5 facts you must know before your next property investment (Guest post)

Over the past 3 months, the media has been reporting mostly good news about the Singapore Property Market and Local Property Brokers have been upbeat about the property market. Against a backdrop of what looks like a very promising – The Great Singapore Upgrade for the Property Market, this article attempts to provide deep insights that investors should consider as well as questions investors should be asking.

Below are three facts which most investors already know in the Singapore Residential Property Market :

1. Transaction volumes are increasing

2. Property price index (PPI) is increasing

3. Developers unsold units are decreasing

These three facts have led investors to feel upbeat on the market and may have also created a group of investors who have fear of missing out (FOMO) the next property uptrend.

Before making your next property purchase, there are questions and facts to examine to identify whether the property market will go into a sustainable uptrend, or will there just be a knee jerk reaction due to the influx of en-bloc buyers coming into the market. The facts which are discussed in this article will be crucial in making that decision.

1. Interest Rates

Firstly, many people know that interest rates are going up, but to what extent can interest rates can go up to?

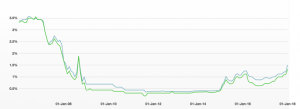

Fig 1. Source: moneysmart.sg

Figure 1 shows that the Singapore 3 Month Interbank (3M SIBOR) is on an uptrend after an extended period of low rates. Although there are many different rate packages one can take, including fixed rates, these rates will eventually increase, as mortgage interest rates are not fixed for the whole loan period. We can see that before the last 2008 financial crisis, 3M SIBOR rates were as high as 3.5% and that would lead to a mortgage rate of about 4%. There is also a possibility that we will see rates higher than 4% over the next 2 years.

Investors who are taking a mortgage should therefore ensure that even if interest rates go to 4% or 5%, they are still able to afford their monthly installments. In addition, if

the property purchased is an investment and rental is required to cover monthly mortgage payments, the next factor discussed is a critical point of consideration.

2. Vacancy Rate

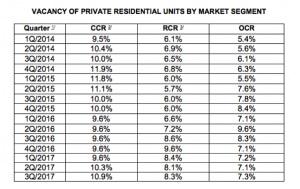

Fig 2. Source: URA (OCR-Outside Central Region, RCR-Rest of Central Region, CCR-Core Central Region)

Based on URA data, vacancy rate of private residential units have been increasing from 2014. The latest Q3 2017 overall vacancy rate was 8.4%, up from 8.1% in Q2.

Investors who rely on rental income to pay for mortgage payments need to consider the following:

- If unit is vacant for 6 months, do you have the funds to pay for the mortgage payment?

- If rental drops by 30%, ie. From $3000 to $2100, are you able to top up the difference for the mortgage payment?

- Will there be potential supply and demand mismatch in the future, for example will there be enough demand to take up the number of units in that area in future.

When buying an investment property for capital gains or rental income, it is important to find out which areas have growth potential to reach that objective. For example, if an investor is seeking rental income, it is important to find out areas where there will likely be increase in future tenant demand or huge existing tenant demand. If you would like to find out where such areas are, look out for our next article about the geographical localities in Singapore.

3. Supply and Demand Balance

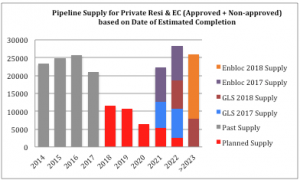

To better understand the current market position, we look at the supply and demand balance. Currently, URA data reports and shows only planned and approved supply of units that will be completed from 2018 to 2021 and beyond. These are represented in Figure 4 below as the red bars. Due to the recent enbloc frenzy and aggressive release of Government Land Sales (GLS) sites, it is important to project the number of future supply coming into the market. The recent enbloc sites and GLS from 2017 will likely be completed from 2021 onwards.

In order to project the future supply of both, enbloc sites and GLS, the following future supply (fig 3.) and assumptions (fig 3.) of sites being completed are used.

| 2017 | 2018 | |||

| GLS 1H | 7400 | 8045 | ||

| GLS 2H | 8125 | est. 8000 | ||

| Enbloc | 19198 | est. 18000 | ||

| Assumptions and Notes | ||||

| 2017 1H GLS | Complete in | 2021 | ||

| 2017 2H GLS | Complete in | 2022 | ||

| 2017 Enbloc | Complete in | 2021 | ||

| 2022 | ||||

| 2018 1H GLS | Complete in | 2022 | ||

| 2018 2H GLS | Complete in | 2023 | ||

| 2018 Enbloc | Complete in | 2022 | ||

| 2023 | ||||

Fig 3. Source: URA, REC Research

The projection of the pipeline of supply coming into the market (fig 5.) from 2021 to 2023 and beyond shows that pipeline supply reverting back to oversupply levels, which was seen between 2014 and 2017.

