Riverstone recently caught my attention. It has tumbled approximately 32% from an intraday high of $4.90 on 7 Aug 2020 to close $3.33 on 11 Sep 2020. One client even…

read moreWilmar recently caught my attention. It has fallen approximately 11% from an intraday high of $4.95 on 7 Aug 2020 to close $4.41 on 1 Sep 2020. Six points attracted me…

read moreThis week, notwithstanding the continuous interest in glove companies, pharmaceutical companies etc, there are some companies which seem to have some steady inflows, based on chart observations. Two companies come…

read moreThis week, China Everbright Water Limited (“CEWL”) catches my attention this week. Since 17 Mar 2020, CEWL has been trading sideways from $0.200 – 0.230. Based on chart, CEWL seems…

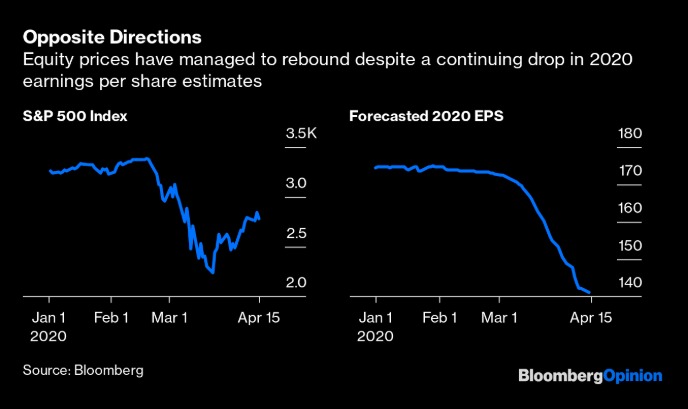

read moreS&P500 has staged a whopping 683 points, or 31% rebound from its intraday low of 2,192 to close 2,875 on 17 Apr 20. Many clients have asked me (almost daily)…

read moreDear all, It has been an extremely busy and hectic period with the U.S. indices clocking in their largest record weekly percentage drop last week. This week, Singpost caught my…

read moreDear readers, Happy New Year! Hope your new year has been great. Market has been extremely interesting for the past couple of months. Recently, China Aviation (“CAO”) caught my attention…

read moreMerry Xmas! As we approach end 2019, most market strategists are putting their market estimates for end 2020. Although I do not profess to be in the league of these…

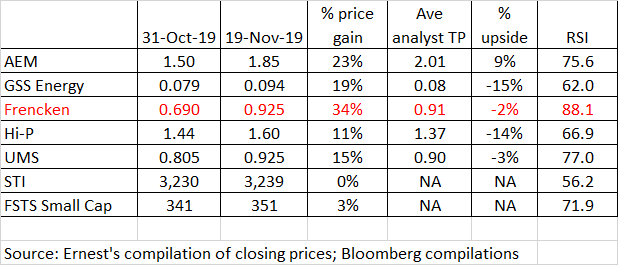

read moreThis week, Frencken has caught my attention with its 34% surge from $0.690 on 31 Oct 2019. It closed $0.925 on 19 Nov 2019. At $0.925, this is very near…

read moreThis week, besides Food Empire which caught my attention (click HERE), Yangzijiang (“YZJ”) also caught my attention for being a laggard. It has given up all the gains since its…

read more