This write-up was reproduced with permission from Ray’s Estate Clinic, written by Founder, Raymond Chng. Please refer to the end of the article for more information on Raymond.

With the record number of new launch properties on the market in 2019 and 2020, all eyes have been on the new launch segment of the property market. Some new property buyers believe that they should buy new properties because they would be buying at the lowest price in the development, and therefore are more likely to make profits when the property obtains TOP. These same property buyers are afraid of buying resale properties because they are worried that there will be limited capital gain potential.

In this article, we will explore the reasons why I believe that investors should particularly look at the private resale condo segment for value buys.

1.New to Resale Price Gap

The New to Resale Property Price Gap is an important indicator of whether New or Resale properties are overvalued. In general, the New to Resale Price Gap should be between 10 to 20%.

For example, in the surrounding area, a similar resale property (of about 10 years old) has a price of $1,000 psf and a new launch property is at $1,200 psf, the new launch property is at a fair value price. In other words, new launch property may have a premium of 10-20% above resale properties.

Using the same example above, if the price of the resale property is at $1,000 psf, while the new launch property is at $1,600psf, then it can be viewed that the new launch property may be overpriced.

So, the question now is, where are we in terms of valuation, based on the New to Resale Price Gap? To answer this question, let us look at two property clusters as examples.

Image 2: Buangkok Cluster Price Gap, Compiled by RaysEstateClinic

For example, the Buangkok cluster.

When Jewel @ Buangkok was launched in 2013, the price gap between Jewel (new) and The Quartz (resale) was about 14%.

When Sengkang Grand was launched in 2019, the price gap between Sengkang Grand (new) and Jewel (now resale) was about 30%, and the price gap between the former and The Quartz was about 70%.

Based on the numbers, it seems that the New to Resale Price Gap in the Buangkok cluster is above average, hence the new property may be viewed to be overvalued by this comparison.

Let’s now look at another, the Bartley Cluster as another example.

Image 3: Bartley Cluster Price Gap, Compiled by RaysEstateClinic

When Botanique @ Bartley was launched, the launch price was very close (~4%) to Bartley Residences (resale).

When The Gazania was launched in 2019 at about $2000psf, the price difference between The Gazania and Botanique was 35%, while the price difference to Bartley Residences was 48%. Despite The Gazania being a freehold property, the price gap appeared to be too large. The current New to Resale price gap here means that the new property can be viewed to be over valued at the moment.

2.Many property buyers have been too focused on buying new properties

A large number of property buyers have been choosing new properties over resale properties. Some believe that buying a new launch property will likely make them generous profits upon TOP, while some buyers just prefer to purchase a new property.

For buyers who are buying new launch properties to gain profits, I think they should review their due-diligence and consider the point above. For buyers who have a strong preference for a brand-new property over capital gains, then it maybe more appropriate.

I believe that now is the time to borrow the famous quote from Warren Buffet, “Be greedy when others are fearful and be fearful when others are greedy”.

When property buyers are avoiding the resale property market, it may be time to look at this segment for particularly good deals.

3.Some Resale properties are undervalued

There are currently a few property clusters that look interesting. Clusters like Tanjong Rhu (see article HERE) and Keppel Bay (see article HERE) which I have written about continue to be undervalued. Some properties in the Bartley and Serangoon cluster also look undervalued. So stay tuned for upcoming articles on these clusters.

Interestingly, for property buyers with a higher risk appetite, some resale properties in the CBD offer high rental yields (~4%) and are undervalued. These properties are, in comparison, priced slightly above the new properties in Potong Pasir and even in the Sengkang vicinity.

4.Private resale condo demand likely to increase

In a previous blog article, I wrote about the spike in HDB owners reaching their 5 year MOPs from 2020 to 2024. There will be more than 20,000 HDBs reaching MOPs each year. If each year, 20% of these HDB owners decide to upgrade, the market would potentially have 6,000 private property buyers. Their choices are new properties or resale properties.

After numerous discussions with friends and readers planning to upgrade, there is one consensus, which is the preference for buying a property that they can move into because they do not want to rent while waiting for a new property to TOP.

