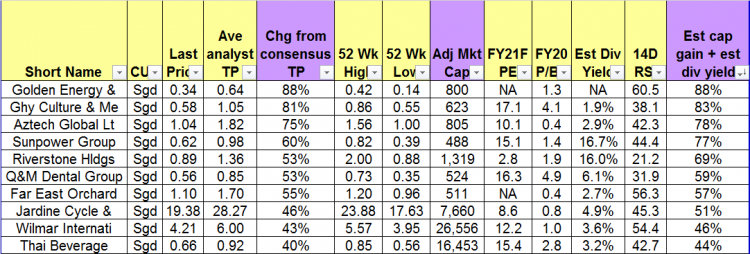

3 stocks, Comfort Delgro, Thai Bev and Wilmar trade at attractive valuations (11 Oct 22)

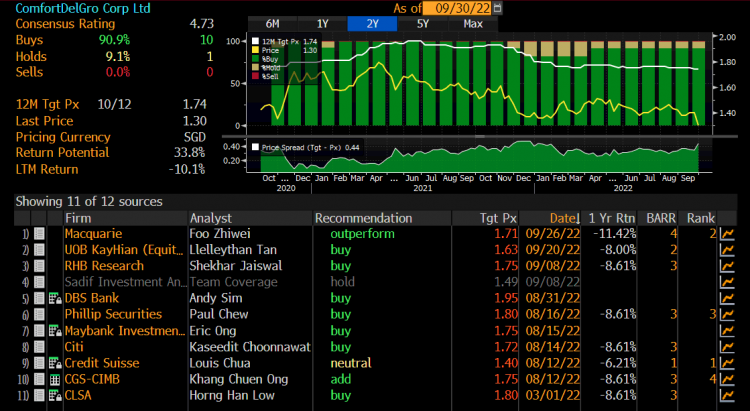

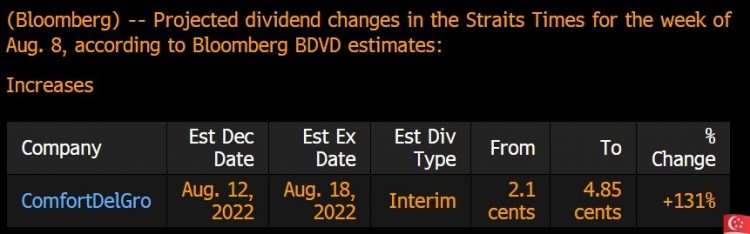

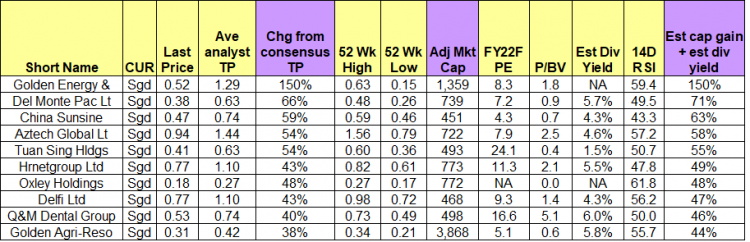

Dear all Yesterday, Comfort Delgro, Thai Bev and Wilmar closed at $1.25; $0.565 and $3.64 respectively. Personally, they look interesting on several aspects. At $1.25, Comfort Delgro trades at levels last seen in 2011 and 2009! At $0.565, Thai Bev sits on a long term uptrend line established since 2009! At $3.64, Wilmar trades at approximately 2.2x and 3.0x standard deviations below its 10Y average PE and P/BV of around 13.8x and 1.1x respectively! Read on for more. *Comfort Delgro* I have previously published a write-up on Comfort Delgro. Readers can refer to my write-up HERE for more information […]