Zixin Group: Riding the Wave of China’s Food Security and Agri-Tech Boom (20 Apr 25)

Dear all

Since President Trump announced tariffs on 4 Apr 4 am (Singapore time), markets have been in a tailspin. Even the once unassailable S&P500 dropped 21.3% from 6,147 on 19 Feb to a low of 4,835 on 7 Apr before closing at 5,282 on 17 Apr.

Market focus has turned to stocks which can best withstand the turmoil from tariffs. A stock that comes to my mind is Zixin Group (Zixin 42W). In addition, Zixin has made several interesting announcements and it may arguably be an opportune time to take a closer look.

Zixin closed at $0.027 on 17 Apr with a market cap of S$42.9m.

Description of Zixin

Zixin is a China-based agri-tech company listed on the SGX. It is emerging as a strong beneficiary of the country’s heightened focus on food security and sustainable agriculture. With vertically integrated operations in sweet potato seedlings production, sweet potato cultivation, R&D, processed foods, and feedstock for animal feed, Zixin presents an intriguing growth story for investors seeking exposure to the China consumer and agri-tech sectors. Zixin operates in Liancheng County, Longyan City, Fujian Province, China. Liancheng County has been dubbed China’s “sweet potato capital of the world” (Click HERE for the reference).

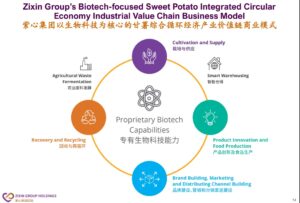

Chart 1: Zixin’s business proposition

Source: Company

Why is it interesting?

Zixin has multiple streams of incomes. Let’s take a look.

A) Fresh sweet potatoes – prices are rising

One of Zixin’s business segments is to sell sweet potatoes in China. Its higher-grade sweet potatoes are sold as fresh produce.

1HFY25 revenue from sweet potatoes amounted to RMB48.6m, 31% of the entire revenue. This is likely to increase over time because since 2HFY24, Zixin has started to outsource its services to smart warehouse in providing automated sweet potato washing, sorting and cold storage. This is expected to reduce spoilage, improve quality and shelf life, enabling premium pricing and further supporting gross margins.

This step is crucial as it is common knowledge that sweet potatoes are perishable items. According to Phillip Securities Research, this outsourcing to a smart warehouse extends the shelf life of the sweet potatoes from 1-2 weeks to 1-2 months. This extension has multiple benefits. Firstly, Zixin can take a longer period of time to sell at prices which they can plan, instead of rushing to sell its fresh sweet potatoes in the shortest possible time. Secondly, Zixin is able to sell the fresh sweet potatoes to supermarkets and e-commerce beyond Liancheng County, opening a new income avenue. Thirdly, Zixin can buy more sweet potatoes to build their inventory given a longer shelf life. In times of rising sweet potato prices, Zixin is likely to stand to benefit more than its competitors.

Although current prices for sweet potatoes are not readily available, based on channel checks, fresh sweet potato prices have risen in the areas which Zixin operates in.

B) High-Value Processed Foods – increasing both in absolute amount with higher margins

Zixin’s has another business segment, namely the sale of sweet potato processed products. Generally speaking, Zixin’s lower-grade harvests and those fresh sweet potatoes purchased from third parties will be processed into their own branded or OEM sweet potato products for other brands, such as Three Squirrels.

Based on Zixin’s business update dated 6 Feb 2025, Zixin is progressing well with the development of its new high-tech manufacturing facility, which spans 83.6 mu (~13.8 acres) with a total built-up area of 86,000 sqm. Once fully operational, the facility will raise the Group’s annual production capacity from 13,700 tonnes to 35,000 tonnes—an increase of approximately 2.6 times.

Phase one of the expansion has seen the installation of three automated production lines across 22,800 sqm, focusing on higher-margin, value-added products. These include functional foods such as purple sweet potato powder (also known as single-cell sweet potato powder), additive-free vacuum-packed steamed sweet potatoes, natural-flavoured steamed varieties, and nutritious orange peel sweet potatoes.

