Dear readers,

STI closed at 2,883 on 31 Dec 2015, down 14.3% year to date. As mentioned last week (see my market outlook here dated 28 Dec), STI is one of the worst performing developed markets, alongside with Greece. Furthermore, our SGD has weakened more than 6% against the USD. Thus, for funds whose base currency is denominated in USD, their returns are likely to be worse than 14% (assuming that they buy stocks which move in tandem with STI), after factoring the weakness in SGD.

STI may face challenging times in 1H2016

On a fundamental basis, STI may face some challenging times in 1H2016 due to the following factors:

a) Corporate results may continue to see disappointments, leading to analysts slashing earnings estimates further;

b) Singapore’s economic data in 1H2016 may also disappoint judging from the recent spate of data;

c) Continued slowdown in China;

d) U.S. interest rate tightening arguably leading to higher borrowing costs in Singapore which may affect small medium enterprises, property companies etc. Also, rising interest rate in the U.S. may result in some funds flowing back to U.S (seeking higher returns).

Valuation support for the STI

Nevertheless, there is valuation support for the STI as we are trading around 1.1x Price to Book Value (“P/BV”) which is on par with that during the Eurozone Crisis 2011/2012. It is just that we do not have immediate near term catalysts for a sharp re-rating. There may be bouts of mini rebound but I would think a clearer picture may be seen in 2H2016.

It is noteworthy that in times of capitulation or extremely weak market conditions, it is entirely possible that STI may trade lower than 1.1x P/BV. What we know for now (based on statistics) is that, STI is trading at levels at the lower end of their historical valuation bands. Ceteris Paribas, when sentiment recovers, coupled with improving economic data / corporate results (be it in the coming months or years), it is likely that it may re-rate nearer to their historical means.

Stock picking is key

Notwithstanding the above, I emphasise that stock picking is key in 2015, and more so in 2016 so as to deliver above average returns. Even in 2015 where STI is one of the worst performing developed markets with a YTD loss of around 14%, there are some star performers such as Innovalues and Riverstone which delivered outsized returns of +67% and +146% respectively. Thus, even if the outlook for 1H2016 is challenging, as long we put in effort to research into companies, there are bound to be some which may generate above average returns.

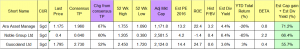

Although I am more familiar with small and mid-caps, I have generated a list of 38 blue chip stocks with the following criteria, sorted by the largest total potential return. Please see Table 1 for the top 3 blue chip stocks with the largest total potential return.

Table 1: Blue chips sorted by total potential return

Source: Bloomberg 31 Dec 15

Criteria

a) Based on my simplistic definition on blue chips, companies whose market cap are more than or equal to S$1b are considered to be blue chips;

b) Estimated dividend yield >=2.9% (slightly higher than our 10Y SGS bond yield of around 2.6%);

c) Average analyst target should be >=10% higher than 31 Dec closing price.

It is noteworthy that this list of 38 stocks is just a list of stocks sorted by the above criteria. Readers should exercise their independent judgement and do their own research before they make any investment decisions.

Readers who wish to see the complete list can either join as my clients via here, or sign up to be included in my website reader’s signup list. As mentioned previously, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails and more details) to my clients first.

Disclaimer

Please refer to the disclaimer here

Wow, awesome blog layout! How long have you been blogging for?

you make running a blog glance easy. The total glance of your website

is great, as smartly as the content! You can see similar here

najlepszy sklep