It’s been a few months since my last blog update – but rest assured, it hasn’t been quiet on my end. I’ve been actively engaging in one-on-one meetings with C-suite executives from listed companies to gain deeper insights into their business models, growth strategies, and outlook.

read moreDear all Two weeks ago, I mentioned that some reits’ charts (click HERE) have caught my attention. On a fundamental basis, besides Lendlease Reit (Click HERE for my key takeaway…

read moreDear all, Based on my personal reading, since a couple of months ago, investor interest seems to be gradually rotating back into the reit sector. Several reits have caught my…

read moreDear all Lendlease Reit (“Lendlease”) caught my attention as according to consensus, it offers a potential dividend yield of around 7.1% in each of FY23F and FY24F (financial year ends…

read moreDear all First of all, apologies for the hiatus in posting new market outlook on my blog. I have been extremely busy for the past three months. My clients can…

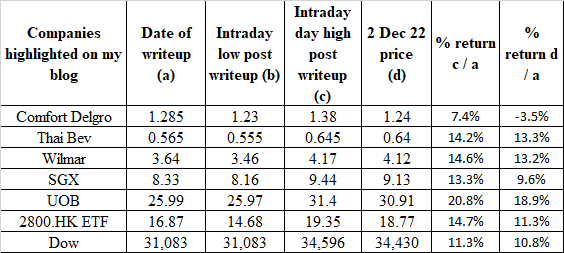

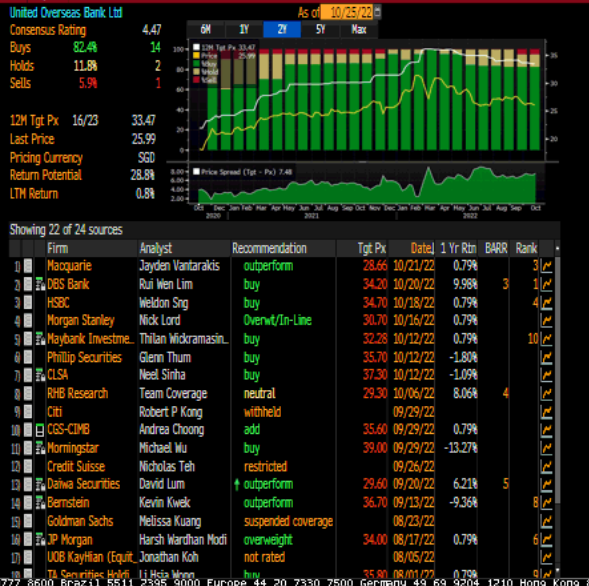

read moreDear all With reference to my writeup published on 25 Oct (click HERE), where markets seem to be plagued with various negative news, I pointed out that Dow may have…

read moreDear all Talk to anyone and I guess at least 50% of them are shaking their heads. Some of their usual concerns are a) Anxieties on the economy and their…

read moreDear all March has been a roller coaster month. Hong Kong market, represented by Hang Seng index touched multi-year lows around 14-15 Mar and has rebounded approximately 21% from the…

read moreDear all S&P500 has clocked its sixth consecutive month of gains in July 2021. This is the longest stretch since 2018. Furthermore, S&P500 has touched a record high to close at…

read moreDear all S&P500 and Nasdaq clinch fresh record highs last Friday with S&P500 clocking in seven consecutive days of gains in its longest winning streak since August 2020. Despite the…

read more