Dear all

Yesterday, Comfort Delgro, Thai Bev and Wilmar closed at $1.25; $0.565 and $3.64 respectively. Personally, they look interesting on several aspects.

At $1.25, Comfort Delgro trades at levels last seen in 2011 and 2009!

At $0.565, Thai Bev sits on a long term uptrend line established since 2009!

At $3.64, Wilmar trades at approximately 2.2x and 3.0x standard deviations below its 10Y average PE and P/BV of around 13.8x and 1.1x respectively!

Read on for more.

*Comfort Delgro*

I have previously published a write-up on Comfort Delgro. Readers can refer to my write-up HERE for more information and the potential risks.

So what else is new?

a) Trades at 2011 & 2009 lows, coupled with oversold RSI

Comfort Delgro closed at $1.25 yesterday which was the level last seen in 2011 and 2009. Furthermore, RSI closed at an oversold level 16.3. Excluding pandemic times and based on pure manual observation, RSI typically rebounds around the region 15.5.

b) Company seems to have emerged from the pandemic – stronger

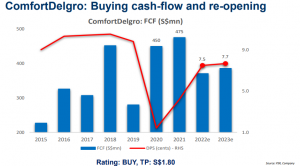

With reference to Figure 1 below, Comfort Delgro’s free cash flows and balance sheet have improved markedly (2020- 2023) as compared to pre pandemic. It is arguably one of the few companies whose balance sheet has emerged stronger post Covid.

Figure 1: Comfort Delgro – Free cash flow seems to have improved

Source: Phillip Securities Research; Company

c) Total potential return ~ 45% if the consensus is correct

Based on Figure 2 below, average analyst target is around $1.74. Estimated dividend yield is around 5.4%. Total potential return is around 45% if the consensus is right.

Figure 2: Average analyst target $1.74; estimated div yield 5.4%

Source: Bloomberg 10 Oct 22

–> Please refer to Comfort Delgro’s analyst reports HERE for more information and very importantly, the potential investment risks.

*Thai Bev*

What catches my attention?

a) Extremely oversold; only 2 days since 2008, where RSI trades lower than 14.2

Thai Bev is extremely oversold. RSI closed at 14.2 yesterday. Since 2008, there were only two days (18 & 19 Mar 2020) where Thai Bev’s RSI was lower than 14.2.

b) Testing the long-term uptrend line established since Mar 2009

Based on chart (see Chart 1 below), Thai Bev seems to be testing its long term up trend line (currently around $0.570) established since Mar 2009. A sustained downside break below $0.570 with volume expansion is negative for the chart. However, given the oversold conditions, odds are less likely of a sustained breach below $0.570.

Chart 1: Testing the long term uptrend line

Source: InvestingNote

c) Total potential return ~ 52% if the consensus is correct

Based on Figure 3 below, average analyst target is around $0.84. Estimated dividend yield is around 3.8%. Total potential return is around 52% if the consensus is right.

Figure 3: Average analyst target $0.84; estimated div yield 3.8%

Source: Bloomberg 10 Oct 22

–> Please refer to Thai Bev’s analyst reports HERE for more information and very importantly, the potential investment risks.

*Wilmar*

What is new?

a) Wilmar spent more on share purchases in 3Q2022 compared to the entire 2021

With reference to this link (click HERE), SGX listed stocks bought back shares worth S$1.19b in 2021. This was led by OCBC, CapitaLand Investment, Wilmar International, UOB and SGX. In 2021, Wilmar bought back $130.9m worth of shares.

In 3Q2022 (just one quarter alone), based on SGX compilation (click HERE), Wilmar bought back $140.5m worth, or 34.6m shares at an average price $4.05. This already eclipsed the entire amount bought back last year. Furthermore, Wilmar contributed approximately 24% of the share buyback dollar amount in 3Q alone.

b) Attractive valuations

Based on Bloomberg, Wilmar trades at 6.9x PE and 0.8x P/BV, approximately 2.2x and 3.0x standard deviations below its 10Y average PE and P/BV of around 13.8x and 1.1x respectively.

c) Wilmar should be able to meet consensus FY22F earnings estimates, given strong 1HFY22

Based on Bloomberg consensus earnings FY22F of around US$1.855b, Wilmar’s 1HFY22 already constituted approximately 53% of full year results. Based on a CIMB report dated 5 Aug (click HERE), CIMB mentioned that relying on historical trends, 2H is usually twice as strong as 1H. Given macro headwinds and on a prudent basis, if we assume 2HFY22F matches that of 1HFY22, Wilmar can still comfortably meet consensus estimates.

d) Total potential return ~ 56% if the consensus is correct

Based on Figure 4 below, average analyst target is around $5.50. Estimated dividend yield is around 5.1%. Total potential return is around 56% if the consensus is right.

Figure 4: Average analyst target $5.50; estimated div yield 5.1%

Source: Bloomberg 10 Oct 22

–> Please refer to Wilmar’s analyst reports HERE for more information and very importantly, the potential investment risks.

