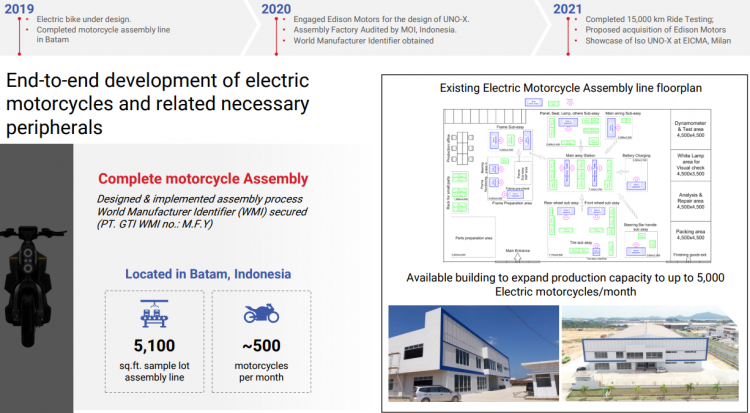

GSS Energy – Electric mobility business takes shape (25 Jan 22)

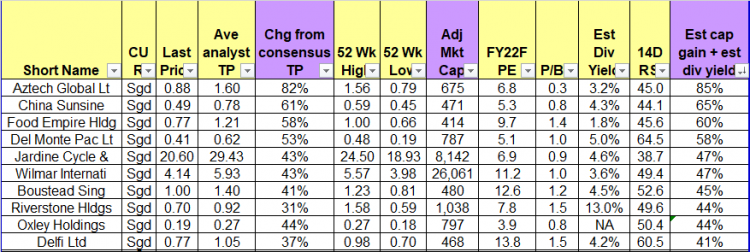

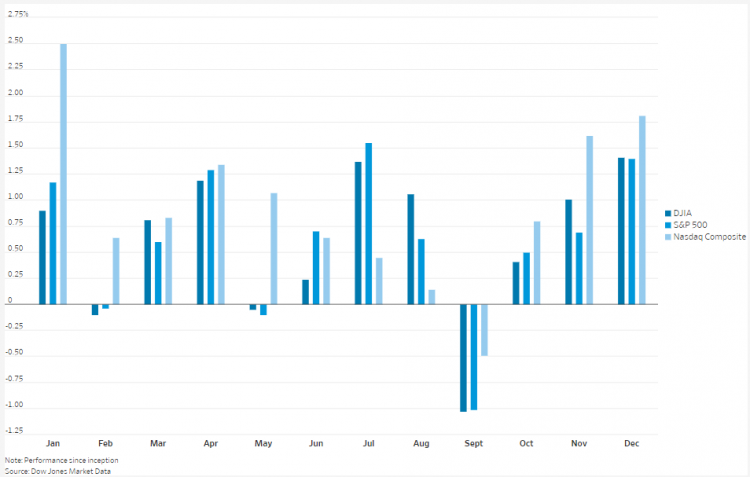

Dear all, With reference to my write-up published on 5 Jan 2022 (click HERE) citing that Asian indices are likely to outperform that of the U.S. market in 2022, our Asian indices, viz. Hang Seng and STI have outperformed the U.S. market significantly (See Table 1 below). U.S. S&P500 notched a 6.4% decline whereas Hang Seng and STI registered a 9.0% and 4.2% gain respectively since my write-up. Table 1: S&P500, Hang Seng and STI 2021 performance since 5 Jan 2022 Source: Ernest’s compilation Given the outperformance, are there still pockets of opportunities in our Singapore market? The short answer […]