5 observations on Sapphire’s results (10 Mar 17)

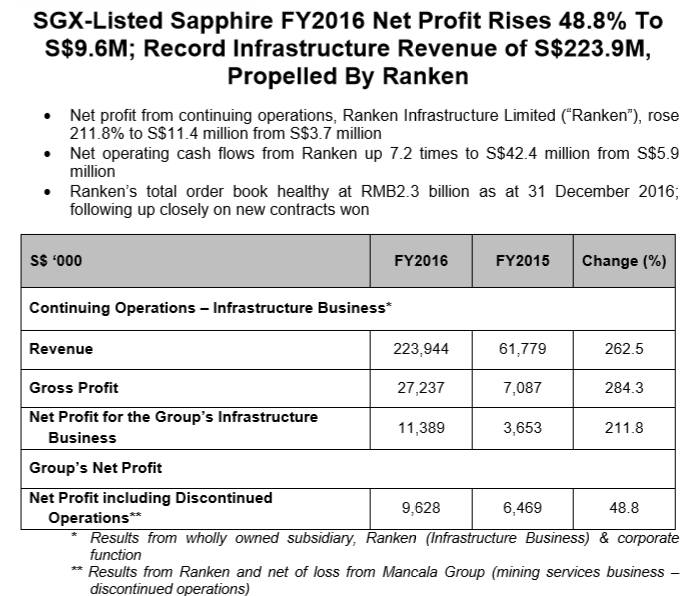

Sapphire’s share price slumped 8% from $0.335 on 27 Feb 2017 (before their results on 27 Feb, after market) to close $0.310 on 10 Mar 2017. Are their FY16 results bad? If yes, why does Mr Teh, CEO of Sapphire, record his first purchase since Sep 2015 now? Below are my five observations on Sapphire’s results. Click HERE for the press release. Table 1: Snapshot of Sapphire’s results Source: Company 5 observations on Sapphire’s results 1.Disposed loss making Mancala to be a focused infrastructure play Sapphire has divested the bulk of Mancala. Based on most industry experts, it is […]