These premium products are expected to achieve gross margins of 35–40%, compared to the current 28–30%, subject to fluctuations of raw material costs, supported by advanced processing techniques and growing consumer demand for healthy, convenient foods. The margin uplift reflects the use of higher-quality sweet potatoes and minimal processing that helps retain nutritional value.

In addition, on 1 Apr, Zixin announced another positive development in this business segment. It has achieved a breakthrough in the production of sweet potato chips and fries snack products —marking a key milestone in its snack product line. Historically, manufacturers have struggled with achieving consistent texture and crispiness in sweet potato snacks compared to traditional potato-based alternatives. See Figure 1 below.

The improved product quality has already gained market traction. In March 2025, Zixin began fulfilling sizable distributor orders for these newly enhanced sweet potato chips and fries under its proprietary brand. In fact, to meet strong demand, Zixin has added a new line at their snack facility. Further expansion will be evaluated based on market growth. Zixin expects this product range to become its flagship offering, providing consumers with an alternative to traditional potato chips and fries.

Figure 1: Newly launched sweet potato chips and fries

Source: Company

C) Sweet Potato seedlings – another potential revenue driver in FY26F

Seedling sales rose 42% YoY in 1H FY25, with Phillip Securities projecting a 7% increase in 2H FY25. Further growth is expected in FY26, supported by the planned expansion of greenhouse capacity from 100 mu in FY24 to 200 mu.

It is noteworthy that the growth in contribution from 100 mu to 200 mu is not linear. To provide some background, Zixin owns a dedicated 300 mu sweet potato seedling farmland in Liancheng County, which it continues to develop through significant investment in soil improvement and nursery construction. This initiative allows Zixin to control sweet potato varieties and cultivation practices, ensuring high-quality yields from its leased sweet potato farmlands.

Historically, Zixin has not relied on third-party seedling suppliers (as it uses its own), with minimal revenue from excess seedling sales. However, the planned expansion to 200 mu of seedling nurseries is expected to drive meaningful growth in this segment due to (i) higher sales volumes (as it has more now to sell to external parties) and (ii) likely rising market prices amid strong demand.

We may see more of such contribution in 1HFY26F as sale of seedlings usually concentrates in 1H due to planting season after Chinese New Year. i.e. March to July.

D) Extension to address feed security

Zixin Group has commenced commercial production and sales of its probiotic-infused sweet potato feedstock, marking a key milestone in completing its circular economy model. In January 2025, the Group secured an initial order of 1,080 tonnes valued at RMB 3.2m from a poultry farm operator. On 28 Mar 2025, Zixin announced it has secured a probiotic-infused fermented sweet potato feedstock order from Liancheng County Guanhe White Duck Family Farm, a local white duck poultry farm, on 19 March 2025. This order of 180 tonnes of feedstock for RMB720K will be valid for an initial period of one year, commencing on 19 Mar 2025.

While modest in scale, the deal signals meaningful progress in Zixin’s sustainability journey.

Production is outsourced to a third-party fermentation facility, which works with the local sweet potato waste collector in Liancheng County, Fujian. Zixin supplies its proprietary probiotic formula and technical guidance for converting agricultural waste into high-value animal feedstock.

Feeding livestock with sweet potato waste is common practice, but Zixin’s biotech-enhanced feedstock offers added benefits—improving feed consistency, reducing reliance on soymeal and corn, lowering environmental impact, and supporting food safety through cleaner meat production.

According to Phillip Securities research, Zixin currently relies solely on sweet potato peels as raw material for its probiotic-infused feedstock. However, from FY26F (financial year ending March), the Group is expected to incorporate sweet potato stems, which are more abundant—yielding up to eight times more per acre than peels—potentially unlocking greater production capacity.

