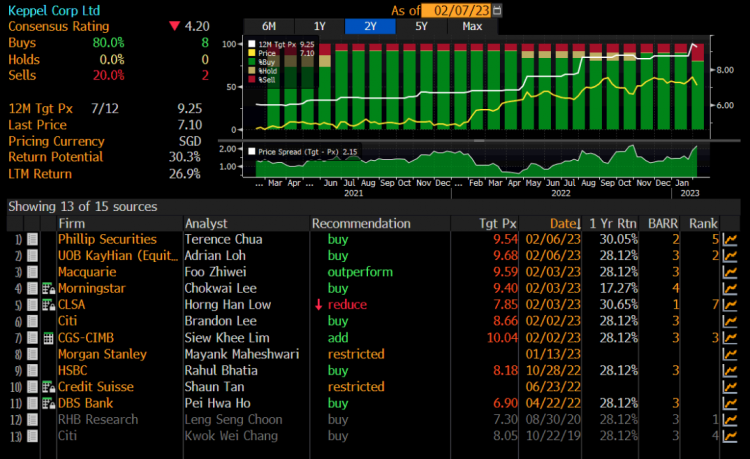

Keppel Corp slumps 7% post results to $7.11 – Any trading opportunity ahead? (8 Feb 23)

Dear all, Kep Corp has fallen $0.54 or 7% from $7.65 on 2 Feb to close $7.11 yesterday. In this write-up, I will elaborate on my take on what has happened and whether there is any trading opportunity. Why did Kep Corp plummet 7%? Kep Corp announced 4QFY22 results on 2 Feb after market. Based on CGS-CIMB report, Kep Corp’s FY22 net profit of S$927m slightly beat estimates, at 102% consensus estimates. So what has caused the sharp drop in share price post results? My guess is that Kep Corp probably drops because a) Kep Corp has appreciated 7.6% […]