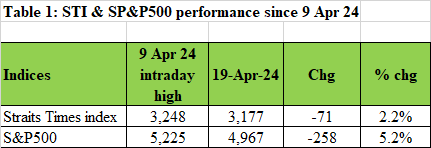

STI & S&P500 fall 2.2% and 5.2% since 9 Apr – Some stocks e.g. Capitaland Investment hit lows with favourable risk reward (21 Apr 24)

Dear all

It has been a while since I last published a post on my blog. I have been extremely busy with clients, trades and appointments, especially with 1-1 meetings with C suite management of listed companies. Readers can refer to my Linkedin HERE to see my activities and which companies I have met on a 1-1 basis.

Based on Table 1 below, since 9 Apr, STI has fallen 71 points or 2.2% from an intraday high of 3,248 to close 3,177 on 19 Apr. S&P500 has fallen 258 points or 5.2% in seven out of eight days to close 4,967 on 19 Apr.

Source: InvestingNote

Concerns over escalating tensions over Iran / Israel; reduction in the number of interest rate cuts and pushing back of the timing of the first rate cut; rising U.S. 10y bond yields; weakening U.S. markets, strengthening of US$, mixed economic data in China are some of the usual factors cited in the weakness.

As the market is starting to look attractive with various SGX listed stocks presenting favourable risk reward set-ups with a medium term horizon, notwithstanding my hectic schedule, I have taken the time to manually compile a list of Singapore listed stocks sorted by total potential return, using the close of 15 Apr. Table 2 shows the top ten stocks listed by total potential return. As usual, readers and clients have to do their own due diligence. This is just a first level screen. The full list is available to my clients.

Table 2: Top ten stocks listed by total potential return

Source: Bloomberg as of the close of 15 Apr

I have cited some companies to my clients which have garnered mostly buy calls from analysts and are trading at near multi year lows or near all-time lows. Below is an example of a company which I have highlighted to my clients last week.

Capitaland Investment

Capitaland Investment (CLI) closed at $2.46 on 19 Apr. This is an all-time low post its listing in 2021 following the restructuring of CapitaLand Limited.

Some noteworthy points are

a) Dividend $0.12 / share to be ex-div on 2 May. CLI’s AGM is on 25 Apr and will report 1QFY24F business update on 26 Apr before market.

b) At $2.46, its dividend yield is around 4.9%.

c) CLI has stopped its shares buyback since 26 Jan 24. CLI bought back shares worth $64m and $92m in 2023 and 1Q2024 respectively (See Table 3 below). The average prices paid in 2023 and 1Q2024 are $3.012 and $2.958 respectively. With the ex-dividend date on 2 May and with the dividend yield at 4.9%, coupled with current share price $2.46 which is significantly lower than their share buyback price $2.958 & $3.012, there is a good chance that CLI may resume share buybacks post its results on 26 Apr.

Table 3: Top five Singapore Primary-listed Companies ranked by share buybacks

Source: SGX Market Update 9 Apr 24

d) Although China’s property market is still trying to find a bottom, coupled with mixed China economic data (e.g. PMI manufacturing and non-manufacturing data are better than expected but retail sales and industrial production are below forecasts), based on some of the readings that I have done, suffice to say that China’s property market is likely to be nearer to a bottom (vs 1-2 years ago) and sentiment on this sector should gradually recover in 2HFY24 and 1HFY25, barring unforeseen circumstances.

e) Although CLI is not a property developer in China, 15.6% of FY23 revenue came from China. Thus, what happens to China is important to CLI from both business and sentiment aspects. CLI earns fee income from four sources, namely fees from fund management of its listed funds management; private funds management; lodging management and commercial management. Thus, China’s recovery plays an important role to CLI.

f) Based on Figure 1 below, average analyst target price and dividend yield are around $3.71 and 4.9% respectively. If the consensus is right, total potential return is around 56%! Readers can refer to the analyst report here https://sginvestors.io/sgx/stock/9ci-capitalandinvest/analyst-report

Fig 1: Average analyst target price $3.71; total potential return 56%!

Source: Bloomberg 19 Apr 24

Below are examples of some risks which may affect CLI.

Some possible risks

a) Reduction of number of interest rate cuts and pushing back of the timing of the first rate cut. In other words, CLI has one less near positive share price catalyst to latch on.

b) Slower than expected scaling up of funds under management.

c) Slower than expected of capital recycling, particularly in markets such as China and the USA, where over half of CLI’s S$9b pipeline assets reside, may have an adverse impact on CLI.

d) Weaker than expected share price performance and business operations of its reits and private funds.

e) Bearish chart. Based on chart, the breakdown from $2.68 points to an eventual technical measured target of around $2.38. Given that CLI’s RSI has reached an oversold level of 27.2 and based on its historical RSI range, RSI typically finds a bottom around 23.5 – 26.0, I am not sure whether the eventual technical measured target price of $2.38 can be attained. Suffice to say that most indicators such as MFI, RSI and MACD are exhibiting bullish divergences but they by themselves are not a good market timing tool. However, I guess it may be fair to say that we are closer to a tradeable bottom.

f) CLI reports results on 26 Apr before market opens. As I have repeatedly mentioned before, buying before a company’s results is risky. Hence it depends on one’s own risk profile and whether you perceive that share price has largely reflected its headwinds and perhaps lacklustre business performance.

Conclusion

In summary, I personally believe that some SGX listed companies which have garnered mostly buy calls from analysts and are trading at near multi year lows or near all-time lows, may be worth a closer look.

An example may be CLI. I have highlighted some of the potential interesting points and some noteworthy risks in CLI. Readers, please do your own due diligence.

I have also reiterated Seatrium in my latest writeup to my clients and also informed them that Singtel has retreated back to interesting levels. However, due to time constraints, I will not be posting on my blog.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at https://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here https://ernest15percent.com/index.php/about-me/

P.S: Among the companies mentioned above, I am vested in CLI, its Long 5x DLC (DPNW) and Seatrium.

Disclaimer

Please refer to the disclaimer HERE