Conclusion

In summary, Comfort Delgro, Thai Bev and Wilmar look interesting on valuation and chart basis. Due to time constraints, this write-up is brief as I only highlight some pertinent points. Readers are strongly encouraged to refer to the respective company’s analyst reports (see links above) for more information.

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

P.S: I am vested in Wilmar, Thai Bev and Comfort Delgro. Wilmar’s is scheduled to report 3QFY22F results on 28 Oct, after market.

Disclaimer

Please refer to the disclaimer HERE

I really liked your article post.Thanks Again. Much obliged.

I think this is a real great blog article.Really looking forward to read more.

Great, thanks for sharing this blog post.Really looking forward to read more. Fantastic.

Thanks-a-mundo for the blog post. Much obliged.

Thanks for sharing, this is a fantastic article.Much thanks again. Awesome.

Im obliged for the blog post.Thanks Again. Really Great.

Really enjoyed this article post.Really thank you! Want more.

Awesome article post.Thanks Again. Really Great.

Really enjoyed this article.Really thank you! Great.

Awesome article post. Really Great.

Major thanks for the article.Really looking forward to read more. Fantastic.

I appreciate you sharing this article. Keep writing.

Thanks a lot for the blog post. Awesome.

I am so grateful for your article post.Really looking forward to read more. Want more.

Thanks for the blog. Awesome.

Fantastic beat ! I would like to apprentice while you amend your site, how can i subscribe for a blog web site?

The account aided me a applicable deal. I were a little bit acquainted of this your broadcast provided vivid

transparent idea

I really enjoy the article post.Really looking forward to read more. Will read on…

Very neat article.Really looking forward to read more. Really Cool.

Muchos Gracias for your article.Much thanks again. Fantastic.

Thanks for the article.Really looking forward to read more.

I loved your blog. Much obliged.

I loved your article.Much thanks again.

Thank you for your article. Fantastic.

I loved your blog.Much thanks again. Keep writing.

Wow, great article post.Much thanks again. Awesome.

I appreciate you sharing this article post.Much thanks again. Cool.

I really liked your blog post.Really thank you! Cool.

Im grateful for the blog post.Really thank you! Keep writing.

Hey, thanks for the article. Great.

Major thanks for the blog.Much thanks again. Will read on…

wow, awesome blog.Thanks Again. Fantastic.

Major thanks for the blog post. Awesome.

Hey, thanks for the article.Thanks Again. Really Great.

This is one awesome blog article.Thanks Again. Cool.

Thanks so much for the post.Really thank you! Really Cool.

A round of applause for your post.Thanks Again. Will read on…

I cannot thank you enough for the blog.Really looking forward to read more. Cool.

I cannot thank you enough for the article post.Much thanks again. Fantastic.

Really informative blog post.Really thank you! Want more.

Appreciate you sharing, great article post.Really thank you! Really Cool.

I am so grateful for your post.Really looking forward to read more. Want more.

I loved your blog.Really looking forward to read more. Really Great.

Great beat ! I would like to apprentice while you

amend your site, how can i subscribe for a blog site?

The account aided me a acceptable deal. I had been tiny bit acquainted

of this your broadcast offered bright clear idea

Im obliged for the article.Really thank you! Really Cool.

you’re actually a just right webmaster. The website loading speed is incredible.

It sort of feels that you’re doing any unique trick.

Furthermore, The contents are masterwork. you’ve done a wonderful job in this topic!

Major thankies for the blog article.Really thank you! Keep writing.

Very neat blog post.Thanks Again. Will read on…

Im obliged for the article.Really thank you! Will read on…

Very good post.Really looking forward to read more. Keep writing.

I appreciate you sharing this blog. Cool.

Major thanks for the blog article. Will read on…

Im obliged for the blog article.Much thanks again. Awesome.

Looking forward to reading more. Great blog post.Much thanks again. Really Great.

Very informative post.Thanks Again. Fantastic.

Im thankful for the blog.

I truly appreciate this article post.Thanks Again. Really Great.

Great blog.Really looking forward to read more. Really Great.

I really liked your post.Much thanks again.

Enjoyed every bit of your blog article.Really thank you! Much obliged.

I cannot thank you enough for the post.Really looking forward to read more. Fantastic.

Fantastic blog.Really thank you!

I really liked your article.Really looking forward to read more. Awesome.

wow, awesome blog post.Really thank you! Cool.

I appreciate you sharing this article post. Cool.

Hey, thanks for the article post.Really thank you! Fantastic.

Very informative blog post.

wow, awesome blog article. Great.

This is one awesome article.Thanks Again. Much obliged.

Im grateful for the blog.Really thank you! Keep writing.

I really enjoy the article post.Much thanks again. Much obliged.

Appreciate you sharing, great blog article.Really thank you!

A big thank you for your blog.Much thanks again. Really Cool.