Comfort Delgro drops back to pandemic lows! What gives? (30 Sep 22)

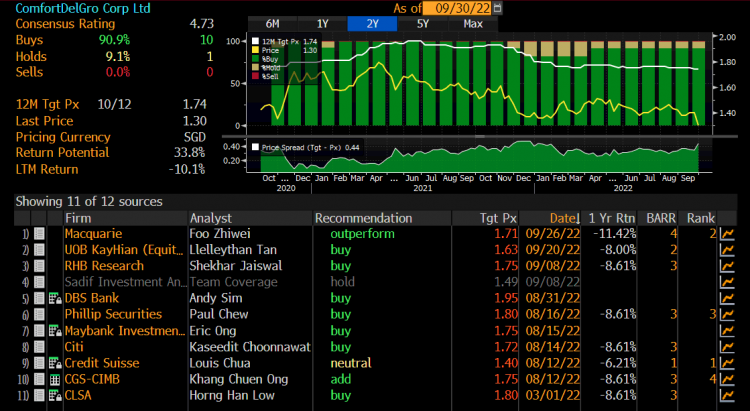

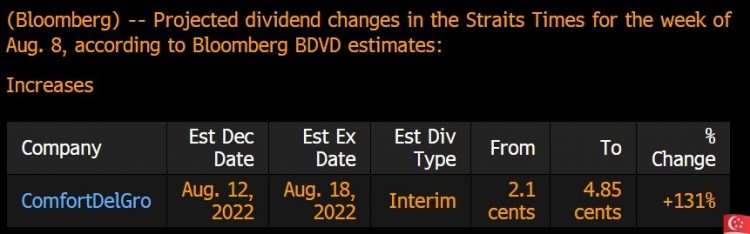

On 1 Sep, it was announced that Comfort Delgro (“CD”) will drop out of STI after being first included in the STI on 28 Jul 2010. Subsequently, there was turmoil in United Kingdom (“UK”) gilts and currency as UK government led by Prime Minister Liz Truss unveiled a (surprisingly) GBP45b plan to reduce taxes (click HERE for more information). Although CD may see some near-term price weakness, at Friday’s close of $1.32 (CD touched an intraday low $1.29 at the point of writing this), I personally believe most of the negatives may have already been priced in. Why am I […]