Sapphire – 4 interesting updates which market may have ignored (2 Jun 17)

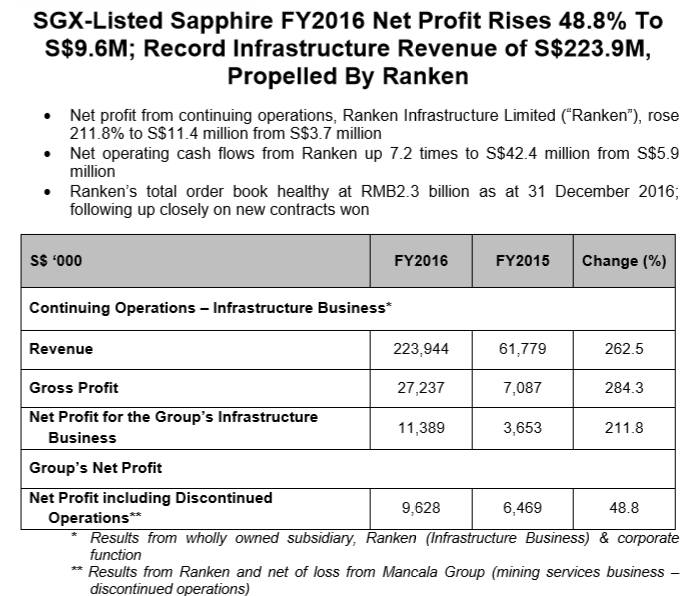

Since my last company update on Sapphire on 10 Mar 2017 (see HERE), Sapphire has unveiled other interesting updates. Although the share price did appreciate 15% from $0.310 on 10 Mar 2017 to a high of $0.355 on 3 Apr 2017, it has since slid back to $0.320 on 2 Jun 2017. What are the recent updates and why are they interesting? Strategic collaboration with Beijing Enterprises Water and China Railway On 16 May 2017, Sapphire announced that its wholly owned infrastructure business, Ranken has entered strategic partnerships with major Chinese conglomerates and state-owned enterprises to explore civil engineering […]