ThaiBev – Attractive Valuations; Muted Expectations and Market Underweight — A Potential Black Horse for 2026 (23 Nov 25)

Dear all,

STI has appreciated 18.0% from 3,788 on 31 Dec 2024 to close 4,469 on 21 Nov 2025. Notwithstanding such stellar performance, one STI component stock with extremely strong brand equity and entrenched market share has lagged severely by being down 14.7% over the same period.

Yes, I am referring to ThaiBev. It closed at $0.465 on 21 Nov.

Personally, ThaiBev looks interesting given attractive valuations; muted expectations and investors underweight position in this stock vis-à-vis other stocks.

This will be a short write-up as I am clearing my backlog of work before my Xiamen family trip on Tues! 😊

Description of ThaiBev

ThaiBev operates in four main business segments (click HERE for ThaiBev’s corporate website):

- Spirits – ThaiBev produces and sells branded liquor under the brands (e.g. Hong Thong, Sang Som, Mekhong and Phraya) and sells soda.

- Beer – The beer business group operates under BeerCo Limited, the largest beer company in ASEAN (in terms of sales volume), operating beer businesses in Thailand and Vietnam. BeerCo Limited brews and distributes beers (such as Chang), along with Chang-branded water and soda.

- Non-Alcoholic Beverages – ThaiBev’s non-alcoholic beverage business boasts strong brand equity and distribution coverage across all regions of Thailand, led by consumer-facing brands like Oishi, Est, and Crystal, complemented by F&N’s long-standing, high-quality products.

- Food – ThaiBev operates under a wide range of restaurant brands, including Japanese, Chinese, Thai, ASEAN, Western, as well as cakes and bakery items. It has exposure in the food sector through its KFC and Starbucks franchises in Thailand.

Some noteworthy points

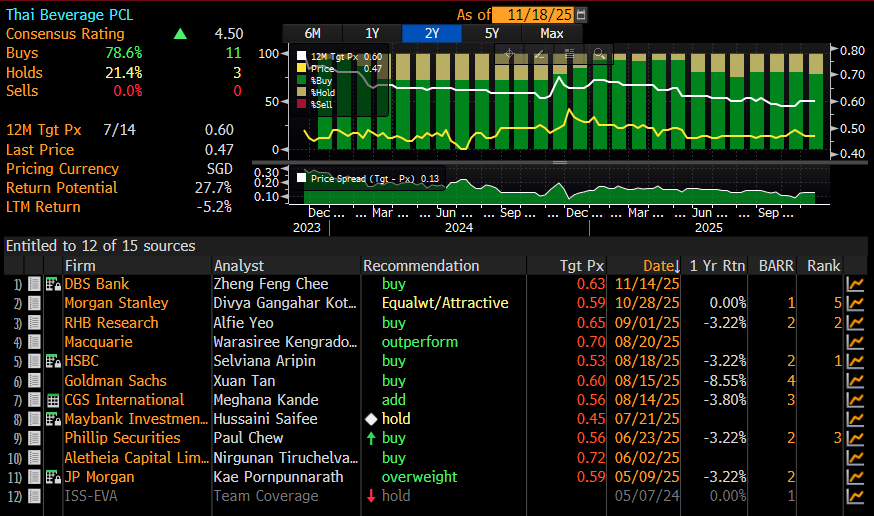

a) Analysts are positive with average analyst target price $0.600

Based on Figure 1 below, 14 analysts cover ThaiBev with 11 Buy Calls; 3 Hold Calls. Average analyst target price is around $0.600. Based on my personal observation, ThaiBev has seen cuts to earnings and target prices in the past 1-2 years. Personally, my gut feel is that given muted expectations heading to ThaiBev’s upcoming FY25 results (scheduled for release on 25 Nov, after-market.), there is room for upside revisions to earnings and target price. Moreover, some analysts may roll forward their valuation based on FY26F earnings.

Figure 1: 11 analysts with Buy Calls; 3 Hold Calls; Target price $0.600

Source: Bloomberg 20 Nov 2025

b) Chart support may limit potential downside

Based on Chart 1 below, there is no doubt that ThaiBev is entrenched in a long-term downtrend established since Aug 2019. It seems to be resting on a good support region $0.465-0.470. A breach of its 200D SMA (currently around $0.475) with volume expansion will be a first positive signal for the chart.

Chart 1: ThaiBev trades at support $0.465 – 0.470

c) Attractive valuations for a company with such strong brand equity

Based on Bloomberg, ThaiBev trades at only 9.9x FY26F PE with a decent 5.6% FY26F dividend yield (See Figure 2 below). It trades at 1.3x standard deviation and 1.0x standard deviation below its 10Y PE and 10Y P/BV of around 15.9x and 3.1x respectively.

Figure 2: Consensus estimates for FY25F to FY27F

Source: Bloomberg 20 Nov 2025

d) ThaiBev’s significant underperformance vis-a-vis STI may have priced in most negatives

At $0.465, ThaiBev’s year to date return (excluding dividends) is a -14.7%. This sharply lags STI’s approximate 18.0% rally. Based solely on absolute price changes, without incorporating the effect of dividends, ThaiBev’s 1Y, 3Y and 5Y returns were -9.7%, 24.4% and 35.9% respectively. Suffice to say that the such significant underperformance may have priced in most negatives.

e) Potential catalysts in the medium term

- Potential value unlocking exercises such as listing of BeerCo;

- Based on CGSI’s report dated 15 Aug 2025, Sabeco’s margins may improve further given that it still has low-cost malt and continues to reap synergies from SABECO’s acquisition of Sabibeco;

- Based on my own reading, prices for ThaiBev’s raw materials are generally declining. After a general spike in raw material prices in 2021 – 2023, most raw materials such as molasses, malt, brown rice, and aluminium are either stablising or declining. This generally bodes well for ThaiBev.

Some potential risks

Below are examples of some potential risks in ThaiBev.

a) Results may be an event risk

Results are generally an event risk for most companies. ThaiBev will report full year results on 25 Nov, after market. Nevertheless, as 9M FY25 sales and EBITDA formed 74% and 82% of FY25F consensus estimates, coupled with muted expectations for their results and guidance, my gut feel is that the odds are lower for a downside shock to its share price.

Notwithstanding the above, we will not know for sure how share price will react on results. Even if the company reports better than expected results or / and guidance, the share price may not move higher. A case in point is Nvidia whose share price has slumped post earnings, despite better-than-expected results and guidance.

b) Other business risks

Any slowdown in consumer demand in both Vietnam and Thailand is likely to have a negative impact on ThaiBev. In addition, ThaiBev may also be affected with unfavourable changes in regulation in both Vietnam and Thailand.

Conclusion

Generally speaking, there are risks involved in investing and I have only listed some examples above. Thus, it is imperative to exercise one’s due diligence and make an informed choice, after carefully evaluating the investment merits and risks.

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. It is imperative to do your own due diligence and form your own independent view. The above is for general information only. Readers can refer to ThaiBev’s analyst reports HERE. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, you can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, I can be reached at ernestlim15@gmail.com.

P.S: I am vested in ThaiBev.

Disclaimer

Please refer to the disclaimer HERE