Background

On 24 Jul 2015, QT said that it is proposing to issue up to US$13.14m of convertible bonds (“CB”) to strengthen its financial position and allow it to focus more resources on developing its Drug Coated Chocolate® platform further. The CB proceeds may also be used for payment of litigation costs and expenses incurred with the ongoing litigation by AngioScore, Inc. (“Angioscore”), provided that no Bonds proceeds shall be utilised for the payment of any final damages (if) awarded to Angioscore by a court of final judgement. [Please refer to SGX announcement dated 24 Jul 2015 for more details.]

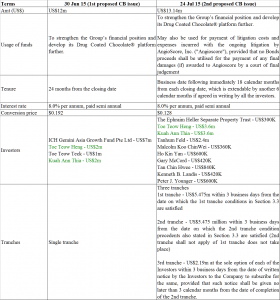

In the same announcement, QT announces that the CB subscription agreement with ICH Gemini Asia Growth Fund Pte Ltd, Toe Teow Heng, Toe Teow Teck and Kuah Ann Thia dated 30 June 2015 has been formally terminated due to non satisfaction of certain conditions in the aforementioned convertible bond subscription agreement. I have compiled some key terms and made comparisons between the proposed CB issue last Fri vs. 30 Jun 2015. See Table 1 below.

Table 1: Summary of the proposed CB issue last Fri vs. 30 Jun 2015

Source: Ernest’s compilations from SGX announcements.

Please refer to the SGX announcements for more details.

Noteworthy points

Mr TTH & Mr Kuah subscribed for a larger amount of CB

Out of the nine investors for the 2nd proposed CB issue, two investors, namely Mr Toe Teow Heng (“TTH”) and Mr Kuah Ann Thia (“Kuah”) were the initial investors for the 1st proposed CB issue on 30 Jun 2015. Although the 1st proposed CB issue was cancelled, Mr TTH and Mr Kuah continued to participate in the 2nd proposed CB issue. What is interesting is that both of them subscribed for a larger amount this round comprising of US$3.6m each, as opposed to US$2.0m each for the 1st proposed CB issue.

Although one can argue that the terms in the 2nd proposed CB are more favourable to investors, it is likely to carry higher risk to investors too. In my opinion, the fact that both Mr TTH and Mr Kuah continue to subscribe for QT’s CB and in larger amounts underscores their continued confidence in QT’s business and prospects.

Significant condition for 2nd tranche

The condition precedent for the 2nd tranche is significant. In order to fulfill the condition precedent for the 2nd tranche, QT has to appoint a reputable investment bank and issue an offering memorandum in relation to the subject matter of a Qualifying Exit Event (as defined in the proposed CB announcement) to potentially interested parties by no later than the date falling 3 months from the date of the subscription agreement. [To be clear, the date of the subscription agreement is 24 Jul 2015. Please refer to the proposed CB announcement dated 24 Jul 2015 for more details].

It is noteworthy that tranche 1 and 2 comprise of equal amounts of US$5.475m each. Thus, it is logical to assume that QT will like to secure tranche 2, else tranche 1 alone may be insufficient for their purposes. Notwithstanding the above, I hasten to add that tranche 2 condition will not be fulfilled if tranche 1 is not completed.

Subject to various conditions precedent

It is noteworthy that the 2nd proposed CB issue is also subject to the various conditions precedent set forth in the subscription agreement. There is no guarantee that all the conditions will be fulfilled.

Chart analysis

QT has slumped 35% from $0.182 on 2 Jul 2015 to $0.118 on 24 Jul 2015 after the announcement of the Angioscore Litigation update and the termination of the 1st proposed CB issue.

With reference to Chart 1 below, it is apparent that QT is in an entrenched downtrend. There is a large gap between $0.138 – 0.182. All the exponential moving averages (“EMAs”) are pointing downwards. Indicators such as MACD have reached near all time oversold levels and are turning upwards. Other indicators such as OBV and RSI have strengthened. In the near term, QT is likely to move higher.

Near term supports: $0.115 – 0.116 / 0.110 / 0.100

Near term resistances: $0.130 / 0.138 – 0.140 / 0.166

Chart 1: QT in a long entrenched downtrend

Source: CIMB chart as of 24 Jul 2015

Disclaimer

Please refer to the disclaimer here http://ernest15percent.com/index.php/disclaimer/

I am truuly grateful to the owner off this website whoo hhas shared this woonderful

aarticle att here.