Dear readers, Happy New Year! Hope your new year has been great. Market has been extremely interesting for the past couple of months. Recently, China Aviation (“CAO”) caught my attention…

read moreMerry Xmas! As we approach end 2019, most market strategists are putting their market estimates for end 2020. Although I do not profess to be in the league of these…

read moreOn 6 Nov 2019, I posted an article (using data as of 5 Nov) on my blog with regard to two stocks, namely ISOTeam and Sunpower (click HERE) for their…

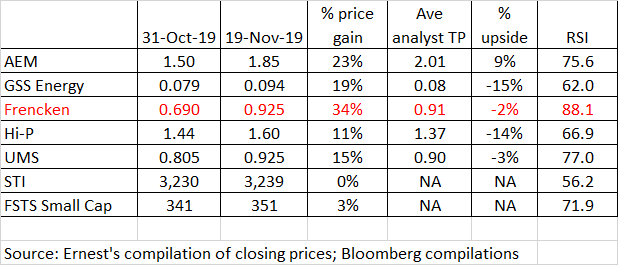

read moreThis week, Frencken has caught my attention with its 34% surge from $0.690 on 31 Oct 2019. It closed $0.925 on 19 Nov 2019. At $0.925, this is very near…

read moreThis week, besides Food Empire which caught my attention (click HERE), Yangzijiang (“YZJ”) also caught my attention for being a laggard. It has given up all the gains since its…

read moreThis week, Food Empire caught my attention with their potential bullish chart developments amid volume expansion. This may be an opportune time to take a look at Food Empire on…

read moreThis week, two stocks, namely ISOTeam and Sunpower caught my attention with their potential bullish chart developments amid volume expansion. 1. ISOTeam Chart looks positive with strengthening indicators and…

read moreLast Friday, Unusual Limited (“Unusual”) caught my attention. It is testing its key resistance $0.270 – 0.280, accompanied by an increase in volume for the past three days with above…

read moreThis week, Hi-P has caught my attention with its 33% surge from the intra-day low of $1.13 on 7 Oct 2019 to trade to an intra-day high of $1.50 on…

read moreDear all, S&P500 hit a near intra-day record high at 3,027 on 25 Oct 2019 (one-point shy of its intra-day record high 3,028 on 26 Jul 2019). However, such optimism…

read more