E) Strategic Partnership with CITIC in Hainan

On 3 Jul 2023, Zixin announced that its wholly owned subsidiary Fujian Zixin Biotechnological Potato Co., Ltd holds a 3% stake in an urban revitalization project in Lingao, Hainan, with CITIC Construction through a joint venture (JV) company. The collaboration will replicate Zixin’s integrated industrial value chain business model, together with the supporting industries of smart warehousing and fermentation plant, in Lingao County, Hainan, which boasts five times the cultivation land and a climate that supports two harvests annually. The asset-light model means government and third parties bear most of the fixed capital outlay.

Although this is underplayed by Zixin, this strategic partnership with Citic in Hainan is a large positive for the company. Firstly, to be able to participate as a partner with Citic Construction, the 2nd largest state-owned conglomerate in China by AUM of foreign assets, is a testament to Zixin’s strengths. Secondly, the Revitalisation Project in Língāo County which involves 12 administrative villages and covers 8,961ha is segregated into primary and secondary projects. The primary project focuses on land development with stipulated milestones to be completed within three years (i.e. by CY2026), which will be carried out in phases to allow the secondary projects which involve agricultural and tourism activities to progress in tandem. Development income, if any, will accrue to the JV company which Zixin holds a 3% stake. Thirdly, subject to discussions, Zixin can earn a management fee as it advises on the best cultivation practices of the arable land. Fourthly, Zixin plans to extend its biotech and high-tech capabilities to Lingao County, Hainan, by replicating its integrated sweet potato value chain from Liancheng.

Key initiatives include:

(i) Selecting and cultivating suitable seedlings for sale and providing farming solutions to local farmland owners,

(ii) Purchasing sweet potatoes for fresh sales,

(iii) Engaging OEM partners to produce proprietary branded products, and

(iv) Collecting agricultural waste to produce and supply probiotic-infused feedstock to animal feed producers, including sales of its proprietary fermentation solutions.

This strategy aims to scale and replicate Zixin’s successful sweet potato ecosystem in a new region. However, it is important to note that according to Phillip Securities’ estimates, the land available for sweet potato cultivation in Lingao County, Hainan spans approximately 500K acres, quintuple the total sweet potato cultivation area in Liancheng County.

F) Net Cash Position Enhances Flexibility

Based on 1HFY25 results, Zixin sits on a net cash of RMB136.2m (approx. S$24.5m) in net cash—around 57% of its market cap—providing it with ample resources for strategic expansion and R&D.

G) Tailwinds from strong government support

The Chinese government is promoting sweet potatoes as an alternative to imported soybeans to enhance food security. Policy support includes land allocation, rental-free periods, and subsidies for construction of basic infrastructure facilities for cold storage warehouses and fermentation plants to attract potential operators to expand in poor rural counties. For example, according to Phillip Securities report, the Liancheng County government has committed RMB120m to build cold storage facilities. It has awarded a four-year free rental period for Zixin’s cold storage operator.

H) Smart money has already noticed Zixin

Based on 25 Oct 2024 announcement, Thomas Khoo has increased his stake in Zixin to 10.35% by acquiring 6.5m shares at $0.02815 / share. This was a sharp increase since he first emerged as a substantial investor (above 5%) in Zixin on 13 Jun 2024.

I) Chart is encouraging

Based on Chart 2 below, it is assuring to see that Zixin closed at $0.027 on 17 Apr, which was the same close on 3 Apr, just before Trump announced retaliatory tariffs on 4 Apr 4 am. Zixin closed at its 50D SMA and one bid above its 200D SMA ($0.026) on 17 Apr with above average volume. Most indicators are quietly gaining strength.

