Margin account – why I started using margin account last couple of months (12 Dec 23)

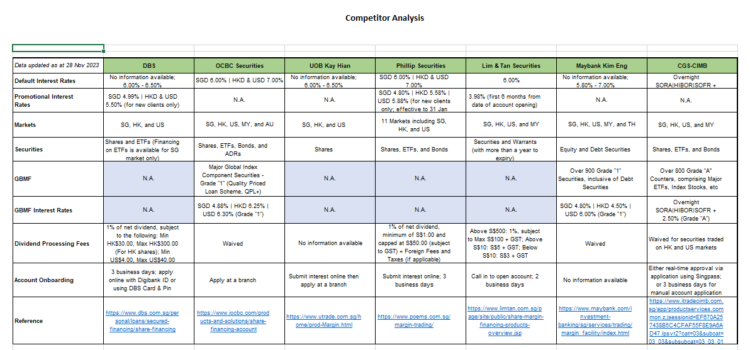

Dear all With reference to my market write-ugp dated 23 Oct (click HERE), where I mentioned that I was buying on dips and was judiciously using leverage via my newly open margin account to accumulate stocks, S&P500 has rallied 8.6%. However, STI is still languishing at almost similar level vs my write-up. Post my write-up, some readers and clients have enquired on the margin account. Hence, I have done a short write-up on margin financing. What is margin financing? What are the things we should be aware of? Read on for more below. A) What is margin financing? Margin […]