Dear all,

After touching an intraday high 4,325 on 16 Aug 22, S&P500 has slid 401 points, or -9.3% to 3,924 on 2 Sep. Hang Seng has slid to around 19,144 at the time of writing.

Given the market pullback, there are several interesting stocks worthy of research. Coupled with various macro events happening this month (e.g. ECB & Fed Chair Powell Speaks 8 Sep; U.S CPI 13 Sep and FOMC 22 Sep etc.), I have to plan my trading strategy. Give the above, time is tight and this will be just be a brief article to update readers. (As usual, my clients will still receive my usual daily updates and my research)

This aside, it has been a hectic yet rewarding results period (Jul to Aug) so far. As we approach Sep, there is an earnings vacuum (since most companies have reported results), coupled with negative seasonality factors (Sep is typically a weak month for equities), what should we do? *Do we buy, hold or sell?

For myself, I am light in equities as I have closed most of my trading positions bought earlier to punt for their upcoming results. As I am not excessively invested at the moment, I am looking for buying opportunities :).

*This depends on your own situation. Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information.

For me, a possible starting point to screen out stocks may be here…

In line with my usual practice, I have sorted some Singapore listed stocks by total potential return using Bloomberg data as of the close of 31 Aug 2022.

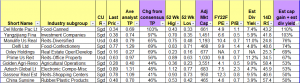

I have generated two tables below and have appended the top 10 and bottom 10 stocks for readers. Table 1 lists the top 10 stocks sorted by highest total potential return. These top 10 stocks offer a total potential return of between 50 – 110%, based on the closing prices as of 31 Aug 2022. Most importantly, please refer to the criteria and caveats below. [My clients have already received the entire list of my compilation of 98 stocks and some highlighted stocks – see important note 4 below.]

Table 1: Top 10 stocks sorted by total potential return

Source: Bloomberg 31 Aug 2022

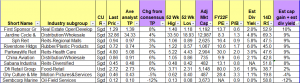

Table 2 lists the bottom 10 stocks sorted by total potential return. These bottom 10 stocks offer a total potential return of around -12% to +10%, based on the closing prices as of 31 Aug 2022.

Table 2: Bottom 10 stocks sorted by total potential return

Source: Bloomberg 31 Aug 2022

Criteria in generating the above tables

a) Mkt cap >= S$400m to potentially capture more market opportunities;

b) Presence of analyst target price.

Very important notes

a) This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that Oxley is definitely better than Wilmar in terms of stock selection. Readers are still required to do their own due diligence and form their own independent investment decisions;

b) Even though I put “Ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices and some of these target prices may not be the most updated figures;

c) Analyst target prices and estimated dividend yield are subject to change anytime, especially after results announcement, or after significant news announcements;

d) In my list of 98 stocks above, I have highlighted some stocks in green (visible to my clients but not for readers) which my private banking clients and I are looking at. Naturally, as I have a limited portfolio size and bandwidth, I do not intend to buy all the highlighted stocks. However, some of my private banking clients have a bigger portfolio and hence they have the capacity to accumulate 10-20 stocks (not only limited to Singapore) with meaningful quantities. Notwithstanding this, we may change our stocks accordingly as variables change (e.g., newsflow on the specific stocks; prices have moved etc.)

e) The above stock prices and average analyst target prices are rounded to two decimal places.

Conclusion – some Singapore and Hong Kong stocks look attractive

With reference to the above compilation of 98 stocks, suffice to say that if the analysts are right, there are opportunities to accumulate with meaningful potential upside. Some Singapore and Hong Kong stocks (pending research, I will share with my clients) look attractive too.

Notwithstanding the above, as usual, I wish to caution that there are risks stemming from geopolitics; interest rate; inflation; supply chain constraints (which are easing somewhat but still present); a strong dollar etc.

Readers who wish to receive my manual compilation of stocks sorted by total potential return can leave their contacts here http://ernest15percent.com/index.php/about-me/. I will send the list out to readers around 10 Sep 2022.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE.

Wow, awesome weblog layout! How long have you been blogging for?

you made blogging look easy. The whole look of your website

is magnificent, as smartly as the content! You can see similar here sklep internetowy

NgBmMfxrTE

Wow, marvelous blog format! How long have you been running a blog for?

you make running a blog look easy. The whole look of your web site is fantastic, as smartly as the content!

You can see similar here e-commerce

Wow, incredible blog layout! How lengthy have you been blogging for?

you made blogging glance easy. The total look of your site

is fantastic, as well as the content material! You can see similar here e-commerce

Hi, Neat post. There is a problem together with your site in web explorer, might test this?

IE nonetheless is the marketplace chief and a huge section of folks will omit your magnificent writing because of this problem.

I saw similar here: E-commerce

Wow, awesome weblog layout! How long have you ever been running a blog

for? you made running a blog look easy. The total look of your website is great,

as neatly as the content material! You can see similar here

sklep

GchApvFljYzTPQ

Hey! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but

I’m not seeing very good gains. If you know of any please share.

Many thanks! You can read similar text here: E-commerce

It’s very interesting! If you need help, look here: ARA Agency

Great article post. Great.

Useful information. Lucky me I discovered your site by chance, and I am stunned why this coincidence did not came about earlier! I bookmarked it. expand your blogexpander

gIyVFXDnCPUfJ

Howdy! Do you know if they make any plugins to help with Search Engine Optimization?

I’m trying to get my blog to rank for some targeted keywords but I’m

not seeing very good success. If you know of any

please share. Cheers! You can read similar text here: Sklep internetowy

Hi! Do you know if they make any plugins to help with SEO?

I’m trying to get my blog to rank for some targeted keywords but

I’m not seeing very good success. If you know of any please share.

Cheers! You can read similar article here: Sklep

This design is wicked! You obviously know how to keep a reader amused.

Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Great job.

I really loved what you had to say, and more than that, how you presented it.

Too cool!

Hello, every time i used to check web site posts here in the early hours

in the dawn, for the reason that i love to learn more and more.

Howdy! Do you know if they make any plugins to assist with Search Engine Optimization? I’m trying to get my site to rank for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Thank you! You can read similar

art here: Auto Approve List

Hi! Do you know if they make any plugins to help with SEO?

I’m trying to get my site to rank for some targeted keywords but I’m not seeing very good gains.

If you know of any please share. Appreciate it! You can read similar art here: Auto Approve List

UVAgOoPEXtqTpkx