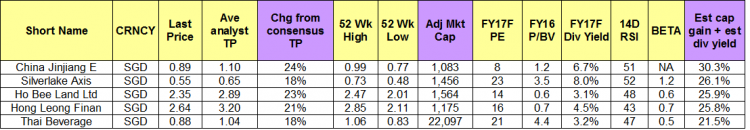

Billion market cap stocks with >=3% dividend yield (12 June 17)

Business Times has an interesting article published today “High-yielding billion-$ stocks go beyond STI”. However, I noticed in the article, it did not list all the stocks with market cap >=S$1 billion and dividend yields >=3%. Therefore, I have sourced data from Bloomberg and have compiled a list of Singapore listed stocks with the following criteria: a) Market capitalisation in SGD terms >= S$1 billion; b) Estimated dividend yields >= 3%. Furthermore, I have sorted the stocks with the above criteria, sorted by total potential return (i.e. Potential capital gain + estimated dividend yield). Table 1 lists the top 5 […]