S&P500 closed at record high! What should we do? Buy or sell? (9 Aug 2021)

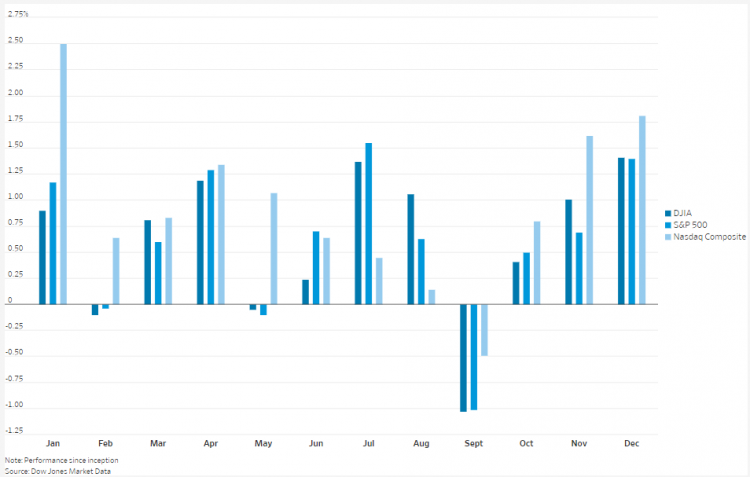

Dear all S&P500 has clocked its sixth consecutive month of gains in July 2021. This is the longest stretch since 2018. Furthermore, S&P500 has touched a record high to close at 4,437 on 6 Aug 2021. In the next 3 months, are markets poised for higher highs? Or should we be prudent and take some profit off the table first? Let’s take a look. Ernest’s personal market observations a) Lack of catalysts to push the market higher Since Covid last year, markets, especially U.S. markets, have been able to push higher due partly to the combination of ultra-easy monetary policies; […]