Amid the backdrop of the recent market weakness, I have done my personal compilation of stocks whose past year Price to Book Value (“P/BV”) are lower than their average five year P/BV (see my http://ernest15percent.com/index.php/2015/09/11/ernests-market-outlook-14-sep-2015/ for more information.) I noticed that Ying Li International Real Estate Limited (“Ying Li”) past year P/BV is only 0.38 and is significantly below its average five year price to book of around 1.19. However, as there is no recent rated coverage on Ying Li, I have left out Ying Li in my personal compilation of stocks above. Notwithstanding this, Ying Li looks interesting and I decide to take a closer look in this company.

Company description

Ying Li is the first Chongqing-based property developer to be listed in Singapore. It is engaged in the development, sale, rental, management and long-term ownership of high-quality commercial and residential properties in prime locations in Chongqing.

Established in 1993, Ying Li has a solid track record in urban renewal, having transformed old city areas into high-quality and premier-design developments. Ying Li has modernized the landscape of Chongqing’s main business districts with the development of several landmark commercial buildings, such as New York New York, Zou Rong Plaza, Future International and Ying Li International Financial Centre.

So what attracts me to take a closer look?

China property sales may rise on the back of China’s easing policies

China’s property sector comprise of approximately 25 – 30% of China’s GDP (if we include the upstream and downstream industries such as such as appliances, cement, furniture, glass and steel etc.). In view of the slowing economy, China has cut both the benchmark interest rates and the banks’ required reserve ratio four times since the start of 2015. In addition, China has reduced the minimum down payment for 2nd home buyers to 20% and also allows foreigners to buy property in China, subject to conditions. All of the aforementioned easing measures are likely to bode well for the property market.

FY16F results likely to be better than FY15F

Based on Ying Li’s existing pipeline of projects, it may see a better FY16F vis-à-vis FY15F due to potential contributions from property sales in San Ya Wan Phase 2 and IEC Phase 1. Rental income may also improve in FY16F vs FY15F due to change in tenant mix, increase occupancy rate and improvements from asset enhancement initiatives in some of their properties.

Becoming more transparent

Ying Li has started to be more transparent with more regular updates to shareholders in terms of company updates. This can be seen in their spate of press releases since Jul 2015 where they updated shareholders on their Ying Li iMIX parks, Beijing Tongzhou and IEC projects.

In addition, in a bid to showcase their properties to the investment community, Ying Li is hosting an analyst site visit from 15 Sep – 18 Sep. This is the first site visit in at least two years. It will be interesting to see whether there will be any reports or updates after the site visit (bearing in mind that there is no rated coverage at the moment.)

CEO purchase, the first in at least four years

Mr Fang Ming, Executive Chairman and Group CEO of Ying Li recently bought 1M shares @$0.126 on 25 Aug 2015. This was the first purchase in at least four years. Although the amount is not extremely significant, it is still a good vote of confidence by the management.

China Everbright Limited’s 14.9% stake in Ying Li is reassuring

Based on Ying Li’s annual report 2014, China Everbright Limited (“CEL”) holds around 14.9% of Ying Li’s shares. CEL is part of the China Everbright Group which is one of the larger state-owned enterprises in China. Thus, CEL’s investment in Ying Li is reassuring to a certain extent as such state owned company is likely to have done extensive checks on Ying Li and their key management. It is noteworthy that CEL’s investment cost for its 14.9% stake in Ying Li is at $0.260.

Depressed valuations

Ying Li’s depressed valuation is the first thing to catch my attention. According to Bloomberg, Ying Li’s past year P/BV is only 0.38 and is significantly below its average five year price to book of around 1.19x. For the past five years, Ying Li trades between 0.23x – 2.02x P/BV.

Furthermore, on a PE comparison, according to Bloomberg, Ying Li trades at a historical PE of around 7.4x and is also at the lowest end of the PE range of 7 – 134x. (See Chart 1 below)

Chart 1: Ying Li PE at the low end of its 5 year PE range

Source: Bloomberg

It is noteworthy that in times of capitulation or extremely weak market conditions, it is entirely possible that Ying Li may trade lower than its P/BV of 0.38x and PE of 7.5x. What we know for now (based on statistics) is that, Ying Li is trading at levels at the lower end of their historical valuation bands. Ceteris Paribas, when sentiment recovers, coupled with Ying Li’s continued delivery of good results and property sales (be it in the coming months or years), it is likely that it may re-rate nearer to their historical means.

