Hatten Land (“Hatten”) has been trading in a tight range $0.192 – 0.210 for the past two months. Recently, there seems to be a pick up in the volume traded…

read moreSince my write-up on GSS Energy (“GSS”) dated 28 Nov 2016 (see HERE), GSS’ share price has surged 154% from $0.078 on 28 Nov 2016 to an intraday high of…

read morePursuant to my previous write-up on 23 May 2017 (click HERE for the earlier write-up) citing the oversold nature on Hatten’s chart, Hatten has surged 20.2% from $0.183 on 23…

read moreCapital World (formerly known as Terratech Group Limited) has slumped a whopping 46% from its intraday high of $0.240 on 29 Mar 2017 to close $0.130 on 1 Jun 2017.…

read moreHatten Land has dropped 39% from an intraday high of $0.300 on 28 Feb 2017 to close $0.183 on 23 May 2017. What has caused the sharp decline? Where is…

read moreErnest’s market opinion (19 May 17)

Ernest’s market opinion (19 May 17) https://ernest15percent.com/wp-content/uploads/2017/05/Table-1_Top-five-stocks-with-the-highest-estimated-total-potential-returns.png 900 220 Ernest Lim's Investing Blog https://ernest15percent.com/wp-content/uploads/2017/05/Table-1_Top-five-stocks-with-the-highest-estimated-total-potential-returns.pngDear all Below is my personal opinion on the market. As previously mentioned to my clients, I aim to reduce my percentage invested in stocks (currently around 130% invested), especially…

Banyan Tree recently clinched two noteworthy strategic partnership with AccorHotels and Vanke on 8 Dec 2016 and 23 Jan 2017 respectively. Since 23 Jan 2017, Banyan has largely traded between…

read moreMidas has slumped 14% post a 76% growth in its FY16 results. It closed at $0.225 on 7 Apr 2017 which was near the all-time closing low of $0.210. Some…

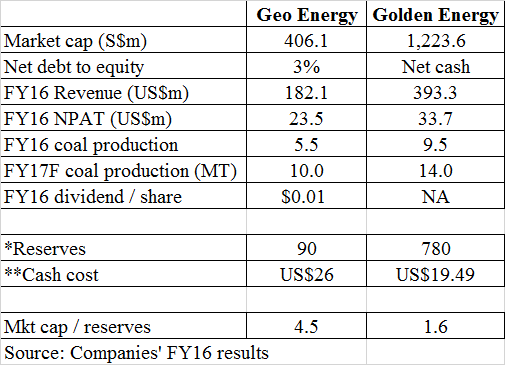

read moreGolden Energy (“GEAR”) has slumped 21% from $0.655 on 12 Dec 2016 to $0.515 on 27 Mar 2017. Compare this with a 47% rally in Geo Energy’s share price over…

read moreNotwithstanding the rally in the equity market, there are some stocks which continue to be laggards and are consolidating around their key support areas. If the market continues to stay…

read more