UOB Kayhian – A key beneficiary of vibrant equity markets (16 Nov 25)

Dear all,

Amid the buoyant market activities, one stock comes to my mind. UOB Kayhian (UOBKH) seems to be an obvious beneficiary of a buoyant equity and capital market.

UOBKH closed at $2.49 on 14 Nov 2025.

Description of UOBKH

Backed by the UOB Group, UOB Kay Hian is one of Asia’s largest brokerage firms. Headquartered in Singapore, it has more than 80 branches worldwide across Southeast Asia, Greater China, the United Kingdom and North America.

With more than a hundred years of history, its client base comprises of institutions, large corporations, high-net-worth individuals and retail investors. In Singapore, it is the largest domestic broker based on the number of registered trading representatives employed as of 2024. In addition to their broking agency services in equities, bonds, CFDs, DLCs, Robo, LFX, structured products, unit trusts and commodities, they provide high value-added services in corporate advisory and fund raising, leveraging their wide network of corporate contacts and deep distribution capabilities to execute IPOs, secondary placements and other corporate finance and investment banking activities.

Investment merits

a) Key beneficiary of MAS cum SGX push to revitalise local equity market

UOBKH’s revenue stems mainly from three aspects, namely trading commissions; interest income and revenue through corporate finance. With reference to the following announcements last month:UOBKH’s revenue stems mainly from three aspects, namely trading comms; interest income and revenue through corporate finance. With reference to the following announcements last month:

- SGX removes financial watch list, stops public trading queries in shift to a more market-driven regime (click HERE);

- MAS to shift IPO review functions to SGX RegCo; Mainboard profit requirement drops to $10 million (click HERE)

The above announcements should bode well for UOBKH as it is a brokerage firm which thrives on strong market volumes and healthy IPO pipeline.t is a brokerage firm which thrives on strong market volumes and healthy IPO pipeline.

Furthermore, according to National Development Minister and Monetary Authority of Singapore (MAS) deputy chairman Chee Hong Tat who spoke at a DBS event on 22 Oct, Singapore will be announcing more details of its “Value Unlock” programme in November. This may include “measures to help listed companies deliver greater shareholder value and actively engage shareholders on their business plans”. Any new and incremental measures may further boost our Singapore market which is likely to be a positive for UOBKH.

b) Chart looks bullish

Based on Chart 1 below, a sustained breach above $2.43 with volume expansion points to an eventual technical measured target of around $2.95. $2.95 is just a theoretical technical measure target and may not reach in one go.

Near term SS: $2.47 / 2.43 (Fibo) / 2.40 (100D SMA) / 2.35 (Fibo)

Near term RR: $2.53 – 2.56 (RR) / 2.62 – 2.64 (RR) / 2.70 – 2.72 (RR, 10-year high)

Chart 1: UOBKH’s –Bullish break above its flag formation warrants closer look!

c) Decline in interest income may abate in the next 12 months

1HFY25 interest income revenue dropped 7.6% from $123.8m in 1HFY24 to $114.4m in 1HFY25 due to lower interest rate earned from their cash management. However, even though Fed may be expected to continue cutting rates in the next 12 months, the rate of decline should be slower going forward. Ie the reduction in their interest income on a y/y basis may be lesser.

d) FX losses recorded in 1HFY25 may reverse in 2HFY25F

Based on 1HFY25 results, UOBKH recorded exchange losses of S$16.4m in 1HFY25 against exchange gains of S$17.1m in 1HFY24, largely due to revaluation of their balances maintained in USD and HKD, which are required to support their businesses in the respective markets. In 2HFY25, based on current exchange rates, this decline seems to have been arrested.

USDSGD has appreciated from 1.2759 on 30 Jun 2025 to 1.2985 today.

HKDSGD has appreciated from 0.1625 on 30 Jun 2025 to 0.1670 today.

If the above exchange rates remain unchanged as of 31 Dec, I guess FX losses should reverse in 2HFY25F.

e) FY24 DPS S$0.119 / share, translates to 4.8% div yield

Assuming UOBKH maintains its FY24 dividend of $0.119 per share in FY25F, the projected dividend yield works out to roughly 4.8%.

f) Attractive valuations – Trades at 11.6x trailing PE

Based on Shareinvestor, UOBKH trades at 11.6x trailing PE. Based on the assumption that UOBKH can generate $224.2m in earnings as it did in FY24, UOBKH estimated FY25F PE is around 10.8x. UOBKH trades at 1.15x P/BV. Based on Yahoo Finance, Futu trades at 22.9x trailing PE and 5.4x P/BV.

