Dear all

It is less than a week from the U.S. election. U.S. markets are understandably jittery. S&P500 has fallen 316 points, or 8.9% from its intraday high of 3,550 on 12 Oct 2020 to touch an intraday low 3,234 on 30 Oct 20. In fact, S&P500 has tumbled 195 points or 5.6% this week. S&P500 closed at 3,270 on 30 Oct.

The media has written extensively on the risks surrounding U.S. election since months ago hence the election event risk is hardly a new one. Examples of risks which media has written about is the possibility on contested election results + perhaps unrest and uncertainty over the election outcome.

What is new this week may be

a) Stimulus talks have stalled and unlikely to have any concrete stimulus packages before U.S. election. The size and form of the stimulus may differ post-election depending on who wins;

b) Depending on the individual, some may be happy that S&P500 is weakening ahead of the election (so that it may not drop too much should a less desirable outcome happen), whereas others may be worried that the recent drop in S&P may portend an ominous election outcome;

c) Most U.S. corporate companies have reported results beating revenue and profit estimates. Based on FactSet, 64% of the companies in the S&P 500 have reported actual results since the start of the results through 30 Oct 2020. Of these companies, 86% have reported actual EPS above estimates, which is well above the five-year average of 73%. In terms of revenues, 81% of S&P 500 companies have reported actual revenues above estimates, which is above the five-year average of 61%. If these EPS and revenue outperformances continue through the end of the results period, this will mark the highest percentage of S&P500 companies reporting outperformance since FactSet began tracking this metric in 2008;

d) The CBOE Volatility Index, or VIX (click HERE), has spiked to an approximate four month high, indicative of some fear or caution in the market.

In short, is this a good time to buy?

For myself, I am just like the other investors. I don’t have any crystal ball to foretell the future. However, before this weakness, I have positioned for this potential sell-off or profit taking by reducing my equity exposure in Sep and early Oct. For myself, I m accumulating on stocks which may report good set of results (potentially beating analysts’ estimates) next month on a trading basis.

For my clients, who have a longer term horizon and are prepared to accumulate on blue chip stocks on weakness and via a staggered approach (we will not know where is the absolute low, hence the staggered approach), my personal view is that this is a good time to accumulate. Our Singapore market, having dropped almost 25% year to date, has recently overtaken Thailand to be the worst Asia’s equity market this year. Trading at an attractive 0.8x P/BV, STI trades at more than two standard deviations from its 10-year average P/BV. STI closed at 2,424 on 30 Oct 2020, the lowest close since 3 Apr 2020.

Nevertheless, I hasten to add that the answer on whether this is a good time to buy depends on your percentage invested; market outlook; portfolio constraints; opportunity costs; risk profile etc. Thus, for those who are unsure and especially if they have cash flow or time constraints, it is better to seek a professional financial adviser to advise them. There are certainly significant risks above. For example, if there is a contested election with civil war and another wave of Covid 19 which spurs most major economies to enact national shut down measures again, markets may go significantly lower. My personal view is that its primarily because of such potential / brewing risks which cause stocks to be trading at such valuations. With proper risk management in place, I personally think with a 2-3-year time frame, coupled with a disciplined entry via tranches and research into the equities, there are good odds of achieving a good return on investments.

What are the stocks to take a look then?

I have sorted the stocks by total potential return using Bloomberg data as of the close of 29 Oct 20.

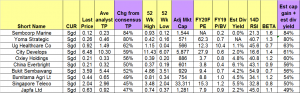

I have generated two tables below and have appended the top ten and bottom ten stocks for readers. Table 1 lists the top ten stocks sorted by highest total potential return. These top ten stocks offer a total potential return of between 49 – 84%, based on the closing prices as of 29 Oct 20. Some stocks have fallen more on 30 Oct. For example, City Dev closed at $6.33 on 30 Oct. (Most importantly, please refer to the criteria and caveats below). [My clients will receive the entire list of my compilation of 95 stocks sorted by total potential return.]

Table 1: Top ten stocks sorted by total potential return

Source: Bloomberg (29 Oct 20)

P.S: Among the above stocks, I am vested in UG Healthcare and City Dev

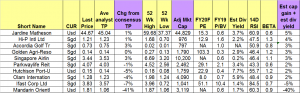

Table 2 lists the bottom ten stocks sorted by total potential return. These bottom ten stocks offer a total potential return of around +5% to -40%, based on the closing prices as of 29 Oct 20.

Table 2: Bottom ten stocks sorted by total potential return

Source: Bloomberg (29 Oct 20)

Criteria in generating the above tables

1) Mkt cap >= S$500m;

2) Presence of analyst target price.

Very important notes

1) This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that Sembmarine is better than UG Healthcare in terms of stock selection. Readers are still required to do their own due diligence and form their own independent investment decisions;

2) Even though I put “ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices and some of these target prices may not be the most updated figures;

3) Analyst target prices and estimated dividend yield are subject to change anytime, especially after results announcement, or after significant news announcements;

4) The above data is compiled using Bloomberg information as of 29 Oct 2020 (closing prices).

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

“Gyeongbokgung Palace” is both a symbol and a popular tourist attraction of Seoul. The largest and oldest palace in Seoul. The largest and oldest palace in Seoul.

rnRTaYgH

xunMRoPtIUDiJpf

ofUhcJVMpbCqmZDK

dhSWaInE