Company writeup: ISOTeam reported record results [29 Aug 2015]

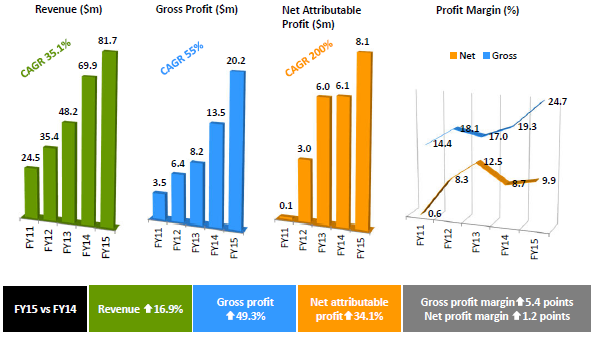

ISOTeam reported its FY15 results on 28 Aug 2015 before market. FY15 revenue and net profit surged 17% and 34% respectively to S$81.7m and S$8.1m respectively. Please see Table 1 for a summary of its results for the past five financial years. Table 1: ISOTeam’s past five financial year performance Source: Company Highlights of FY15 results 1. Once off expenses amounting to a total of S$1.8m In FY15, ISOTeam recorded some once off depreciation expenses amounting to S$1.5m. In addition, it also incurred professional fees due to legal costs and acquisitions of new subsidiaries amounting to S$0.3m. These S$1.8m expenses […]