK, provided the product contains less than 0.2 THC as measured by dry weight.

CBD edibles are a simple and delicious way to enjoy the benefits of CBD. Whether you’re looking to reduce anxiety, manage pain, or simply promote relaxation, CBD edibles are a convenient option that can easily fit into your daily routine. At BritishCBD, we offer a variety of CBD edibles that are infused with high-quality CBD oil, providing you with a simple and effective way to enjoy the benefits of CBD. So why not try our CBD edibles today and see the difference for yourself?

The THC concentrations in Herbal Health CBD products, such as our CBD Oil, are below detectable levels. These THC-free broad-spectrum CBD gummy sweet products will never flag a drug test. The reason for this is simple: no one tests for CBD. Athletes can use it in the Olympics, the elderly are thriving on these products, and plenty of people are only taking these products to enhance their daily lives.

Whether you’re a seasoned CBD enthusiast or just beginning your wellness journey, CBD Guru’s CBD Gummies are the perfect companion. Boost your daily routine with a burst of flavour and the holistic benefits of high-quality CBD. Shop with confidence, knowing you’re choosing a product that’s crafted with expertise and a commitment to your well-being. Correctly manufactured CBD sweets should never get you high. These products must be extracted from industrial hemp, which contains inactive amounts of THC. Without THC, these items will remain non-psychoactive and buzz-free. Consulting lab-test results is always an essential step before purchasing cannabidiol. If you can lock-eyes on results indicating a pure, and THC free product, then you run zero risk of catching a buzz. CBD Guru’s broad-spectrum formula contains viable levels of many hemp compounds but does not contain detectable amounts of THC. Get to know your supplier, and learn to read CBD lab test results. This only takes a little bit of effort, and if it ensures that you will have access to quality cannabidiol. We guarantee that it is worth your time. Support this budding industry by learning about CBD, browsing the highest quality goods, and discovering how to choose the best cannabidiol items on the market. The THC concentrations in CBD Guru products are below detectable levels. These THC-free broad-spectrum CBD Gummies will never flag a drug test. The reason for this is simple: no one tests for CBD. Athletes can use it in the Olympics, the elderly are thriving on these products, and plenty of people are only taking these products to enhance their daily lives. There is no penalty for taking a thoroughly tested and carefully formulated cannabidiol product. Your mind and body will thank you, and local law-enforcement agents recognise the legal availability of these hemp items. You never need to worry when purchasing a CBD gummy product. At first, many customers may have asked themselves, “Is it legal to buy CBD Gummies in the UK?” The answer is an absolute yes. The UN WHO (World Health Organisation) has stated that products containing under 0.2 THC should be distributed freely. Regulators in the UK have not classified CBD as a food, cosmetic, or medicinal, indicating that it can be bought and sold without issue. The hemp used to create these tasty treats are all grown in Colorado, a state notorious for its legal cannabis and hemp cultivation. These premium plants are held to the high standards of the CO state regulations. The plant material is processed and infused into our premium products in GMP facilities that produce food-grade products.The importation of these hemp products is legal, while the extraction of cannabinoids from any hemp plant is still not allowed in the UK. Although the nation is turning to other sources to procure its medicinal cannabis and hemp supply, there will be a wait before we can cultivate our own UK grown plants. In the meantime, we choose farmers who uphold the best organic and sustainable hemp farming practices. Using CBD sweets & gummies is an easy task. All you need to do is to savour and eat these delicious products to get your daily dose. You can eat these back to back, but pay attention to the dosage. We know that the flavour of our gummies can be quite enticing, but you may want to save your gummies and eat only the minimum effective dose. Before purchasing these items, check the amount of total CBD mg in your selected package and the CBD mg amount of individual pieces. If you are buying CBD for the first time, start with pieces with low mg amounts such as 20mg gummies. This will allow you to easily explore various dosages and find out how your body responds.

CBD Edibles are known for their potent benefits, which include reducing anxiety, assisting with sleep and relieving pain. High CBD edibles are an excellent way to promote relaxation and calmness, making them an ideal choice for those who struggle with anxiety. CBD edibles also have anti-inflammatory properties, making them an effective tool for managing pain and inflammation.CBD Edibles in the UK: Legal and Safe

An intriguing discussion is worth comment. I do think that you ought to publish more on thisissue, it might not be a taboo matter but typically folks don’t discuss such subjects.To the next! Many thanks!!

CBD sweets and gummies are precisely as they sound – delicious gummy sweets that deliver cannabidiol. They can be infused with a variety of CBD infusions, ingredients, and flavours. The design can be simple, extravagant, decadent, and everything in between. When it comes to choosing the best CBD sweets & edibles, you’ll have to take the time to find ones that speak to your taste buds.