Risks

China’s property market is still challenging

According to the China Index Academy, new home prices in China saw their first year on year increase in August 2015, the first in 11 months. Thus, China’s property market continues to be challenging despite the above China’s easing measures.

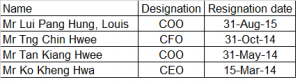

Key management changes since 2014

With reference to Table 1 below, since 2014, there were some notable management resignations. For example, there were high hopes when Mr Ko Kheng Hwa, previously CEO of Singbridge and JTC Corp, when he joined Ying Li in 2013. However, he resigned in 2014 citing personal reasons. Both Mr Tan Kiang Hwee and Mr Lui Pang Hung quitted their role as COO in one year or so. This rapid movement in key management bears watching as it may be a potential red flag.

Table 1: Key management changes since 2014

Source: SGX; Ernest’s compilations

Despite the management shuffles, it is noteworthy that Mr Lim Gee Kiat re joined Ying Li as their CFO. He was the ex Senior Vice President, Finance of Ying Li from 2011 – 2013. Mr Lim has an illustrious record as he was the CFO of Nera Telecommunications (Listed on Singapore Mainboard with a market capitalization of S$215m) from 2013 to 2015. He was VP of GIC Special Investments from 2007 – 2011.

Lumpy quarterly results

As a developer, Ying Li’s quarterly results are lumpy, in line with other property developers. Ying Li is cognizant of their lumpiness and seeks to smooth out this lumpiness by increasing their rental income proportion. This naturally takes time and we may be able to see their efforts in FY2016F.

Chart analysis

Ying Li has been entrenched in a strong downtrend since Apr 2015 with ADX at 55.0. ADX reached a recent high of 66.5 on 26 Aug 2015 and has fallen from such overextended levels. RSI reached an all-time oversold 13.0 on 24 Aug 2015 and have rebounded to 34.4 in tandem with the recovery in the share price. Coupled with a bullish moving average crossover in MACD, it is likely that the largest and sharpest decline in Ying Li’s share price may have already been over.

Near term supports: $0.133 / 0.128 / 0.125 – 0.126

Near term resistances: $0.143 – 0.145 / 0.153 – 0.157

Chart 1: Ying Li’s share price is below GFC levels

Source: CIMB chart as of 10 Sep 15

Conclusion

The above is a brief introductory write-up on Ying Li. Ying Li’s attractive valuations, upcoming analyst site visit and updates on their property sales are some interesting and potentially positive factors. However, the still challenging property market, lumpy results and high turnover at key management levels are noteworthy factors for readers to take into consideration. Readers can refer to Ying Li’s corporate website http://www.yingligj.com/ for more information.

Disclaimer

Please refer to the disclaimer here http://ernest15percent.com/index.php/disclaimer/ .

I really enjoy the blog article.Thanks Again. Really Great.

I am so grateful for your article post.Much thanks again. Keep writing.

Thank you ever so for you blog article.Really thank you! Fantastic.

Hey, thanks for the blog post.Really thank you! Fantastic.

Hey, thanks for the article.Really looking forward to read more. Awesome.

Enjoyed every bit of your blog. Cool.

Thanks for the post.Much thanks again. Keep writing.

I really enjoy the blog.Much thanks again. Much obliged.

Major thankies for the post.Thanks Again. Really Great.

Wow, great article.Really looking forward to read more. Really Cool.

Great, thanks for sharing this post.Much thanks again. Much obliged.

Looking forward to reading more. Great post.Much thanks again. Great.

Thanks so much for the article post.Much thanks again. Really Cool.

Appreciate you sharing, great blog.Much thanks again. Want more.

Enjoyed every bit of your blog article.Thanks Again. Awesome.

Very good blog post.Really thank you! Really Cool.

Great article post.Really looking forward to read more. Want more.

Awesome article.Really thank you! Want more.

Awesome blog post.Much thanks again. Cool.

Hey, thanks for the blog post. Cool.

Very informative blog post.Really thank you! Will read on…

Muchos Gracias for your blog.Really looking forward to read more. Really Cool.

Thank you for your blog post.Much thanks again. Will read on…

Im obliged for the blog article.Much thanks again. Great.

Thanks a lot for the blog post.Really looking forward to read more. Will read on…

Hey, thanks for the post.Thanks Again. Really Cool.

Im obliged for the blog article. Much obliged.

Im grateful for the blog.Really looking forward to read more. Much obliged.

Very informative article post.Much thanks again. Awesome.

A round of applause for your blog article.Much thanks again. Awesome.

