HRNet – All time oversold levels amid lowest price since IPO! (29 Aug 19)

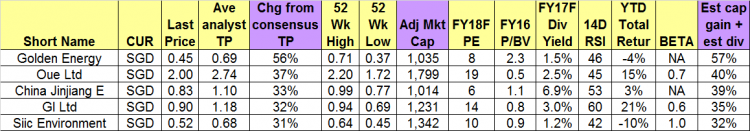

Dear all Another exciting week! This week, HRNet caught my attention as it approaches all time oversold RSI level. In addition, it is trading at the lowest price $0.560 since its IPO price at $0.900. Given the basis below, my personal view is that HRNet may be presenting a favourable risk reward setup for a long trade. Do look at the basis and more importantly, the risks inherent in such trades. My personal basis a) Average target price $0.93! Based on Figure 1 below, average analyst target is around $0.930, representing a potential capital upside 66%. Estimated div yield […]