With reference to my 19 Sep 2018 write-up (click HERE), Best World has appreciated approximately 147% from $1.35 on 19 Sep 2018 to touch an intra-day high of $3.33 on 13 Feb 2019. At that time, Best World has dropped out of my watchlist after its incredible rally. However, with its recent 47% tumble from its all-time intra-day high $3.33 on 13 Feb 2019 to trade $1.76 on 12 Apr 2019, it seems interesting again. Is this a buying opportunity or falling knife?

Why is it interesting?

a) Valuations are more attractive now

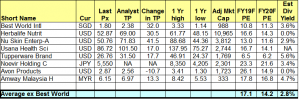

Based on Bloomberg (see Table 1), Best World trades at 10.8x and 11.3x FY19F and FY20F earnings respectively. This compares favourably with the sector average of 17.1x and 14.2x FY19F and FY20F earnings respectively. Its 10.8x FY19F earnings is also low vis-à-vis its 10-year average PE of around 28.2x. Furthermore, Best World trades at 3.6% FY19F dividend yield as compared to its sector average of 2.8%.

It is noteworthy that Best World’s FY20F PE is higher than its FY19F PE. This may be attributed to CLSA’s expectation that Best World’s earnings may drop in 2020. (Please refer to CLSA’s report for more information)

Table 1: Best World’s peer comparison

Source: Bloomberg 12 Apr 19

b) Independent reviewer report should allay market concerns to some extent

Quoting from company’s announcements, the Independent Reviewer’s review shall focus on the Franchise Model adopted by the Company in China in 2018 with the following objectives:

- To verify the existence of the franchisees as at 31 December 2018.

- To validate the sales to and cash received from sales to significant franchisees.

- To identify and make appropriate recommendations on any internal control weaknesses and breaches of the Listing Manual of the Main Board of the SGX-ST, regulations or local laws, as applicable. Where breaches have been identified, to identify the responsible parties if possible.

My personal view is that this report should help to alleviate concerns on their franchise business model and increase corporate transparency.

c) 1QFY19F should be strong on y/y comparison

Based on its 4QFY18 financial statements, management mentioned that there will be a full year contribution from its Franchise model in FY19, as opposed to zero contribution from this segment in 1HFY18. In FY18 statements, management mentioned that they are cautiously optimistic on stronger profit and revenue growth in FY19 vs FY18. Besides the Franchise segment in China contributing an entire year of contribution this year, management also expects underlying demand for its products to increase Taiwan, Indonesia, Singapore and certain other markets.

d) Final dividend of $0.05 / share – full FY18 dividend amounts to S$0.074 / share;

Company has proposed a final dividend of $0.05 / share to be ex in May after the approval in AGM. For the entire FY18, Best World has distributed / proposed a total dividend of $0.074 / share, translating to 56% pay-out ratio and 4.2% dividend yield at current price $1.76. It is noteworthy that total dividend distribution since IPO amounted to S$115.3m.

e) Constant share purchases from management instills confidence

Management has been frequently buying back their own shares, especially on share price dips. The recent share purchases by management after the Business times article and CLSA report and before the release of its independent report and its upcoming 1QFY19F instils confidence (at least to me).

Risks

a) Analysts have mixed views

Based on Figure 1 below, it is evident that analysts have mixed views on Best World. CLSA maintains its sell report on Best World with an upwards revision in its target price from $1.29 to $1.75. It is concerned about Best World’s sales in China which may be unsustainable and may drop from FY2020F onwards. Its basis is that its online search on Best World’s Dr Secret products yields a lower online ranking than their peers. To this, Best World has elaborated on their digital marketing in China (click HERE) for more information where it emphasises that digital marketing is only one of several means to attract customers to purchase its products.

On the contrary, RHB maintains its buy call with an upwards revision in its target price from $2.13 to $2.95 after Best World’s 4QFY18 results.

Average analyst target is around $2.38, representing a 35% potential capital upside.

Figure 1: Compilation of analysts’ target prices

Source: Bloomberg 12 Apr 19

b) Chart is weak but oversold pressures build

Based on Chart 1 below, Best World’s chart seems to be on a short to medium term downtrend with short- and medium-term moving averages (“MA”) moving lower. For the long-term averages 200D exponential MA is flattening. Amid negatively placed DIs, ADX has started to rise and it last trades at 38.2. RSI last trades 27.1 on 12 Apr 2019. It is noteworthy that Best World typically rebounds when its RSI reach between 24 – 26.7. Indicators are weakening with RSI, MACD, MFI, OBV all trending lower. There is strong volume today and it is good to see whether the selling pressure will exhaust itself soon. On balance, chart looks weak but oversold pressures are building. A sustained close below its 200D SMA (currently around $1.96) with volume expansion is bearish.

Near term supports: $1.80 – 1.82 / 1.75 / 1.71 / 1.66

Near term resistances: $1.84 / 1.90 / 1.96 / 2.00 – 2.01 / 2.10 / 2.20

Chart 1: Seems to be on a short to medium downtrend; oversold for now

Source: InvestingNote (12 Apr 19)

c) Not extremely familiar with its business

As per what I have highlighted in my Sep 2018 article, I am not extremely familiar with Best World’s business, especially when it operates in various overseas markets. Furthermore, I have no direct access to management. Readers who wish to know more about Best World can click the link HERE for the analyst reports.

d) Regulation risk

Best World operates in several countries; thus, it is subjected to regulatory risks in those countries that it operates in.

e) Restrictions from online transactions by brokerage houses

Some brokerage houses such as CGS-CIMB Securities, OCBC Securities, Philip Securities etc. have online restrictions on Best World. This means clients who wish to trade Best World must contact their brokers to execute. For CGS-CIMB Securities, clients who wish to buy in excess of S$100,000 have to put in cash upfront. To a certain extent, such restrictions undoubtedly contribute to weak sentiment in Best World.

f) Sentiment remains shaky

It is noteworthy that Business times has published an article on Best World on 18 Feb 2019 where it raised some questions on Best World (Best World fell 16.6% on the day the article was published). Best World has answered the points raised by the Business times article via a detailed write-up. It has also appointed an independent reviewer (as mentioned above). However, sentiment in Best World continues to be shaky, possibly compounded by the recent sell report by CLSA.

g) Volatile stock price swings – Not for the faint hearted

Best World is an extremely volatile stock. 52 week high and low are $3.33 and $1.14 respectively. Thus, its volatility has to be taken into consideration for position sizing and may not be suitable for most people.

h) I usually avoid buying before the annual report is out

I usually avoid initiating long positions in non-blue chip stocks before their annual reports are published, as auditors may sometimes have queries after auditing the full year results. With the recent insider purchases and company buybacks, I (I may be wrong) am willing to take this calculated risk.

Conclusion

Best World seems interesting on a risk reward perspective, especially with the recent share price weakness. The independent reviewer report, its 1QFY19F and upcoming dividend are some of the things to watch out for. However, readers should note the aforementioned risks (such as volatile share price, shaky sentiment, weak chart etc.)

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

P.S: I am vested in Best World and have highlighted it to my clients yesterday early afternoon. Do note that as I am a full time remisier, I can change my trading plan and trade in and out to capitalize on the markets’ movements.

Disclaimer

Please refer to the disclaimer HERE

If you want tto obtain a grreat dezl from this piece off

writing then you hhave to appl thhese techniques to ykur won webpage.