In my opinion, I think this is a valid concern, and it does not make sense to pay for other people’s mortgage, of course every property buyer has their unique circumstance and strategy. Furthermore, it is also not guaranteed that the new property would appreciate upon TOP.

Scenario 1 – Rent and Buy New Property

Let’s assume that a property buyer buys a new launch for $1 million and has to rent a property for about 3 years (assume buy at preview period for the “best” price after selling off your current property.

Most would rent either a HDB or condo, in this example, let me assume a good condition HDB at $2,000 per month. Renting for 3 years would cost $72,000, or more depending on the cost of rent.

We assume that upon TOP, there is a generous gain of 20% or about $200,000. Your net gain without considering cost of selling and cost of holding for ease of calculation is $128,000 ($200k less $72k).

Simply put, your net gain here would be $128k, assuming the property price does increase.

The next question is now, what happens if you don’t see capital gains?

Generally, most new launch properties these days are smaller in size than older condos, unless you are comfortable with the size, most owners would find newer condos relatively small. If there is no capital gain, most owners may feel disappointed and now have to hold out with a smaller house, which at times does not feel like as comfortable a home, and hopefully it also does not affect your family’s mood.

If no capital gains are seen, some owners will then regret paying $72k of rental which was probably used to finance someone else’s mortgage.

These are some considerations for new property buyers to consider before buying a new property. As long as you know what you are getting to, I believe that you will make a better informed decision.

Scenario 2 – Buy Resale Property

Here, we will also assume that a property buyer purchases a $1,000,000 resale property. In this scenario, you can move into your property almost immediately and do not need to pay rent. Immediately saving $72K from not having to rent, which also means it is an immediate $72K gain (money not spent, is money saved or kept in your pocket).

I will not consider renovation costs here because renovation preferences are unique to each property buyer, and it is a post purchase cost that does not affect the property price appreciation significantly.

Property buyers who buy resale properties can look for value buys. There are property clusters which have properties that are currently undervalued. Further in the article, you will be able to see some resale properties that already have profit.

Some of my clients, with appropriate guidance and due diligence, had bought properties with in-built profits, meaning that they had bought a property that is undervalued and/or in a location where the probability of property price appreciation is high. Contributing factors to the price increase depend on a few factors, one such factor is the proximity to a new launch that will sell at a much higher price. In such a scenario, property prices could, in the same 3-year period (that someone is waiting for their new property), appreciate up to 20% as well.

In this scenario, if the price appreciates by just 10% (assuming only half the gain of a new property), the profit is $100K, without factoring the cost of holding and transactions.

Comparing the two Scenarios

In scenario 1, the net gains are $128k while in scenario 2, the net gains is $100k. Based on the assumptions in the two scenarios, the difference in gain is only $28k. In my opinion, the difference is really small compared to the risk of buying a new property and having to rent first, where rent is a definite expense (loss) of $72k.

There are numerous factors to consider, but in the current market environment where I think majority of new properties are overvalued, property buyers should consider all their options and evaluate risks appropriately before making a decision.

The above is an actual discussion and scenario analysis which I had with clients when considering their options. There are people who just want to buy a new property and that capital gains are not their priority, and that is fine too as everyone has different priorities and preferences. However, if you would like to have a balance of having potential profits and a comfortable home, private resale properties are definitely a good segment to look into.

5.Some resale property clusters have already started to move up

The resale property market has not been all doom and gloom. Some property clusters have started to move up, and the window of opportunity is still open. Let us look at a few resale properties that already have capital gains over the past 3 to 4 years.

a.Bukit Panjang

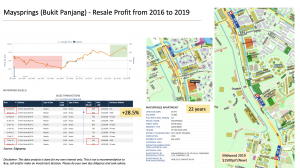

Image 4: Maysprings Analysis, Compiled by RaysEstateClinic

In the first 10 years post launch, prices moved down as seen in the red rectangle before starting its uptrend after the 2008 Global Financial Crisis.

