Dear readers, Last Fri, S&P500 logged its largest one day fall since 3 Jan 2019, due in part to the weak European PMI and the yield curve inversion between U.S.…

read moreThis week, Hong Fok catches my attention this week because a) It has risen approximately 33% in 12 out of the past 13 trading days from an intraday low of…

read moreThis week, Kraft (KHC – Nasdaq) has caught my attention. It seems to be a trading play with a favourable risk reward setup based on a technical chart basis (aim…

read moreThis week, Hi-P caught my attention due to its chart. It last trades at $0.990. Day range 0.985 – 1.00. Let’s take a look. Basis below 1.Chart looks interesting with…

read moreThis week, Sing Medical’s (“SMG”) caught my attention. At the time of writing this write-up, SMG is trading +0.005 to $0.430. Day range 0.425 – 0.430. Some interesting observations…

read moreDear all Since my write-up on 23 Dec 2018 (see HERE), S&P500 has jumped approximately 7.5% since then. In fact, S&P500, after touching an intraday low of 2,347 on 26…

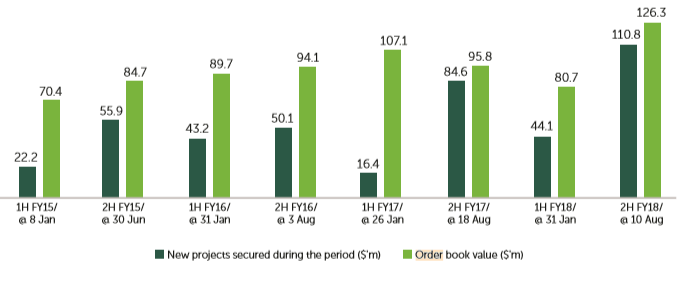

read moreISOTeam (“ISO”) caught my attention. Despite sitting on a record order book, ISO has tumbled approximately 44% from an intra-day high of $0.385 on 10 Apr 2018 to close near…

read moreSIA Engineering (“SIE”) catches my attention this week because 1) Share price has fallen to the lows last seen in May 2009 – 9 +year low with negative news, more…

read moreDear all After hitting an intra-day high of 2,941 on 21 Sep 2018, S&P500 has tumbled 17.9% or 525 points to close 2,416 on 21 Dec 2018. In fact, S&P500…

read moreThe sudden Singapore property market cooling measures on 5th July 2018 had shocked the market as no one was expecting this measures. Many panicked causing a knee-jerk reaction which caused…

read more