This week, Hi-P caught my attention due to its chart. It last trades at $0.990. Day range 0.985 – 1.00. Let’s take a look. Basis below 1.Chart looks interesting with…

read moreThis week, Sing Medical’s (“SMG”) caught my attention. At the time of writing this write-up, SMG is trading +0.005 to $0.430. Day range 0.425 – 0.430. Some interesting observations…

read moreDear all Since my write-up on 23 Dec 2018 (see HERE), S&P500 has jumped approximately 7.5% since then. In fact, S&P500, after touching an intraday low of 2,347 on 26…

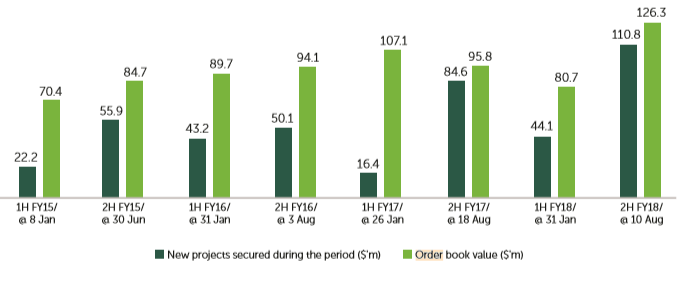

read moreISOTeam (“ISO”) caught my attention. Despite sitting on a record order book, ISO has tumbled approximately 44% from an intra-day high of $0.385 on 10 Apr 2018 to close near…

read moreSIA Engineering (“SIE”) catches my attention this week because 1) Share price has fallen to the lows last seen in May 2009 – 9 +year low with negative news, more…

read moreDear all After hitting an intra-day high of 2,941 on 21 Sep 2018, S&P500 has tumbled 17.9% or 525 points to close 2,416 on 21 Dec 2018. In fact, S&P500…

read moreDear readers, Some of you have sent me emails to express concerns whether I am still maintaining my blog, as I have not posted an article in the past couple…

read moreThis week, Sunpower attracts me due partly to the industry which it is in; the recent US$180m investments made by DCP and CDH into Sunpower whose market cap is only…

read moreDear all, U.S. equity markets have logged their worst weekly performance in the past six months. For our local market, STI has dropped 16.7% from an intra-day high of 3,642…

read moreNotwithstanding the sea of red in the equity markets for the past couple of days, these two stock charts caught my attention. They are Best World and Tencent. Best…

read more