From 2016, the price of some units at Maysprings started moving up. In 2019, actual transaction data shows a price appreciation of 28.5%. During the same period, there were some new properties that did not move up as much.

The question to ask now is, why did prices move up?

It appears that the price for Mayspring went up because there were new launches nearby that were selling at much higher prices. For example Midwood, which is a new launch located at Hillview, was going for $1,500psf while prices in Mayspring were much lower. The New to Resale Price Gap was too wide, and eventually narrowed.

b.Beauty World

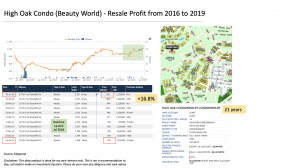

Image 5: High Oak Analysis, Compiled by RaysEstateClinic

The Beauty World cluster is rather interesting as there are a number of new launches in this area due to En-bloc redevelopment. Here, we look at the price movements for High Oak Condo between 2016 to 2020, with price appreciating by around 16.8%.

A new launch condo called Daintree, which is just beside High Oak, launched at an average price of $1650psf, around $650psf above the selling price of High Oak Condo. As the new – resale price gap was rather huge (~65%), prices of High Oak inched up, narrowing the gap.

c.Amber Cluster

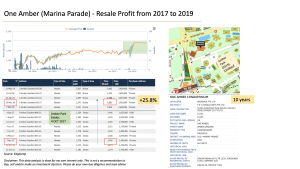

Image 6: One Amber Analysis, Compiled by RaysEstateClinic

The price movement for the Amber cluster has been spectacular over the past 3 years. Here, we observe that at One Amber, prices increased by around 25.8% in just 1 year!

The price appreciation of One Amber was fast and furious, likely because of the Amber Park En-bloc just directly opposite. Amber Park would be selling at $2,500psf which is about $1,000psf higher than the price of One Amber. The New to Resale Price Gap hit an all-time high of 66%, which encouraged owners of surrounding properties to revise their asking prices upwards. Prices stayed up because owners maintained their increased asking prices and is supported by strong buying demand for the property.

While the property examples shown in this section may not be undervalued anymore as their prices have already gone up, there are still opportunities to look at other resale properties for good deals.

Buying a property is a big decision, it is probably the biggest purchase anyone would be making. Therefore, it is important to know the various options you have. Buying a resale property may be a good choice now because many buyers are only considering new properties now and that there are still other property clusters that are laggards (prices have not moved yet but have potential).

Closing Thoughts

If you would like to reduce your risk of making a bad property investment, understanding the value of the property is extremely important. Value, is not buying at the lowest price in the development (like what some experts claim for new properties), it is about buying a property that is valuable compared to its surrounding comparable properties.

With Covid-19 disrupting global economies, it is absolutely pertinent that home buyers and investors look for properties that are “recession resilient” and can hold its value well in most crisis scenarios. In upcoming articles, I will be sharing in detail what a recession resilient property is and how to identify such.

Over the last 4-5 years, private resale properties have generally not been in favour, this is likely to change over the next 5 years. With the current market conditions, it is becoming more favourable for private resale properties, and it’s a good time to look and shortlist the areas or developments to watch, especially property clusters that have good potential, but prices have not moved up yet.

About the Author

Ray’s Estate Clinic (REC), founded by Raymond Chng, is a platform for Investors’ and homeowners to have a Property Portfolio Health Check by utilizing data analytics, ensuring that their portfolio remains healthy providing optimized returns.

“Health is Wealth” is what Raymond believes in, and it is not related only to your own body’s health, but it also refers to one’s financial health. Having a Property Portfolio that is not performing does not help improve an investor’s wealth. Hence, converting non-performing assets into optimized performing assets is essential to portfolio’s health improvement.

Raymond can be reached at raysestateclinic@gmail.com. Do visit his blog HERE for more information.

Disclaimers

Please refer to Raymond’s blog for the disclaimer HERE

Also, please refer to my disclaimer HERE

Wow, amazing weblog format! How lengthy have you been blogging for?

you made running a blog glance easy. The entire glance of your site is excellent, let alone the content!

You can see similar here e-commerce