Guocoleisure (“GLL”) reported its 1QFY16 results yesterday evening. 1QFY16 revenue and net profit registered -2% and +89% year on year (“y/y”). Excluding the one off compensation amounting to approximately US$13.1m received from the cessation of management of 19 regional Thistle Hotels owned by a 3rd party, 1QFY16 net profit should be around US$18.3m, still up about 10% y/y.

To put its 1QFY16 net profit (US$18.3m) in perspective, this formed 38% of FY15 net profit and CIMB’s estimates.

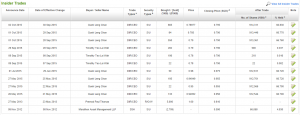

Spate of insider buying buoys confidence

With reference to Table 1 below, Mr. Quek Leng Chan and Mr. Timothy Teo were the most recent two buyers with Mr. Quek’s last transaction on 30 Sep 2015. It is noteworthy that Mr. Quek’s recent purchases are more significant in transaction amounts than his previous purchases on 21 May 2015.

Before 21 May 2015, the last purchase by Mr. Quek was a transaction of 667K GLL shares @$0.64875 on 18 Oct 2012. From 18 Oct 2012 to 21 May 2015, GLL touched a low of $0.560 in Nov 2012 and it spent multiple months trading below $0.950 and $0.790 during the period. However, Mr. Quek only started purchases from May 2015 onwards. This may be indicative of some positive developments in GLL which were not present before May 2015.

Table 1: Recent significant purchases by Mr. Quek Leng Chan buoys confidence

Source: Shareinvestor as of 14 Oct 15

FY15 dividend hike – reflects management confidence

From FY2011 – FY2014, GLL has been distributing S$0.02 / share for the past four financial years. In FY15, GLL raised its dividend by 10% to S$0.022 which might be an indication of management’s confidence in better or similar performance ahead.

Despite weak oil price, FY16F may not be that poor

According to management, they believe that the oil price is unlikely to recover to 2014 level, thus the contribution from their Base Straits Oil Royalty is likely to be affected. However, FY16F results may not be poorer than FY15 due primarily to the following factors.

Firstly, 1HFY15 had no significant interest savings as GLL only refinanced its GBP138m 10.75% mortgage debenture to below 4% in Dec 2014. The interest savings will have a full year impact to FY16F.

Secondly, according to Lim & Tan’s Aug 2015 research report, although GLL will continue its refurbishment program for its hotels in FY16F, management is targeting to refurbish 25,000 room nights in FY16F vis-à-vis the average 50,000 room nights in the past two years.

Chart analysis

With reference to Chart 1 below, GLL slumped to a low of $0.735 on 24 Aug 2015 which was more than a two year low. It subsequently rebounded and closed at $0.880 on 16 Oct 2015. OBV is bullish as it sits near all-time highs. Other indicators such as RSI and MACD are strengthening.

Near term supports: $0.880 / 0.845 – 0.850 / 0.835

Near term resistances: $0.890 / 0.900 – 0.905 / 0.925

Chart 1: GLL staged a strong rebound after hitting more than a two year low

Source: CIMB chart as of 16 Oct 15

Conclusion

The above write-up is meant to summarise GLL’s recent developments. I should have some updated analysts’ reports next week and will send to both my clients and readers who are on my reader’s mailing list.

As mentioned previously, readers who wish to be notified of my write-ups and / or informative emails, they can consider to sign up at http://ernest15percent.com so as to be included in my mailing list. However, this reader’s mailing list has a one or two day lag time as I will (naturally) send information (more information and more details) to my clients first.

Disclaimer

Please refer to the disclaimer here