Dear all Sing Medical Group (“SMG”) announced on 18 Dec 20 that the Company is currently in discussions with a third party regarding a possible transaction involving the Company’s shares.…

read moreDear all Since my write-up “Singapore – Asia’s worst equity market YTD, any opportunities ahead?” posted on my blog on 1 Nov 2020 (click HERE) citing opportunities in our Singapore…

read moreDear all It is less than a week from the U.S. election. U.S. markets are understandably jittery. S&P500 has fallen 316 points, or 8.9% from its intraday high of 3,550…

read moreDear all, UG Healthcare (“UG”) recently caught my attention. It has tumbled approximately 20% from an intraday high of around $1.15 on 7 Aug 2020 to close $0.915 on 26…

read moreChina Railway Construction (“CRCC”) recently caught my attention as it has tumbled approximately 44% from an intraday high of $9.99 on 5 Mar 2020 to close HKD5.64 on 21 Sep…

read moreRiverstone recently caught my attention. It has tumbled approximately 32% from an intraday high of $4.90 on 7 Aug 2020 to close $3.33 on 11 Sep 2020. One client even…

read moreWilmar recently caught my attention. It has fallen approximately 11% from an intraday high of $4.95 on 7 Aug 2020 to close $4.41 on 1 Sep 2020. Six points attracted me…

read moreThis week, notwithstanding the continuous interest in glove companies, pharmaceutical companies etc, there are some companies which seem to have some steady inflows, based on chart observations. Two companies come…

read moreThis week, China Everbright Water Limited (“CEWL”) catches my attention this week. Since 17 Mar 2020, CEWL has been trading sideways from $0.200 – 0.230. Based on chart, CEWL seems…

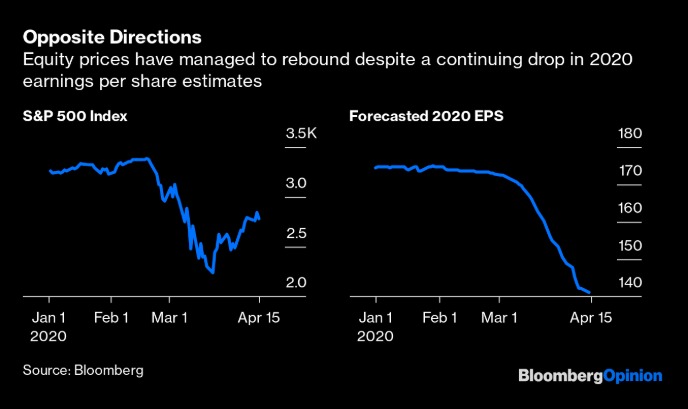

read moreS&P500 has staged a whopping 683 points, or 31% rebound from its intraday low of 2,192 to close 2,875 on 17 Apr 20. Many clients have asked me (almost daily)…

read more