Getting your daily dose of CBD has just got even easier with SupremeCBD thanks to our range of mouth watering CBD Gummies. Our CBD Gummies are designed to be easy to take, easy to store, and easy to have while you’re out and about. All you have to do is simply pop your grab bag or tub in your bag for easy reach when you need them most. And because our gummies are the size of most jelly sweets, they’re the perfect addition to your morning routine and easy to take. CBD Gummies are also one of the best ways to take your CBD safe in the knowledge that they’ll be working their magic and providing beneficial goodness for hours. Our Grab Bags Are Perfect For Taking CBD Gummies On The Go If you have a busy lifestyle – family, work, kids – it’s easy to forget about taking your CBD when you need it, which is why we have you covered. To make it easy to get your regular dose of CBD you can now buy our CBD gummies in handy grab-bags, as well as our recyclable tubs. And not only that, we now offer an amazing variety of delicious flavours and shapes, ranging from worms and strawberries, to our mouth watering cherries and bears. So now you never need a reason to miss your CBD, all you have to do is pop them in your hand bag, gym bag, or even pop them in your pocket and you’ll always have them within reach, ensuring you never miss your dose. How Many Gummies Can You Take? This is a question we get asked a lot. Understanding the right amount of CBD gummies you should take depends on a couple of factors, 1) Your desired effect 2) your individual tolerance and body weight. At SupremeCBD we understand that everyone’s needs and preferences are unique which is why we put together this handy blog: “how many gummies should I eat?”. But if you’re looking for a quick answer, we recommend starting with one gummy and waiting for about an hour to see how it affects you. If you feel the need to increase your dosage try taking another edible until you find an amount that works for you. One thing you can be sure of is that each of our CBD gummies are carefully made to offer you a delicious, and enjoyable way to maintain your overall physical and mental well-being. If you have any questions feel fee to contact our team. Alternatively you can always consult with a healthcare professional if you have any concerns or are unsure about the right dosage for you. 100 Gluten Free and Vegan CBD Gummies Did we forget to mention that our CBD edibles can be enjoyed by all? Whether you have an intolerance to gluten or you are vegan, we have made sure you can still enjoy our delicious range of CBD gummies. All of our gummies are 100 gluten-free and vegan, making them a perfect choice if you have specific dietary requirements. Looking after all of our customers is important to us which is why we have meticulously crafted our edibles to provide you with a guilt-free way to enjoy the benefits of CBD everyday. Our Customers and Ambassadors Love Our CBD Gummies

Whether you’re a seasoned CBD enthusiast or just beginning your wellness journey, CBD Guru’s CBD Gummies are the perfect companion. Boost your daily routine with a burst of flavour and the holistic benefits of high-quality CBD. Shop with confidence, knowing you’re choosing a product that’s crafted with expertise and a commitment to your well-being. Correctly manufactured CBD sweets should never get you high. These products must be extracted from industrial hemp, which contains inactive amounts of THC. Without THC, these items will remain non-psychoactive and buzz-free. Consulting lab-test results is always an essential step before purchasing cannabidiol. If you can lock-eyes on results indicating a pure, and THC free product, then you run zero risk of catching a buzz. CBD Guru’s broad-spectrum formula contains viable levels of many hemp compounds but does not contain detectable amounts of THC. Get to know your supplier, and learn to read CBD lab test results. This only takes a little bit of effort, and if it ensures that you will have access to quality cannabidiol. We guarantee that it is worth your time. Support this budding industry by learning about CBD, browsing the highest quality goods, and discovering how to choose the best cannabidiol items on the market. The THC concentrations in CBD Guru products are below detectable levels. These THC-free broad-spectrum CBD Gummies will never flag a drug test. The reason for this is simple: no one tests for CBD. Athletes can use it in the Olympics, the elderly are thriving on these products, and plenty of people are only taking these products to enhance their daily lives. There is no penalty for taking a thoroughly tested and carefully formulated cannabidiol product. Your mind and body will thank you, and local law-enforcement agents recognise the legal availability of these hemp items. You never need to worry when purchasing a CBD gummy product. At first, many customers may have asked themselves, “Is it legal to buy CBD Gummies in the UK?” The answer is an absolute yes. The UN WHO (World Health Organisation) has stated that products containing under 0.2 THC should be distributed freely. Regulators in the UK have not classified CBD as a food, cosmetic, or medicinal, indicating that it can be bought and sold without issue. The hemp used to create these tasty treats are all grown in Colorado, a state notorious for its legal cannabis and hemp cultivation. These premium plants are held to the high standards of the CO state regulations. The plant material is processed and infused into our premium products in GMP facilities that produce food-grade products.The importation of these hemp products is legal, while the extraction of cannabinoids from any hemp plant is still not allowed in the UK. Although the nation is turning to other sources to procure its medicinal cannabis and hemp supply, there will be a wait before we can cultivate our own UK grown plants. In the meantime, we choose farmers who uphold the best organic and sustainable hemp farming practices. Using CBD sweets & gummies is an easy task. All you need to do is to savour and eat these delicious products to get your daily dose. You can eat these back to back, but pay attention to the dosage. We know that the flavour of our gummies can be quite enticing, but you may want to save your gummies and eat only the minimum effective dose. Before purchasing these items, check the amount of total CBD mg in your selected package and the CBD mg amount of individual pieces. If you are buying CBD for the first time, start with pieces with low mg amounts such as 20mg gummies. This will allow you to easily explore various dosages and find out how your body responds.