Thanks a lot for the article.Thanks Again. Cool.

Fantastic blog post. Really Cool.

Very informative post.Thanks Again. Really Cool.

Very good blog post. Great.

Looking forward to reading more. Great article post.Really looking forward to read more. Great.

I value the blog.Much thanks again. Great.

Great, thanks for sharing this blog article.Really looking forward to read more.

I loved your blog article. Fantastic.

Major thanks for the blog.Much thanks again. Much obliged.

Major thanks for the blog article.Really thank you! Great.

Great, thanks for sharing this blog.Really thank you! Really Cool.

Great blog.Really looking forward to read more. Cool.

Appreciate you sharing, great blog.Much thanks again. Really Cool.

Hey, thanks for the blog.Thanks Again. Cool.

Thank you for your blog article.Thanks Again. Really Cool.

Muchos Gracias for your article post.Really thank you! Much obliged.

Thank you for your blog.Really thank you! Great.

Wow, great blog article.Really looking forward to read more. Much obliged.

I cannot thank you enough for the post.Thanks Again. Really Cool.

Major thankies for the post.Thanks Again. Great.

Very good article.Thanks Again. Really Cool.

Hey, thanks for the post.Much thanks again. Cool.

I appreciate you sharing this article.Thanks Again. Really Great.

Thank you ever so for you article post.Thanks Again. Really Great.

I value the blog.Much thanks again. Keep writing.

Great, thanks for sharing this blog post. Keep writing.

Really informative blog post.Really looking forward to read more.

Major thankies for the blog.Much thanks again. Keep writing.

Looking forward to reading more. Great blog post.Really thank you! Will read on…

Really informative blog article.Much thanks again. Fantastic.

Can someone recommend Glass Dildos? Cheers xxx

I really enjoy the article.Thanks Again. Will read on…

Major thankies for the blog post.Thanks Again. Much obliged.

Im grateful for the blog post.Really looking forward to read more. Awesome.

https://binomo.as

Превърнете вградената си кухня в идеалното място за готвене, Как да преобразите вградения си шкаф с минимални усилия, Съвети за подобряване на вградената си етажерка, Топ идеи за декорация на вградената стена в дома ви, Удивително превръщане на вградения гардероб в гардеробна стая, преобразете вградената си работна зона с тези идеи, Как да направите вградената си всекидневна уютна и стилна, Тайни за успешно подобряване на вградените шкафове на балкона, как да направите вградената си трапезария удобна и стилна, Най-добрите начини за подобряване на вградения гардероб, Тайните за уютен вграден кът за отдих, Идеи за подобряване на вградената ви кухненска зона, най-добрият начин да преобразите вградената си дневна с помощта на декор, нови идеи за обновяване на вградения гардероб в антрето, Съвети за подобряване на вградената зона на камината, Върхови идеи за декорация на вградена библиотека в дома ви, как да превърнете вградения гардероб в спалнята в удобно място за съхранение

комплект уреди за вграждане bosch комплект уреди за вграждане bosch .

equilibrador

Sistemas de equilibrado: fundamental para el funcionamiento suave y efectivo de las máquinas.

En el entorno de la tecnología avanzada, donde la eficiencia y la fiabilidad del dispositivo son de suma relevancia, los aparatos de ajuste tienen un función fundamental. Estos dispositivos dedicados están creados para balancear y asegurar partes dinámicas, ya sea en herramientas productiva, transportes de movilidad o incluso en dispositivos hogareños.

Para los técnicos en soporte de dispositivos y los profesionales, trabajar con equipos de balanceo es crucial para proteger el rendimiento suave y estable de cualquier dispositivo móvil. Gracias a estas soluciones avanzadas avanzadas, es posible reducir considerablemente las sacudidas, el ruido y la esfuerzo sobre los soportes, extendiendo la tiempo de servicio de elementos importantes.

También trascendental es el tarea que desempeñan los sistemas de balanceo en la atención al usuario. El asistencia especializado y el mantenimiento regular usando estos equipos permiten dar soluciones de alta nivel, incrementando la bienestar de los consumidores.

Para los responsables de empresas, la contribución en estaciones de balanceo y detectores puede ser clave para incrementar la productividad y eficiencia de sus dispositivos. Esto es sobre todo importante para los inversores que gestionan reducidas y pequeñas empresas, donde cada detalle cuenta.

