Dear all,

Kep Corp has fallen $0.54 or 7% from $7.65 on 2 Feb to close $7.11 yesterday.

In this write-up, I will elaborate on my take on what has happened and whether there is any trading opportunity.

Why did Kep Corp plummet 7%?

Kep Corp announced 4QFY22 results on 2 Feb after market. Based on CGS-CIMB report, Kep Corp’s FY22 net profit of S$927m slightly beat estimates, at 102% consensus estimates. So what has caused the sharp drop in share price post results?

My guess is that Kep Corp probably drops because

a) Kep Corp has appreciated 7.6% from its intraday low $7.11 on 16 Jan to close $7.65 on 2 Feb, before its results. Suffice to say that some anticipation may have been priced into this stock in anticipation of its results.

b) CLSA has a reduced call on Kep Corp citing a lack of price catalysts beyond the distribution in specie of Sembmarine shares post the sale of Kep Corp’s O&M business to Sembmarine. It is noteworthy that CLSA’s target price for Kep Corp was adjusted upwards from $7.65 to $7.85, post results.

Notwithstanding the above, I personally believe that Kep Corp looks interesting at this level.

Basis

a) Analysts are generally positive on Kep Corp with average analyst target price $9.25

Based on Chart 1 below, based on the analyst calls in Feb, there are 6 buy calls and 1 sell call. Assuming the consensus is right, there may be a potential capital upside of around 30% in the medium term. Coupled with the consensus’ 4.0% dividend estimate in FY23F, total potential return amounts to around 34%. Kep Corp ex dividend $0.18 / share on 27 Apr 23.

Chart 1: Average analyst target price $9.25; 30% potential capital upside

Source: Bloomberg 7 Feb 23

b) Possibility of raising its asset monetization target >$5.0b

Since the commencement of the group’s asset monetisation program in October 2020, Kep Corp has announced asset monetization worth more than $4.6b. Based on their 4QFY22 presentation slides, they mentioned that they are on track to exceed their target of $5.0b by end 2023. Given that Kep Corp has already announced more than $4.6b worth of asset monetization, there is a possibility that they may raise their asset monetization target. If so, it is likely that this may bolster earnings in 2023 and into 2024

c) A proxy to the beleaguered China property which may recover in the medium term

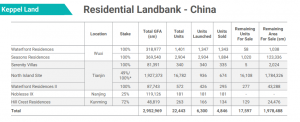

Kep Corp through its wholly owned subsidiary Keppel Land has a vast residential land bank in China. Based on Table 1 below, Kep Corp has substantial residential land bank in China. Although the property recovery in China may take some time, this may arguably be another tailwind for Kep Corp through its property exposure in China.

Table 1: Kep Corp’s China residential land bank

Source: Company

d) Evolving to an asset light business model with recurring income streams

Kep Corp’s Vision 2030 is to move from lumpy profits and order book businesses to an asset light business model with recurring income streams. Management believes that by doing so, the market may ascribe a higher earnings multiple for Kep Corp, and perhaps be valued by sum of parts, or discounted cash flow instead of simply valuing by price to book.

e) Sembmarine EGM – A successful one paves the way to further transformation

Sembmarine’s EGM is scheduled on 16 Feb, Thurs, 11 am. A successful one should pave the way to further transformation in Kep Corp to an asset light business model with recurring income streams.

As usual, there are risks involved in equity investments. Below are just some examples of risk factors. Most of these risk factors are self-explanatory.

Risks

a) A delay in the approvals required for the Keppel-Sembmarine transaction

b) Slower-than-expected pace of economic recovery

c) News known to the market but unknown to me

As usual, I wish to caution that there may be news known to the market but unknown to me to cause Kep Corp to fall 7% with volume.

d) Chart seems to have broken down

Based on Chart 1 below, Kep Corp seems to have breached the uptrend line established since Oct 2022 with volume expansion. A sustained break below $7.11 with volume expansion is bearish for the chart.

Near term supports: $7.09 – 7.11 / 7.01 / 6.95 – 6.97

Near term resistances: $7.16 / 7.22 / 7.28 / 7.39 – 7.40

Chart 1: Kep Corp seems to have breached the uptrend line

Source: InvestingNote 8 Feb 23

Conclusion

Kep Corp seems interesting as it sheds its O&M business to Sembmarine and embarks on its Vision 2030 – Asset light business model with recurring income streams. The potential recovery in China’s property market in the next few years may serve to be another tailwind for Kep Corp.

Notwithstanding the above, there are definitely risks involved. A delayed in the Kep Corp-Sembmarine transaction; a slowdown in the global economic recovery and the breakdown in its chart are some potential risk factors.

For a more complete picture, it is advisable to refer to Kep Corp’s analyst reports (Click HERE) and SGX website (Click HERE).

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

P.S: I am vested in Kep Corp.

Disclaimer

Please refer to the disclaimer HERE

Great write..

Good write.. awesome.