Dear all

Dow surged past 26,000 overnight and Hang Seng closed at a record 32,122 today. Is the BIG Bull coming?

For this write-up, I will focus on the U.S. market

Based on Bloomberg, Grantham, the chief investment strategist for GMO wrote on 3 Jan 2018 that the U.S. stock market may be approaching a melt up or blow off phase. A melt up phase refers to a sharp increase in the share prices driven by sentiment or the fear of losing out.

Are we in the blow off phase? To be frank, I am not sure. However, here are some startling statistics to ponder.

a) Dow has surged 5.7%, or close to 1,400 points since the start of the year;

b) Dow took 13 calendar days to rise more than 1,000 points and closed above 26,000 on a closing basis on 17 Jan 2018. Based on Bloomberg (See Chart 1 below), this is likely to be the fastest on record;

Chart 1: Dow Jones 1,000-point track

Source: Bloomberg 16 Jan 18 (Dow hit 26,000 on 16 Jan but I disregard this as it did not close >=26,000 on 16 Jan)

c) Investor optimism recently hit a 7-year high. Based on the latest AAII Sentiment Survey, 59.8% of the people surveyed expect to see stock prices rise over the next six months. This was the highest percentage in the past seven years. Historical average is around 38.5%;

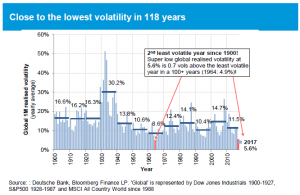

d) Volatility in the market is among the lowest in 118 years. Although this does not necessary imply or indicate that the market will tumble soon, it seems that market is quite complacent now. See Chart 2 below.

Chart 2: Volatility among the lowest in 118 years

Source: Deutsche Bank see above

e) Dow has reached the highest RSI overbought level since 1990

Using Bloomberg’s data since 1990, Dow’s RSI hit the highest yesterday at 88.5! Using Yahoo Finance data, MACD seems to have reached the highest level since 1990 too. Although overbought conditions can remain overbought for an extended period, extreme overbought levels such as now, typically face some form of consolidation in the near term.

My two cents worth

I have pared most of my equity positions and have have initiated opportunistic short Dow positions via CFDs as I think that markets, especially the U.S. market may consolidate in the near term.

Notwithstanding the above, based on current information, I believe that the trend continues to be up over the medium term and I am ready to accumulate shares either on weakness, or / and nearer to their results.

Some additional information

As some of my active clients are interested in the U.S. market, I have compiled a list of Dow 30 and S&P500 stocks, sorted by total potential return. Table 1 shows the top five stocks with the highest total potential return. (My clients will receive the full compilation of the above lists via email.)

Table 1: Top five U.S. Stocks sorted by total potential return

Source: Bloomberg 18 Jan 18

Criteria:

1. Component stock of Dow 30 / S&P500;

2. Presence of analyst target price;

3. Even though I put “Ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage;

4. Analyst target prices and estimated dividend yield may be subject to change anytime, especially after results announcement.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

P.S: Do note that as I am a full time remisier, I can change my equity allocation fast to capitalize on the markets’ movements.

Disclaimer

Please refer to the disclaimer HERE

I appreciate you sharing this post.Really looking forward to read more. Will read on…

Thank you ever so for you article post.Really thank you! Awesome.

Muchos Gracias for your post.Really looking forward to read more. Much obliged.

Wow, great post.Thanks Again. Awesome.

Thanks for sharing, this is a fantastic blog.Thanks Again. Great.

Thank you ever so for you article post.Much thanks again. Fantastic.

Very good post.Much thanks again. Much obliged.

This is one awesome blog article.Really thank you! Cool.

I truly appreciate this post.Much thanks again. Much obliged.

Thanks-a-mundo for the article post.Really looking forward to read more. Cool.

Enjoyed every bit of your blog article. Fantastic.

I really liked your blog article.Really thank you! Cool.

Enjoyed every bit of your blog.Really thank you! Cool.

Thank you for your blog post.Much thanks again. Cool.

Great, thanks for sharing this blog post. Will read on…

Great, thanks for sharing this article.Thanks Again. Cool.

Im obliged for the blog. Want more.

I value the blog. Great.

Great article post.Really looking forward to read more. Cool.

A big thank you for your article.Really looking forward to read more. Will read on…

I appreciate you sharing this article post.Really thank you! Really Great.

I cannot thank you enough for the article post.Really looking forward to read more. Really Great.

Im grateful for the article post.Really looking forward to read more.

Very neat article post.

A big thank you for your blog article.Really looking forward to read more. Really Cool.