Además, los aparatos de balanceo tienen una vasta uso en el sector de la prevención y el monitoreo de nivel. Permiten localizar potenciales defectos, previniendo intervenciones onerosas y perjuicios a los sistemas. Además, los datos extraídos de estos dispositivos pueden emplearse para maximizar procedimientos y mejorar la presencia en motores de consulta.

Las zonas de uso de los equipos de ajuste incluyen numerosas áreas, desde la manufactura de transporte personal hasta el seguimiento ecológico. No interesa si se trata de enormes manufacturas industriales o modestos establecimientos de uso personal, los aparatos de equilibrado son necesarios para asegurar un operación efectivo y libre de interrupciones.

Equipos de calibración: clave para el rendimiento fluido y óptimo de las dispositivos.

En el entorno de la avances moderna, donde la rendimiento y la fiabilidad del dispositivo son de gran relevancia, los aparatos de balanceo tienen un función crucial. Estos equipos especializados están desarrollados para calibrar y fijar elementos móviles, ya sea en dispositivos manufacturera, medios de transporte de movilidad o incluso en electrodomésticos de uso diario.

Para los técnicos en mantenimiento de sistemas y los ingenieros, operar con aparatos de balanceo es esencial para proteger el operación fluido y fiable de cualquier mecanismo rotativo. Gracias a estas herramientas innovadoras sofisticadas, es posible limitar sustancialmente las oscilaciones, el ruido y la carga sobre los soportes, extendiendo la longevidad de componentes valiosos.

Igualmente importante es el rol que juegan los sistemas de balanceo en la servicio al usuario. El ayuda experto y el reparación permanente aplicando estos equipos facilitan dar prestaciones de óptima nivel, elevando la bienestar de los consumidores.

Para los titulares de emprendimientos, la aporte en estaciones de balanceo y dispositivos puede ser clave para aumentar la productividad y desempeño de sus dispositivos. Esto es sobre todo relevante para los inversores que gestionan pequeñas y intermedias empresas, donde cada aspecto cuenta.

Asimismo, los dispositivos de calibración tienen una gran implementación en el campo de la seguridad y el gestión de nivel. Posibilitan localizar probables errores, evitando arreglos onerosas y problemas a los equipos. Más aún, los resultados extraídos de estos equipos pueden utilizarse para optimizar procedimientos y potenciar la reconocimiento en buscadores de búsqueda.

Las áreas de aplicación de los aparatos de calibración incluyen múltiples ramas, desde la manufactura de vehículos de dos ruedas hasta el monitoreo ecológico. No importa si se considera de enormes manufacturas manufactureras o modestos establecimientos hogareños, los equipos de ajuste son fundamentales para garantizar un operación eficiente y sin riesgo de paradas.

loli porn

==> xzy.cz/5151 eit.tw/gs3oW3 <==

Здравствуйте!

BlackSput(bs2best,bs2site,bsme.at) актуальная ссылка 02.2025г.

Hmm it appears like your site ate my first comment (it was super long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog writer but I’m still new to everything.

Do you have any helpful hints for newbie blog writers?

I’d genuinely appreciate it.

vibracion de motor

Sistemas de equilibrado: clave para el funcionamiento fluido y óptimo de las dispositivos.

En el entorno de la ciencia contemporánea, donde la productividad y la estabilidad del sistema son de máxima significancia, los equipos de ajuste desempeñan un tarea crucial. Estos sistemas dedicados están diseñados para ajustar y estabilizar partes móviles, ya sea en herramientas manufacturera, transportes de desplazamiento o incluso en equipos domésticos.

Para los especialistas en reparación de sistemas y los técnicos, manejar con dispositivos de calibración es crucial para proteger el funcionamiento estable y fiable de cualquier dispositivo rotativo. Gracias a estas soluciones innovadoras sofisticadas, es posible reducir significativamente las oscilaciones, el sonido y la carga sobre los cojinetes, extendiendo la tiempo de servicio de piezas valiosos.

También importante es el papel que desempeñan los aparatos de equilibrado en la soporte al cliente. El soporte técnico y el conservación constante aplicando estos aparatos facilitan proporcionar servicios de gran nivel, elevando la bienestar de los compradores.

Para los titulares de empresas, la inversión en estaciones de equilibrado y detectores puede ser clave para incrementar la eficiencia y rendimiento de sus sistemas. Esto es sobre todo trascendental para los emprendedores que dirigen modestas y pequeñas emprendimientos, donde cada punto es relevante.