As you are aware, there are extremely few listed companies in Singapore which benefit from equity trading. CIMB Group acquired the stockbroking business of GK Goh Holdings in 2005 at 13.7x annualized nine months’ earnings to 30 Sep, 2004. The acquisition price was also equivalent to 1.35x P/BV.

Based on the above metrics, UOBKH trades at attractive valuations.

Investment risks

The below risks are just a few examples of some potential risks.

a) Limited information available – No analyst coverage and no access to management

Although UOBKH has a market cap of around $2.4b with a 4.8% dividend yield, there is no analyst coverage. As UOBKH is not very liquid, sell side research may find less reasons to cover this.

Besides having no analyst coverage, I have no access to UOBKH’s management too.

b) Not liquid (but growing liquidity)

This ties in to the above point. UOBKH’s average volume per day in the past 30 days amounted to 548.2K shares. Volume done on 14 Nov amounted to 290.4K shares. Contrast this to the start of the year, where average volume per day in the past 30 days was around 124.4K shares.

Liquidity is improving but it is still not very liquid. I do hope that there will be analyst coverage so that I can cross check my basis against their reports. 😊

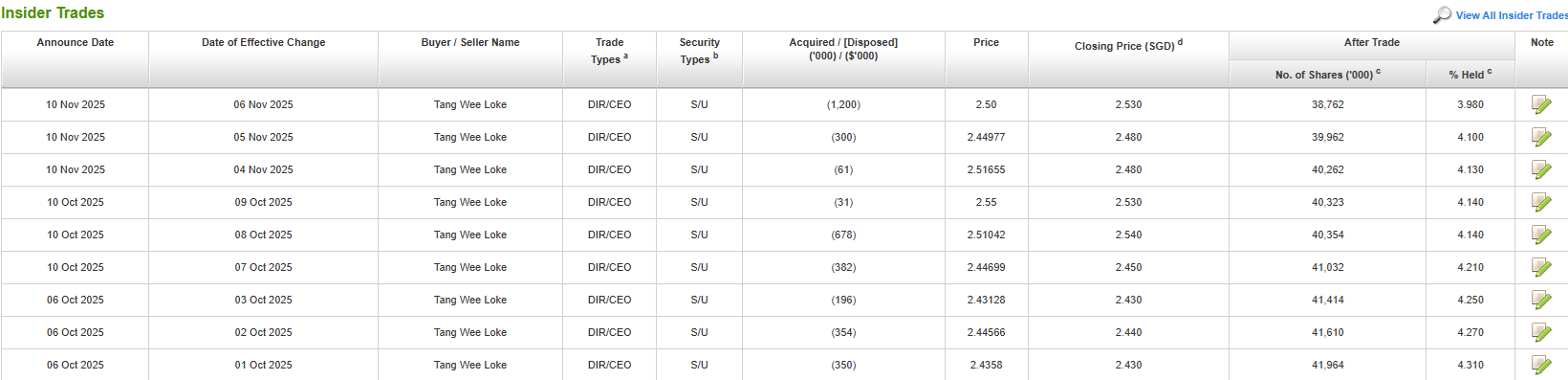

c) Selling pressure from insider

Based on Table 1 below, Non-Executive Non-Independent Director Mr. Tang Wee Loke sells UOBKH shares from time to time in measured quantities. His last sale transactions were from 4 – 6 Nov around $2.45 – 2.52 (rounded to 2 decimal places.) Notwithstanding his measured selling, UOBKH’s price seems to be holding well.

Table 1: Mr. Tang Wee Lock has been selling in measured quantities

Source: Shareinvestor

d) 1HFY25 results showed a 13% drop in profit y/y

It is noteworthy that UOBKH 1HFY25 reported net profit dropped 13% from S$113.9m in 1HFY24 to S$99.2m in 1HFY25. If I exclude the FX losses (non-cash) in 1HFY25 and also the FX gains from 1HFY24, 1HFY25 net profit would have grown 19% instead.

In addition, I wish to point out that in 2HFY24, UOBKH recorded an impairment loss on goodwill of $9.5m for their Thailand operations. I do not know whether there may be impairment losses on goodwill in 2HFY25. It is noteworthy that UOBKH is doing a voluntary delisting of its subsidiary, UOB Kay Hian Securities (Thailand) Public Company Limited (“UOBKH Thailand”), from the Stock Exchange of Thailand. I do not know what are the implications to its financials (if any) either in 2HFY25F or FY26F.

Conclusion

Generally speaking, there are risks involved in investing. Thus, it is imperative to exercise one’s due diligence and make an informed choice, after carefully evaluating the investment merits and risks.

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, you can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, I can be reached at ernestlim15@gmail.com.

P.S: Notwithstanding the limited information available, I am vested in both UOBKH.

Disclaimer

Please refer to the disclaimer HERE