Thank you ever so for you blog article. Will read on…

Thanks a lot for the post.Really looking forward to read more. Want more.

Thanks again for the article post.Much thanks again. Really Great.

Thank you for your blog. Keep writing.

I value the article.Thanks Again. Great.

Im obliged for the post.Much thanks again. Want more.

Thanks for the article post.Thanks Again. Fantastic.

Hey, thanks for the article post.Thanks Again. Fantastic.

Thanks for the blog. Awesome.

Thanks again for the blog article.Thanks Again. Want more.

A round of applause for your article post. Really Great.

Thanks so much for the blog post.Really looking forward to read more. Keep writing.

I loved your blog. Keep writing.

A round of applause for your blog.Really looking forward to read more. Keep writing.

Major thankies for the blog.Thanks Again. Keep writing.

Fantastic blog.Really looking forward to read more.

I loved your blog post.Thanks Again. Fantastic.

Major thanks for the blog article.Really looking forward to read more. Great.

Major thanks for the article.Much thanks again. Keep writing.

Thanks so much for the article post.Really thank you! Much obliged.

I truly appreciate this blog post.Really looking forward to read more. Great.

I value the blog post.Really looking forward to read more.

Major thankies for the article post.Really thank you! Cool.

Really informative article.Really thank you! Awesome.

Im grateful for the blog article.Really looking forward to read more.

Appreciate you sharing, great article post. Much obliged.

Appreciate you sharing, great blog article.Really looking forward to read more.

I value the blog.Much thanks again. Really Great.

Very informative article post.Thanks Again. Will read on…

Im thankful for the post.Much thanks again. Will read on…

I cannot thank you enough for the article.Really looking forward to read more. Much obliged.

Awesome blog article.Really looking forward to read more. Want more.

Im thankful for the article post.

Wow, great blog post.Much thanks again. Really Cool.

Im grateful for the article. Fantastic.

Im obliged for the blog article.Really looking forward to read more.

A round of applause for your blog.Really looking forward to read more.

I really like and appreciate your post.Much thanks again. Keep writing.

Thanks for sharing, this is a fantastic article. Really Cool.

Very informative article post.Much thanks again. Fantastic.

Appreciate you sharing, great blog article.Really looking forward to read more. Cool.

Thanks for the blog.Thanks Again. Want more.

Thanks so much for the blog article.Thanks Again. Keep writing.

Appreciate you sharing, great post.Really looking forward to read more. Much obliged.

Im thankful for the blog post.Thanks Again. Really Cool.

Thanks a lot for the blog article.Really looking forward to read more. Great.

Very good blog.Much thanks again. Really Great.

Thanks for sharing, this is a fantastic blog post.Thanks Again. Will read on…

A round of applause for your blog post. Cool.

Great, thanks for sharing this article post.Much thanks again. Awesome.

I am so grateful for your article.Much thanks again.

Thank you for your blog. Really Cool.

A big thank you for your article. Really Great.

Thanks for the article.Really looking forward to read more. Really Great.

I truly appreciate this post.Really thank you! Awesome.

Thanks again for the blog.Really looking forward to read more.

Thanks again for the article.Much thanks again. Want more.

Thanks-a-mundo for the article.Much thanks again. Awesome.

Thanks again for the post.Thanks Again. Awesome.

Major thankies for the article post. Fantastic.

Major thanks for the article.Really looking forward to read more. Really Cool.

Really appreciate you sharing this article post.Really looking forward to read more. Cool.

Awesome blog.Much thanks again. Want more.

Im obliged for the article. Want more.

I loved your blog article.Much thanks again. Much obliged.

A round of applause for your post.Thanks Again.

I think this is a real great post.Thanks Again. Keep writing.

Say, you got a nice blog post. Awesome.

Muchos Gracias for your article post. Keep writing.

Thanks a lot for the blog post.Really thank you! Will read on…

Thanks for sharing, this is a fantastic blog.Really looking forward to read more. Will read on…

A round of applause for your blog.Really thank you! Really Cool.

Thank you for your blog post. Much obliged.

Really appreciate you sharing this blog article.Much thanks again. Great.

A round of applause for your article.Really looking forward to read more. Want more.

Thanks again for the blog post.Really looking forward to read more.

I am so grateful for your post.Much thanks again. Fantastic.

Great, thanks for sharing this blog.Much thanks again. Great.

I really like and appreciate your post. Really Great.

Thanks so much for the blog post.Much thanks again. Fantastic.

I truly appreciate this blog post.Thanks Again. Much obliged.