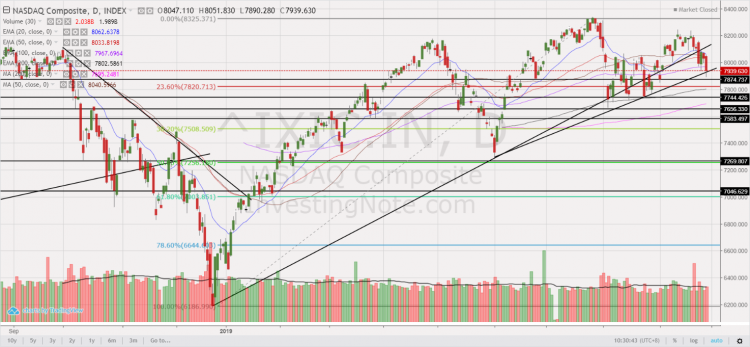

U.S & European stocks logged their largest weekly falls for 2023. What’s next for the equity markets? (26 Feb 23)

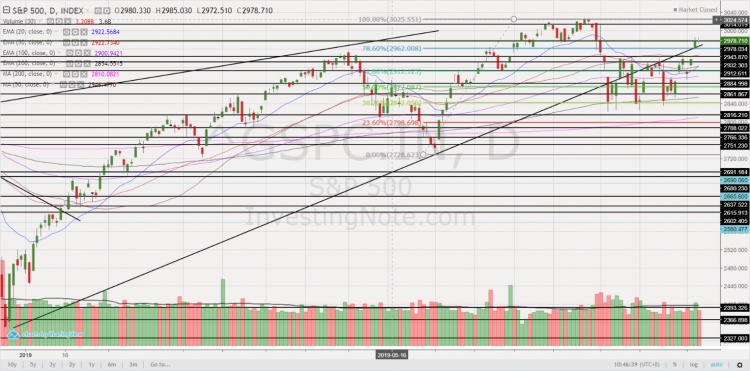

Dear all With reference to my writeup published on 30 Jan 2023 (click HERE), where I mentioned I would be cautious in the overall markets, especially after a sharp run up, US stocks have dropped consecutively for the in the past three weeks. Dow has fallen consecutively for the past three weeks and logged its sharpest 1,010 points or 3.0% last week. So, what is next for our markets? Do we buy, hold or sell? Just to highlight, the below is a sample of a brief stock alert or / and observation which I typically send to my clients […]