Typically, when you read an analyst report, or a news article on a company, or when someone asks you to take a look at a stock with promising prospects, the decision to buy is usually easier, as you are buying on the prospect of potential gains. After your purchase, if the stock subsequently appreciates, or slumps, or stays around the same level for some time, you may wonder what to do with your existing stocks.

Through my work as a remisier, I have received extremely frequent (and rather standard) questions from my clients (or sometimes readers), whether they should buy more, hold or sell their existing stocks. Some of the situations which they are worried are

a) If they buy more, the stock may drop after their purchase;

b) If they hold (i.e. not buying or selling), the stock may appreciate or drop further;

c) If they sell, the stock appreciates after their sale.

Selling has always been a less discussed topic than buying. This may be because selling is considered “giving up” on the stock and its potential future returns. Oftentimes, it may also seem to be a recognition that one has made a mistake to invest in the stock. However, I believe that knowing when to sell is paramount to obtain an overall respectable portfolio return.

When do you sell?

According to Philip Fisher, the best time to sell a stock is “almost never”. The key word is “almost”. This means that under certain circumstances, it is justifiable to sell. What are these “certain circumstances”? In my opinion, these are the usual situations which I will tell my clients to consider selling.

1. Basis of entry is invalidated

This can manifest in four main ways.

Firstly, if my reason for buying a stock is event driven, such as to punt on its upcoming results (likelihood of a good set of results), or a potential bullish chart breakout, once the event materializes, I will sell the stock. Even if the event does not materialize in a favourable way (e.g. the results turn out to be below analysts’ expectations or the chart breaks down), I will still sell since the basis of entry is invalidated.

Secondly, the company’s fundamentals may have deteriorated to such an extent which you would not have bought it in the first place if you have known that the fundamentals would have changed. For example, assume that I initially bought stock A with its excellent growth prospects and seemingly honest management. However, after some time, there was an abrupt change in management and the new management proved to be incompetent which seriously undermines investor confidence. Alternatively, stock A may issue a profit warning which would have invalidated my view of its excellent growth prospects. If the above occurs, the company’s fundamentals have changed and it warrants a sell.

Thirdly, I may have bought stock A due in part to my preference (or familiarity) in the industry and stock A’s pivotal position in the industry. However, if I sense that the industry may encounter a prolonged multi-year slump, which even the best company in the industry is unlikely to escape unscathed, I will sell it.

Fourthly, as a whole, there may be a change in the underlying fundamentals for the equity market, such as a global recession. If this happens, almost all companies will be affected and it may be wise to sell (at least) some stocks. (This is based on the assumption that we are able to identify the recession and sell the stocks at the early part of the recession.)

2. Valuations overshot fundamentals

Another situation which may warrant a “sell” is that valuations have overshot fundamentals. Take stock B as an example. You may have bought it at 10x FY16F Price to Earnings Ratio (“PE”). Due to your astute judgment, the price surged. After the surge, stock B trades at 30x FY16F PE vis-à-vis its peers which are trading at 15x FY10F PE. Stock B trades at 2.0x Price to Earnings Growth Ratio (“PEG”) against the industry mean of 1.0x PEG. Thus, according to these valuation metrics, stock B seems to be richly valued against its peers. Furthermore, at 30x FY16F PE and 2.0 PEG, this may imply that stock B is “priced to perfection” and it may take just a small hiccup such as a minor earnings’ miss to disappoint the market. This is another factor to consider whether to take the decision to sell.

3. Better usage of funds

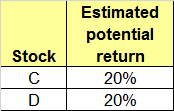

Table 1 shows the existing portfolio of investments owned by an investor. These stocks have appreciated but they still have about 20% potential upside each.

Table 1: Stocks in existing portfolio

Source: Ernest

Table 2 shows the stocks which the investor intends to buy. Besides the estimated potential return, I have made an assumption that the investments in both Tables 1 and 2 have the same risk and all other factors being the same (or almost the same) for “apple to apple” comparison.

Table 2: Stocks which the investor intends to buy

Source: Ernest

Having compared both Tables 1 and 2, ceteris paribus, stocks E and F offer a better return to risk ratio. If the investor is unable, or not willing to put in fresh funds to buy these stocks, it may be wise to liquidate both stocks C and D so as to invest in stocks E & F.

