Stocks in focus – Capitaland Investment and Riverstone (1 Sep 25)

Four stocks, namely Capitaland Investment (CLI), NTT DC Reit, OKP and Riverstone caught my attention last month. In the interest of time, I will just outline some noteworthy points on CLI and Riverstone.

1) CLI closed at $2.79

a) Strength in China equity market

Shanghai Composite Index (SSE) closes at 3,876 on 1 Sep, near a 10 year high. Previously, when China market rallied from 2,690 on 18 Sep 2024 to an intraday high of 3,674 on 8 Oct 2024, CLI soared to a high of $3.20 during that period. SSE is now at 3,876 and CLI is only at $2.79;

b) CLI has stakes in six listed reits

CLI has stakes in Capitaland Ascendas, Capitaland Int Comm; Capitaland Ascott; Capitaland China; Capitaland India and Capitaland Malaysia Trust. If the reits perform well in share prices and operations, CLI should benefit to some extent too. Today, Business times has an article on Capitaland Ascott and highlights its attractive valuations and business.

Based on my observation, the Capitaland group of reits is slowing moving higher, hence this should bode well for CLI.

c) CLI expands into Chinese capital markets

CLI has obtained approval to list their eighth reit CapitaLand Commercial C-Reit (CLCR) sometime by 4Q 2025. This is a testament to its leadership position as Asia-Pacific’s largest Reit manager by market capitalisation and marks a meaningful leap in CLI’s expansion into Chinese capital markets.

d) Chart looks positive

Based on chart, barring unforeseen circumstances, CLI looks likely to head higher. ADX is turning higher, amid positively placed DIs. In addition, it is encouraging to see that CLI has bounced off its 50D SMA (currently around $2.73). A sustained breach above $2.82 (downtrend line established since 31 Jan 2023) is very positive.

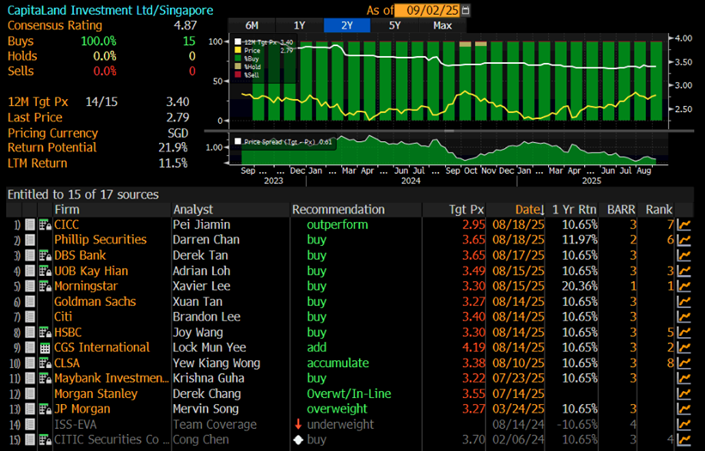

e) All analysts who cover CLI rate it a Buy; average analyst target $3.40

Based on Figure 1 below, 15 analysts cover CLI. All of them rate it a Buy with average target price $3.40. Coupled with FY25F div yield of around 4.4%, total potential return is around 26%.

Figure 1: 15 analysts cover CLI; all rate it a BUY with average target price $2.79

Source: Bloomberg 1 Sep 25

2) Riverstone closed at $0.735

*Barring unforeseen circumstances and based on my personal view, there are certain positives working towards RS in the next 6-12 months*

a) 2H extremely likely to be better than 1H

Based on the results call last month, RS is seeing a 10-15% volume growth in cleanroom (CR) glove segment increase in 3Q vs 2Q and a double digit growth rate in 2H vs 1H. To illustrate how important CR is, although CR contributes approximately 15% of RS’ group 2QFY25 glove volume, it contributes 70% to its overall gross profit. Thus, a 10-15% improvement CR segment bodes well for the group in 2H.

b) Multi-month base building

Based on Chart 1 and price action, there seems to be quiet accumulation on this stock as it trades between $0.670 – 0.750 since mid-May 2025. Even when RS reported 2QFY25 results on 7 Aug which is far off from some analysts’ estimates, RS did not drop much. The lowest it touched was $0.675 on 8 Aug which didn’t breach the important support region $0.670 – 0.685. A sustained breach $0.750 with volume expansion is extremely positive for the chart and points to an eventual technical measured target of around $0.830.

Chart 1: Multi-month base building with key resistance $0.750

c) FY25F numbers have been revised downwards, lowering the bar for outperformance

Based on Bloomberg, post RS’ 2QFY25 results, the Street has revised FY25F net profit numbers downwards from MYR288m to a more achievable MYR242m. 1HFY25 net profit was MYR 102m. Given than 2H is likely to be stronger than 1H, I suspect this net profit estimate should be achievable. Even if RS somehow misses these estimates, it is unlikely for them to miss by a lot (barring unforeseen circumstances such as a drastic drop in US$ against MYR, sudden spike in costs) and market is likely to forgive them, especially if they can cite an improving FY26F.

d) Trades at attractive valuations vis-à-vis sector and vs itself

Based on Bloomberg, average analyst target and estimated div yield are $0.850 and 6.4% respectively. RS trades at 14.8x FY25F PE and 13.6x FY26F PE which is low for a glove stock. Its Malaysia listed peers are trading around 18 – 93x next FY PE. Furthermore, RS trades at approximately 1.0 standard deviation below its 2Y PE 16.4x.

e) Likely a beneficiary of the MAS S$5B Equity Market Development Fund

RS is likely to be one of the beneficiaries of the MAS S$5B Equity Market Development Fund due to its excellent track record, clear leadership in CR segment; high dividend yield; net cash and solid management etc.

f) Ex div MYR0.025 / share on 16 Sep

1HFY25 dividend per share (DPS) amounts to MYR0.055, translating to 80% dividend payout ratio. Given RS’ track record of paying more than 100% of its earnings out as dividends and its strong net cash position, I suspect RS can easily pay out 100% of its earnings as dividends this year. Based on Bloomberg, consensus estimates FY25F DPS to be MYR0.155, translating to an estimated dividend yield of around 6.4%.

Important! Caveat Emptor, as usual…

Due to time constraints, for the investment risks, please refer to the analyst reports.

CLI – Click HERE.

Riverstone – Click HERE.

Every stock has its own peculiar risks hence please do your own due diligence too.

P.S: I have mentioned CLI, NTT DC Reit and OKP on 25 Aug. I have mentioned Riverstone to my clients on 10 Aug, post its results. I am vested in all four stocks.

📩 Want to receive such write-ups earlier?

To open an account or explore your options, feel free to email me at ernestlim15@gmail.com.

✨ Extra Value for Clients:

My clients regularly receive:

- Market observations and potential trading ideas with the usual caveats.

- Exclusive notes and insights after my 1-on-1 meetings with C-suite leaders – deeper than what I share on LinkedIn.

Importantly, every investor is different. Always assess your own financial situation and risk appetite before making investment decisions. Readers should do their own due diligence as everybody is different with different individual circumstances.

Lastly, feel free to add me on LinkedIn for market updates and company insights.

*Disclaimer*

Please refer to the disclaimer HERE