Near term supports: $0.027 / 0.026 / 0.023

Near term resistances: $0.028 / 0.031 – 0.032 / 0.035

Chart 2: Zixin relatively unscathed since President Trump announced tariffs on 4 Apr 4 am

J) Valuations are compelling

Zixin’s NAV / share is around S$0.062. Based on Phillip Securities’ estimate of FY25F earnings of around RMB34.8m, Zixin FY25F PE is around 6.9x. It is noteworthy that we may see more contributions from their processed food segment; sale of sweet potato seedlings and sales of its probiotic-infused sweet potato feedstock in FY26F.

Naturally, almost all investments carry risks. Below is a list of some risks.

Potential risks

A) Execution risk

Scaling operations, including processed food manufacturing and animal feed production, depend on successful execution and uptake of new technologies.

B) Agricultural risk

Weather, disease, or environmental changes could affect sweet potato yield and quality, especially with the planned expansion to new geographies like Hainan

C) Regulatory and Policy Changes

While Zixin currently benefits from government support, changes in subsidies or policies may affect profitability.

D) Product Demand Uncertainty

Processed food and feed products are subject to shifts in consumer preferences and industry competition.

E) No dividends at the moment

Zixin has not given out dividends in the past few financial years as it is in a rapid expansion phase. One of the reasons why the Group intends to retain its cash resources is for exploring any opportunities in increasing contracted farmlands through co-operatives which will require advance payment for supplies of sweet potato.

F) Currency conversion risk

At the moment, Zixin does not face much problems from currency exposure. Its costs and revenue are primarily denominated in RMB (thereby providing a natural hedge of sorts) and its financials are also presented in RMB (thereby no translation risk). However, going forward, if a dividend policy is introduced, any payout will be subject to the RMB-SGD exchange rate, as the Group earns profits in RMB and must convert them to SGD for distribution.

G) Warrants – expire on 23 June 2026

As at 30 Sep 2024, Zixin has approximately 578m outstanding warrants which are convertible to 578m ordinary shares. The warrants may be converted to ordinary shares during the period up to 23 June 2026 at an exercise price of S$0.045 per warrant share. This may serve as an overhang in the near term.

Nevertheless, it is noteworthy that company can issue the warrants with a longer tenure or with a lower exercise price. However, it chooses a two-year tenure and an extremely high exercise price $0.045 / share. At the time when it first announced the rights and warrants, Zixin was only trading at $0.022. To some extent, I believe this shows management’s confidence in the company and for the market to recognise Zixin’s value over time.

H) First time looking at Zixin

This is only my first look into Zixin. For a more complete picture, it is advisable to refer to Phillip Securities initiation report dated 30 Sep 2024 (click HERE); 27 Nov 2024 report (Click HERE) and SGX website (Click HERE).

I) Lack of analyst coverage

As a S chip and in the sweet potato industry, suffice to say that it is not the sexiest company to excite the investment community. As there is a lack of analyst coverage, there may be insufficient information to make a well-rounded investment decision on Zixin.

Conversely, this also leaves room for price discovery. If there are more reports from the analyst community, Zixin may see a significant up-move in share price especially when it is likely under-owned and under researched by the investment community. Phillip Securities is the only brokerage house covering Zixin now.

J) Small market cap of S$43m

Zixin is a small company with an approximate market capitalisation of S$42.9m. With its small market capitalisation and illiquid nature (average 30-day volume is only 3.2m shares), it may be difficult to attract analysts and fund managers’ attention.

Conclusion

It is noteworthy that there are risks involved such as the aforementioned risks (e.g., various business, execution risks; product demand uncertainties etc.). Nevertheless, Zixin’s numerous income streams with more contributions to be seen in FY26F; stable industry prospects supported by government initiatives, low valuations, it may arguably be worth a closer look.

For a more complete picture, it is advisable to refer to Phillip Securities initiation report dated 30 Sep 2024 (click HERE); 27 Nov 2024 report (Click HERE) and SGX website (Click HERE).

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, you can consider signing up at https://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, I can be reached at ernestlim15@gmail.com.

P.S: I am vested in Zixin and have informed my clients on Zixin too.

Disclaimer

Please refer to the disclaimer HERE