WHAT ARE CBD GUMMIES? CBD Gummies are the most effective, delicious and convenient way to take your daily dose of CBD. Each delicious, calming, vegan gummy contains only 15 calories and helps you so support stress and anxiety throughout the day.CBD is short for Cannabidiol – one of over 120 known compounds found in the cannabis/hemp plant (Cannabis Sativa L.) while Gummies are delicious, sweet cubes of delight that can be taken anywhere and offer the perfect way to get all the benefits of CBD while on the move. CBD is the second most prevalent compound in the plant, is non-intoxicating and has been shown to help ease anxiety, improve sleep and promote muscle recovery by supporting the body’s natural endocannabinoid system. The role of the endocannabinoid system (ECS) is to maintain homeostasis (balance) across all of the vital systems within the human body. CBD interacts with the ECS receptors distributed throughout our brains and nervous systems, helping to regulate functions including appetite, sleep, inflammation and pain response.How long before I feel the effects of a CBD Gummy? The average time from eating a gummy to feeling the effects is around 30 minutes and the daily recommended dose is 70mg which leaves room for a morning, noon and evening treat. Embrace the art of relaxation everyday.HOW MANY AND WHEN DO I TAKE CBD GUMMIES?There is no right or wrong answer. If you are using CBD for pre-work anxiety, take one when you wake up. If you are looking to stay composed before a presentation, take one at the office. If you are searching for a more refined sleeping pattern, consider having your gummies up to an hour before you go to bed.Our CBD Gummies are contained in a compact tub and box so you can take your CBD with you wherever you go. Our packaging is also fully recyclable.Goodrays UK CBD gummies are packed with 25mg of premium quality CBD. Most consumers feel the full benefits of CBD after a 25mg dose while other more experienced users may require more. Each pack contains 30 gummies designed to last you between 2 weeks and a month, depending on your preferred daily dosage. While CBD is non-toxic, we recommend you don’t exceed 70mg per day as a general rule. Check out our 5 star reviews on the product page to see what our customers have to say!WHAT ARE CBD GUMMIES? CBD Gummies are a delicious compact and discrete way to consumer CBD. The CBD is infused with delicious, natural jellies for maximum enjoyment. WHAT ARE THE BENEFITS OF CBD GUMMIES? Every consumer is different but CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. ARE CBD GUMMIES AS EFFECTIVE AS OTHER CBD PRODUCTS? Yes CBD gummies are effective as other CBD products but for the fastest effects we always recommend CBD oils, taken sublingually so they can be absorbed quicker WHAT EFFECTS SHOULD I EXPECT FROM CBD GUMMIES? CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. HOW MANY CBD GUMMIES SHOULD I EAT? Between 2 – 3 gummies per day. HOW LONG DO THE EFFECTS OF CBD GUMMIES LAST? The effects of CBD last a few hours but for the best long-term affects we recommend that consumers use CBD daily to support the body’s natural Endocannabinoid System. DO CBD GUMMIES CONTAIN THC? No, all our products contain 0 THC ARE CBD EDIBLES EGAL? Yes, CBD oil is legal. Approved products are listed under the FSA’s Public List of Novel Food products which can be found here: https://data.food.gov.uk/cbd-products.

Our gummies can be bought in a variety of sizes. You’ll be able to purchase our tasty CBD sweets and gummy bears in both small and large quantities.

How delicious are our CBD gummies? Don’t just take our word for it, professional football player, John Hartson, said “I take the 4800mg gummies and I love them. I don’t have to worry about missing my CBD, all I do is put the tub in my gym bag and I can take it in between sessions. I can already feel the benefits and the flavours are great”. If that’s still not enough, just check out our amazing 5 star reviews on Trustpilot from over 3000 testimonials from happy customers across the UK. Join the SupremeCBD family today to start benefiting from our incredible edibles. Free UK Delivery on All Orders Over £50 Enjoy FREE UK delivery on all orders of £50 or more. Don’t miss out on this amazing offer and make the most of your CBD experience with our delicious gummies, delivered straight to your door! Shop now and unlock the power of CBD Gummies in the UK

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