Por otro lado, los dispositivos de ajuste tienen una extensa uso en el área de la seguridad y el monitoreo de calidad. Posibilitan identificar potenciales defectos, previniendo mantenimientos elevadas y daños a los dispositivos. Además, los resultados obtenidos de estos equipos pueden utilizarse para mejorar sistemas y potenciar la reconocimiento en sistemas de consulta.

Las sectores de implementación de los equipos de equilibrado abarcan múltiples industrias, desde la manufactura de transporte personal hasta el supervisión del medio ambiente. No afecta si se considera de importantes manufacturas manufactureras o pequeños espacios de uso personal, los aparatos de ajuste son necesarios para proteger un rendimiento eficiente y libre de interrupciones.

Greetings! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the

same niche. Your blog provided us beneficial information to

work on. You have done a extraordinary job!

Thank you for Sharing good quality article. it’s more useful.

Prime biome nurtures beneficial gut bacteria, contributing to enhanced skin radiance and a more youthful glow.

Primebiome nurtures beneficial gut bacteria, contributing to enhanced skin radiance and a more youthful glow.

Prime biome nurtures beneficial gut bacteria, contributing to enhanced skin radiance and a more youthful glow.

If some one wants to be updated with most up-to-date technologies therefore he

must be visit this web site and be up to date all the time.

Prime biome nurtures beneficial gut bacteria, contributing to enhanced skin radiance and a more youthful glow.

Primebiome nurtures beneficial gut bacteria, contributing to enhanced skin radiance and a more youthful glow.

Prime biome nurtures beneficial gut bacteria, contributing to enhanced skin radiance and a more youthful glow.

nitric boost is a nutritional supplement that supports enhanced sexual performance and general wellness.

nitric boost is a nutritional supplement that supports enhanced sexual performance and general wellness.

nitric boost is a nutritional supplement that supports enhanced sexual performance and general wellness.

aizen power is a huge scientific-breakthrough supplement that concentrates on improving your sexual life in a very safe and easy manner.

aqua sculpt is a cutting-edge dietary supplement crafted to support your weight management journey by optimizing mitochondrial performance and enhancing metabolic processes.

bing porn child

bing porn child

porno web

nitehush is designed to support your respiratory system, helping you enjoy a quiet, uninterrupted night’s sleep.

nitehush is designed to support your respiratory system, helping you enjoy a quiet, uninterrupted night’s sleep.

nitehush is designed to support your respiratory system, helping you enjoy a quiet, uninterrupted night’s sleep.

https://www.denisewilliamswrites.com/blog/its-may-and-im-in-love-with-these-books

aquasculpt is an advanced dietary supplement designed to support your weight management journey by optimizing mitochondrial efficiency and enhancing metabolic performance.

aquasculpt is a dietary supplement uniquely designed to promote healthy weight management and boost metabolic performance.

prodentim a groundbreaking probiotic supplement uniquely designed to support oral health and promote robust gums and teeth.

aquasculpt a groundbreaking probiotic supplement uniquely designed to support oral health and promote robust gums and teeth.

glycofortin is a uniquely crafted liquid dietary supplement designed to aid in maintaining balanced blood sugar levels.

https://rebarcampboston.com/

is a carefully developed dietary supplement designed to naturally support individuals dealing with sciatic nerve discomfort while promoting overall nerve wellness.

aquasculpt is a groundbreaking weight management supplement designed to support your journey by naturally enhancing metabolism, curbing hunger, and boosting energy levels.

glycofortin is a uniquely crafted liquid dietary supplement designed to aid in maintaining balanced blood sugar levels.

vivogut is an advanced digestive health formula crafted to support healthy digestion, improve nutrient uptake, and rebalance the gut microbiome.

arialief is a carefully developed dietary supplement designed to naturally support individuals dealing with sciatic nerve discomfort while promoting overall nerve wellness.

vivogut is an advanced digestive health formula crafted to support healthy digestion, improve nutrient uptake, and rebalance the gut microbiome.

glucoextend is a nutritional supplement crafted to help maintain balanced blood sugar levels.

vivogut is an advanced digestive health formula crafted to support healthy digestion, improve nutrient uptake, and rebalance the gut microbiome.

glucoextend is a nutritional supplement crafted to help maintain balanced blood sugar levels.

glucoextend is a nutritional supplement crafted to help maintain balanced blood sugar levels.

mitolyn is a natural dietary supplement specifically outlined to enhance metabolism and support weight loss. Its potent blend of ingredients works to increase energy levels, promote fat burning

lipozem is is an advanced dietary supplement developed to support your weight loss objectives while boosting overall health and energy levels.