I have been utilising CFDs for many years to boost my portfolio returns. Over the years, I noticed the following trends:

a) Market volatility has risen

Even blue chips such as our banks, or telcos, such as Singtel can move in a range of 10% within a couple of months. CFDs which allow up to 10x leverage can be used to capitalise on such wild swings.

b) Local CFD platforms have vastly improved over time

For example, CIMB CFD allows contingent order, stop loss etc. which minimise the time invested in monitoring your positions.

c) Shorting is still lucrative in this bull market

Despite the S&P500 entering the 7th year of a bull cycle, shorting remains pretty lucrative, if we short the right sector or / & the right stocks.

How do I use CFD to boost my portfolio return?

Everybody uses CFD in a different manner due to differences in risk profile, returns expectations, market outlook, portfolio size and commitments etc.

For myself, I find that the following strategies work well for me:

a) Leverage

As my clients are aware, I occasionally use leverage to raise my percentage invested to more than 100% of my portfolio. For example, as at 12 Feb 2016, I was approximately 128% invested with the aid of CFDs.

b) Opportunistic trades in extremely oversold, or overbought stocks

I use CFDs to long stocks (typically blue chips) which have been extremely oversold (preferably near all-time oversold), or I use CFDs to short stocks which are extremely overbought (preferably near all-time overbought).

c) To magnify the returns in a range trading stock

Some stocks have low volatility. Based on chart, if I assess the risk to reward ratios for trading such stocks to be favourable (e.g. probability of a $0.01 profit is significantly > than a $0.01 loss), I may use CFDs to magnify the potential returns.

What are CFDs?

To quote from my CIMB CFD website (click here for more information), CFD, or Contract for Difference is an agreement between two parties to exchange, at the close of the contract, the difference between the opening price and closing price of the contract, multiplied by the number of underlying stocks specified in the contract.

CIMB CFDs – worth to take a closer look

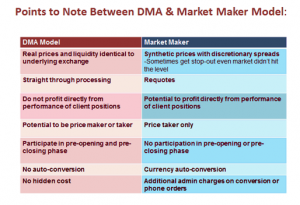

CIMB CFD offers direct market access (“DMA”) to global markets. Some other platforms offer a slightly lower commission rate through their market maker model. As usual, the devil is in the details. Below is a brief comparison of DMA vs Market Maker. (See Figure 1 below)

Figure 1: DMA vs Market Maker

Source: CIMB

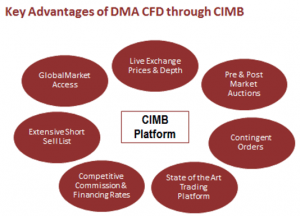

Secondly, readers can consider CIMB CFDs due to the following advantages. (See Figure 2 below)

Figure 2: Advantages of CIMB’s DMA CFD

Source: CIMB

Equity Indices Futures CFDs

Last but not least, we have just rolled out Equity Indices Futures CFDs. Readers can trade such indices futures CFDs with up to 20x leverage. This is likely to form my 4th reason / strategy why I will use CFD.

Risks

As with leveraged instruments, readers should be aware that CFDs are leveraged instruments. Even if you have satisfied the SIP requirements and are qualified to trade CFDs, they may not be suitable to your risk profile, or trading strategy. It is noteworthy that you may lose more than the principal that you put into the CFD due to their leveraged nature.

Readers who wish to know more should attend the seminars below.

Seminars on CFD and how to use our CFD platform

Please visit our website here for more information. Click the various seminar to see the topics discussed in each seminar.

Disclaimer

Please refer to the disclaimer here

Please tell me more about this. May I ask you a question?

Sustain the excellent work and producing in the group!

Thanks for your help and for writing this post. It’s been great.

Hi! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?