Dear all With reference to my market outlook published on 3 Oct (see HERE) citing opportunities in our Singapore market, STI has soared 191 points, or 6.3% from 3,051 on…

read moreDear all With reference to my market outlook published on National Day (see HERE), both STI and Hang Seng have hit their highs on 10 Aug and 11 Aug respectively…

read moreDear all It is less than a week from the U.S. election. U.S. markets are understandably jittery. S&P500 has fallen 316 points, or 8.9% from its intraday high of 3,550…

read moreDear all Based on Table 1 below, U.S. indices have fallen between 5.5% – 10% from the close of 2 Sep to 8 Sep. Nasdaq led the decline with a…

read moreDear all U.S. markets have fallen sharply with Nasdaq dropping almost 1,200 points or 10% from an intraday high of 12,074 on 2 Sep to an intraday low of 10,876…

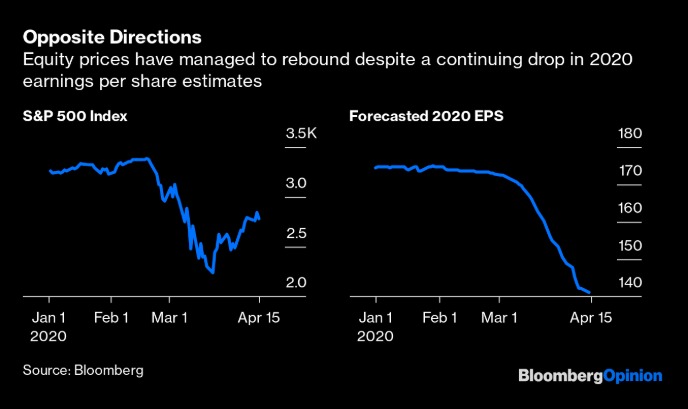

read moreS&P500 has staged a whopping 683 points, or 31% rebound from its intraday low of 2,192 to close 2,875 on 17 Apr 20. Many clients have asked me (almost daily)…

read moreMerry Xmas! As we approach end 2019, most market strategists are putting their market estimates for end 2020. Although I do not profess to be in the league of these…

read moreOur markets have been whipsawed by multiple events, such as rising inflation expectations and bond yields, protectionism (for e.g. Trade tariffs), upcoming FOMC meeting and sudden key personnel changes in…

read moreDear all S&P500 hit another record last Fri! Some private banking clients have enquired on any interesting stocks to take a closer look with a horizon of 1-3 years. Therefore,…

read moreSTI has tumbled 130 points, or 4.5% from an intraday high of 2,882 on 9 Jun 2016 to close 2,752 on 16 Jun 2016. The recent rapid sell off seems…

read more