Thai Bev may be ripe for a bounce; BeerCo IPO potential near term catalyst (29 Mar 21)

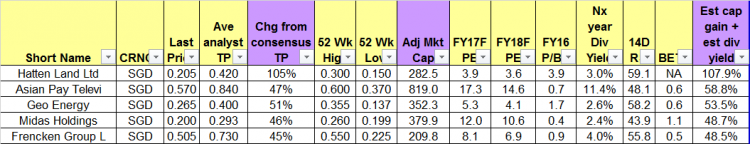

Thai Bev has slumped 14% from an intraday high of $0.850 on 8 Feb to close $0.735 on 29 Mar 21. It is looking interesting again as it hovers around its strong confluence of supports from $0.715 – 0.725. Personally, it seems ripe for a technical bounce. Besides the technical outlook, Thai Bev has the highest potential upside among the STI component stocks with a potential capital upside of around 21%! What else is interesting about Thai Bev? Read on for more. Interesting points on Thai Bev a) Highest potential capital upside for STI component stock With reference to […]