Profit from the Panic – Developers’ Deadlines? BREXIT? (Guest post)

– Developer’s deadlines to sell units are reaching – Where are the opportunities?

– Is the Singapore Property Market bottoming out?

– If ABSD is removed who will benefit the most?

– Does BREXIT pose risks to Singapore Property Markets? What are the other risks?

Developers’ deadlines to sell units are reaching – Where are the opportunities?

With many developers hitting their deadlines for Qualifying Certificate (QC) – which need to sell within 5 years of construction else fined 8/16/24% for 1st/2nd/3rd year OR ABSD (developers to pay 15% absd if deadline hit), there will be opportunities as developers try to sell off their units. The developments highlighted in yellow (Fig.1), will be or have already started special promo of 10-15% discounts which have garnered huge interests from investors. For eg. OUE sold more than 80 units at TwinPeaks, D’Leedon & Interlace selling more than 100 units over last weekend. The window of opportunity has arrived for investors who have planned and are ready to act. Good Deals currently – OUE Twin Peaks, Ardmore Three and D’leedon Developments to look out for as promotions are expected are – The Crest, The Nassim, Mon Jervois.

Fig. 1 – Selected Developer Affected by QC and ABSD

Source: The Edge Property, Compiled by Raymond Chng

Is the Singapore Property Market forming a bottom?

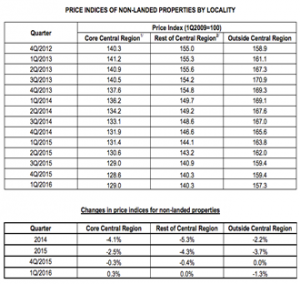

Past research from 2004 have shown that the property market usually starts to bottom out and pick up when the prime properties see a rebound. In 1Q 2016, we have finally seen the property price index reverse and is up 0.3% from 4Q 2015 (seen in fig. 2) after the prime property market (CCR) has been in downtrend for 12 consecutive quarters since 1Q 2013. This does not mean that the property markets have reversed fully into an uptrend, but a period where the reversal may happen soon.

It remains to be seen if there is continuation of this trend over the next few quarters. Should there be continuation, we can confirm that we have reversed the downtrend. It is also noteworthy to consider that the pricing may not immediately shoot up just yet, constant increase in transaction volumes need to be seen in order for the prime property market to move up steadily, while the rest of the market follow in tandem.

Fig. 2 – Property Index by Segment

Source: SRX Analyzer, URA

If ABSD is removed, who will benefit most?

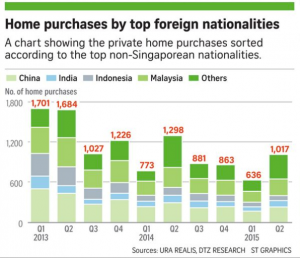

The ABSD was introduced as a measure to stop property speculations as a whole. However, the highest ABSD was to foreigners and companies. This severely reduced the number of foreign buyers. In 3Q 2013, foreign purchases (seen in fig.3) accounted for 10% of the transactions, while in 3Q 2015, the foreign purchases accounted for only 4% which is a drop of more than 50%. From the ground, with talks with estate agents servicing foreign clients, it is known that there are still a lot of money waiting to be allocated into Singapore properties, the only concern is paying the ABSD.

Qing Jian, a china developer has aggressively tendered two plots of land in Singapore. One which is the enbloc of ShunFu Estate for (S$638mil) and Bukit Batok Mix Development (S$301mil). Qing Jian outbid many local developers, showing that they are still aggressively land bank in Singapore.

One reason could be the diversification of their businesses away from China, and Singapore still being a place where they see value. Singapore Properties are still in demand, as seen from the array of property funds, foreign developers and foreign ultra high net-worth still picking up properties here. Demand for properties here has picked up recently especially within the Prime Property Segment. Comparing Singapore’s property markets vis a vis developed markets like Hong Kong, Singapore’s prime properties are at a ~30-40% discount, Thus making our prime market an attractive proposition for investors.

Between 2010 and 2012, property prices sky rocketed with the influx of foreign buyers (on a backdrop where many Singaporeans expected the markets to drop with some even selling off their properties in anticipation of market correction). With all factors considered, it is very likely that when ABSD is reduced or removed, the prime segment will be the first to move. Investors who collect deep valued prime properties will reap the returns of the market recovery.

Fig. 3 – Home purchases by top foreigners

Source: URA, DTZ Research

What are the potential risks for the Property Market now?

Many investors have expressed concerns about BREXIT and its potential spillover effects into the Singapore Property Market. For the past few years, hot money has been flowing into UK properties, however with BREXIT uncertainties money will flow out of the UK & Europe. As a result, it is likely money will flow into Asia, in particular, Singapore Properties in search of safe real assets for wealth preservation. A more detailed report on “The BREXIT effect” will be release in due time.

Others potential risks are the threat of china’s slowing economy and high corporate debts which could affect the global financial markets. Other headwinds include the rising tensions over the China Sea, 2016 US presidential elections. Baring all unforeseen circumstances, these risks are unlikely to cause a great impact in the Singapore property markets. Properties are a hedge against inflation and with recent negative interest rate environment in Japan and Europe, real assets (properties) remain one of the safer investment picks available.

P.S: This write-up was reproduced with permission from Raymond Chng (singaporepropertyinsights.blogspot.com).

Raymond Chng joined the Real Estate industry in 2011. He graduated from Singapore Management University with a Bachelors of Business Management (Finance). He believes strongly in building multiple assets that makes people’s hard earn money work for them. His aim is to help property buyers and investors to be able to make a well informed decision based on transactional trends and financial risk management to ensure a minimal risk entry. He can be contacted at raychngrx@gmail.com

Really enjoyed this article post.Really thank you! Fantastic.