Dear all, Dow has logged a seventh consecutive rise and small caps as measured by S&P600 index have just closed at a record high as of 11 May 2018. Our…

read moreSunningdale has plunged 46% in less than half a year, from an intraday high of $2.40 on 6 Nov 2017 to close $1.30 on 30 Apr 2018. What happened? Is…

read moreREC Insights is a 3 part series hopes to provide insights to investors looking for opportunities in the Singapore Property Market. These insights will be accompanied with detailed, straight to…

read moreDear all, Venture has entered into bear territory after dropping 21% from an intraday high of $29.65 on 13 Apr 2018 to close $23.40 on 24 Apr 2018. What should…

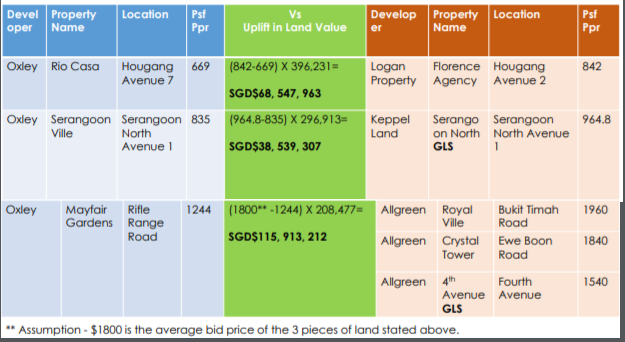

read moreDear all, Do you know that Oxley has the largest residential land bank in Singapore by number of dwelling units, based on an article in the Business times dated 23…

read moreDear all, Besides the headline grabbing news on Facebook and the U.S. China trade tariffs etc. some of you may have noticed other equally interesting / alarming headlines such as…

read moreDear all, Based on a simple tracking of DBS’ share price performance from CD to XD, on average, DBS seems to move approximately 4-9% above its CD price, nearer to…

read moreWith reference to my earlier write-up (click HERE), besides SGX listed stocks, clients and readers can consider to take a look at some of the China banks listed on HK…

read moreDear all, Previously, I mentioned in my write-up dated 21 Mar that I am avoiding the event risk of the U.S. tariff package against Chinese (click HERE). This proves timely…

read moreOur markets have been whipsawed by multiple events, such as rising inflation expectations and bond yields, protectionism (for e.g. Trade tariffs), upcoming FOMC meeting and sudden key personnel changes in…

read more