Dear all Happy Chinese New Year! Gong Xi Fa Cai! I am doing my usual work preparation over the weekend so as to provide timely updates to my clients. As…

read moreDear all I am sure everybody here is familiar with Parkway Life Reit. It owns 64 properties located in the Asia Pacific region, with a total portfolio size of approximately…

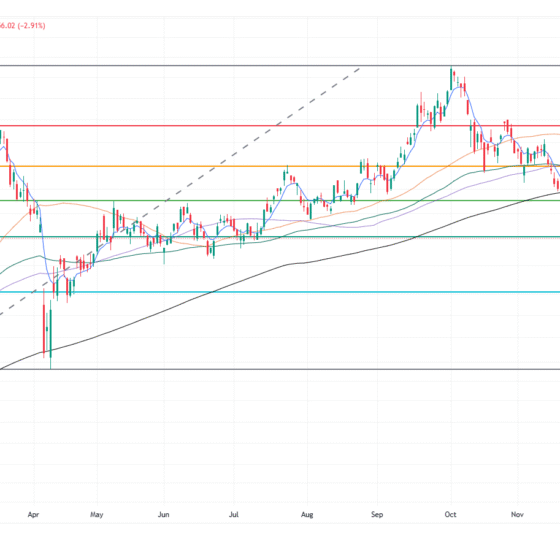

read moreHPH Trust – Potential laggard in this market FOMO to buy interest rate cut beneficiaries (20 Sep 24)

Dear all While I was doing my usual screening of stocks and sort them by price to book; estimated dividend yield and total potential return etc, one stock stood out.…

read moreDear all With reference to my technical write-up on Boustead Singapore dated 23 Jun (click HERE), I pointed out that Boustead Singapore seems to be poised for a bullish breakout.…

read moreDear all CDL Hospitality Trust (CDREIT) has caught my attention after slumping from $1.19 on 31 Jul to close $1.03 on 31 Aug. After taking into account of $0.0251 dividend…

read moreDear all Two weeks ago, I mentioned that some reits’ charts (click HERE) have caught my attention. On a fundamental basis, besides Lendlease Reit (Click HERE for my key takeaway…

read moreDear all Lendlease Reit (“Lendlease”) caught my attention as according to consensus, it offers a potential dividend yield of around 7.1% in each of FY23F and FY24F (financial year ends…

read moreDear all Comfort Delgro (“CD”) closed at $1.03 today. Based on Bloomberg, this was the lowest close last seen on 18 Mar 2004. The main reason cited for this recent…

read moreDear all With reference to my writeup published on 30 Jan 2023 (click HERE), where I mentioned I would be cautious in the overall markets, especially after a sharp run…

read moreDear all On 11 Jan, Comfort (CD) closed at $1.21, the lowest close since 31 Oct 2008. The next day, to the horror of CD’s shareholders, it broke $1.21 with…

read more