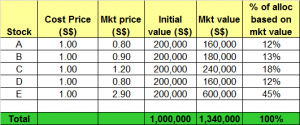

4. Portfolio re-balancing

Most retail investors make their investment decisions by viewing their stocks individually and not on an overall portfolio basis. Let’s assume investor A has S$1,000,000 and invests equally (i.e. 20%) in the following five stocks as depicted in Table 3. He reviews his portfolio one year later and to his pleasant surprise, his portfolio has appreciated 34% in a year. He realizes that the outperformance mainly comes from Stock D which has tripled over the year. Due to the sharp appreciation in stock D’s share price, stock D now occupies 45% of the entire portfolio (instead of the previous 20%). As a result, investor A’s portfolio return is significantly exposed to the gyrations of stock D’s share price. Assuming fundamentals for all five stocks remain status quo, it may be worthwhile to consider divesting part of stock D to reduce the significant exposure and reallocate the portfolio accordingly.

Table 3: Portfolio*

Source: Ernest

*Excludes dividend income in the above computation

Conclusion – Selling is important too!

I have listed some of the factors above which should justify a “sell”, or at least warrant some thought on the investment decisions. Readers are advised to allocate as much time and effort on their “sell” choice as their “buy” choice. Remember – Selling is important too!

Disclaimer

Please refer to the disclaimer HERE

My main triggers for selling a stock are:

1. When EPS or Cash flow come in below expectations, assuming it is not a one-off “,blip”.

2. When Target price of more than one Analyst is reached.

Here we have to be careful if Analsts Target Price upgrades are trailing the results,

I.e. They raise their Target Price after the event , when results are a ” best”

As has been the case with Best world this year.

Hi Peter, thanks for reading my write-up all this while. Appreciate it! 🙂

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

GUMMIES FAQs WHAT ARE CBD GUMMIES? CBD Gummies are a delicious compact and discrete way to consumer CBD. The CBD is infused with delicious, natural jellies for maximum enjoyment. WHAT ARE THE BENEFITS OF CBD GUMMIES? Every consumer is different but CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. ARE CBD GUMMIES AS EFFECTIVE AS OTHER CBD PRODUCTS? Yes CBD gummies are effective as other CBD products but for the fastest effects we always recommend CBD oils, taken sublingually so they can be absorbed quicker WHAT EFFECTS SHOULD I EXPECT FROM CBD GUMMIES? CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. HOW MANY CBD GUMMIES SHOULD I EAT? Between 2 – 3 gummies per day. HOW LONG DO THE EFFECTS OF CBD GUMMIES LAST? The effects of CBD last a few hours but for the best long-term affects we recommend that consumers use CBD daily to support the body’s natural Endocannabinoid System. DO CBD GUMMIES CONTAIN THC? No, all our products contain 0 THC ARE CBD EDIBLES LEGAL? Yes, CBD oil is legal. Approved products are listed under the FSA’s Public List of Novel Food products which can be found here: https://data.food.gov.uk/cbd-products. ARE CBD GUMMIES GLUTEN FREE? Yep, CBD gummies are gluten-free, vegan and 100 natural. WILL CBD GUMMIES GET ME HIGH? No, all our products contain 0 THC so you won’t feel any phschoactive effects.ARE CBD GUMMIES SAFE? Yep, all our CBD gummies are third-party tested and are fully legal for sale.

Orange County is proudly plant-powered: all our CBD Edibles are made from 100 vegan ingredients. You can enjoy the succulent taste of juicy Cherries, Peaches and Strawberries without compromising your ethics or dietary preferences. Plus, our CBD oil is sourced from 100 organically-grown hemp. Our vegan-friendly CBD edibles are made with top-quality ingredients and packed with organic broad-spectrum CBD. Halal roughly translates to ‘lawful’ or ‘permissible’ in English: this is a term used in the Quran to describe practices that adhere to Islamic law.Under Islamic practices, substances that ‘curtain the mind’ are considered the opposite of Halal, otherwise known as Haram, meaning ‘impermissible’ or ‘unlawful’. THC is considered Haram, as it is an intoxicating substance. However, CBD has no psychoactive properties. Here at Orange County, our products are sent off for third-party laboratory testing to ensure the level of THC is undetectable. Therefore, our CBD gummies are halal. ‘Kosher’ is a term used in Judaism to describe strict dietary rules. Outlined in the Torah, Kosher laws dictate that those practising Judaism should not consume gelatin, which is made from the bones and ligaments of cows and pigs. Our CBD gummies are manufactured using all vegan-friendly ingredients, meaning they fall under the definition of Kosher.

Your CBD experience will rely greatly on a number of factors. These include personal bioavailability factors (such as height, weight, and body mass), the strength of your CBD oil product, and the supporting ingredients. In general, CBD has a gentle calming effect for the mind and body. In CBD oil sweets, containing ingredients to boost energy or nutrition, that calming effect can help to focus the mind. In relaxation-based products, that calming effect can be more pronounced — especially CBD products formulated for sleep.Is CBD Legal In The UK?Yes! CBD is legal in the UK, provided the product contains less than 0.2 THC as measured by dry weight.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