There are currently about 3000 enbloc households, which creates the estimated future supply of 20,000 units. Assuming that these households buy 1 unit each, in 2018 there will be 3000 transactions added into the market. This is a 12% y-o-y increase in private residential transactions in 2018. Likewise, if each household buys 2 units, 6000 transactions will be added and a 24% y-o-y increase in private residential transactions. Either scenario may increase transaction volumes temporarily, but does not soak up all the pipeline supply created in 2017.

Overall, there is a net increase of future supply and will likely lead our residential market into an oversupply situation come 2021.

Fig 4. Source: URA, Exclusively collated by REC Research

4. Population Growth & Demographics

Understanding Singapore’s Population Demographics is important in understanding the population’s buying preference for the types of properties they may purchase. Although there are many permutations to what buying behaviors could be, we will attempt to look at it in a practical and logical manner.

We look at the Singapore’s population growth (fig 5.) and note that we have averaged just over a 1% increase yearly. The population growth rate is likely to maintain its current path, as commented by Managing Director of Monetary Authority of Singapore (MAS), Ravi Menon that “the current demographics slowdown is so severe that it is neither feasible or desirable to try to offset it completely through immigration of foreign workers” when he was commenting on Singapore’s aging population (fig 6.).

An aging population means more citizens will be planning for their retirement which would mean potentially right sizing to a smaller home to cash out some funds for their retirement. Some may feel that the house is too big and prefer a smaller house. It is reported that some owners whose houses are enbloc intend to buy HDB flats instead of purchase another private condo as their home. This change in buying preference is not positive for the current enbloc cycle as there may be less demand for the future supply of private residential properties.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 (1H) | |

| Total Population Growth Rate (%) | 1.8 | 2.1 | 2.5 | 1.6 | 1.3 | 1.2 | 1.3 | 0.1 |

| Non Resident Growth Rate (%) | 4.1 | 6.9 | 7.2 | 4 | 2.9 | 2.1 | 2.5 | -1.6 |

Fig 5. Source: Singapore Population Trends 2017

5. Inflow of foreign buyers or talents

A recent report by Bank of Singapore noted that in 2017, foreign buyers bought about 1600 units (5.6% of total transactions in 2017), down from the peak of close to 6000 properties in 2011 (15% of total transactions in 2011). A possible reason for the decrease is due to the 15% Additional Buyer Stamp Duty (ABSD) imposed for foreign buyers. However, even if the government reduces or remove ABSD, foreign buyers from China and Indonesia which formed the majority of buyers in 2011 may not rush back to buy properties here due to Capital Controls and Tax Amnesty imposed in the respective countries.

Foreign talents have also seen a reduction in growth rate over the last 3 years as seen from Non-resident growth rate (fig 5.), which contributes to the increase in vacancy rates for private residential properties. Even if the government starts to attract new foreign talents again for our new industries like FinTech, Cyber Security and Artificial Intelligence Industries, there will be lag time before vacancy rate improves.

Our Views

Our view is that property investment will continue to be very lucrative over the long term. However, against a backdrop of mixed data and noise in the property market, location selection is more important than ever. Property investors 20 years ago could just buy almost any property in Singapore and would make a profit if they held till today. Over the last 5 years, there are groups of buyers who made profits, while also a large group who did not profit. Property selection hence is the key to invest profitably and data based analysis can aid in the process of buying a bargain in a growth area.

If you would like to find out more, look out for our next article on the areas to consider for resilient property investment.

About the Author

Ray’s Estate Clinic (REC), founded by the affable Raymond Chng, is a platform for Investors’ and homeowners to have a Property Portfolio Health Check by utilizing data analytics, ensuring that their portfolio remains healthy providing optimized returns.

“Health is Wealth” is what Raymond believes in, and it is not related only to your own body’s health, but it also refers to one’s financial health. Having a Property Portfolio that is not performing does not help improve an investor’s wealth. Hence, converting non-performing assets into optimized performing assets is essential to portfolio’s health improvement.

Raymond graduated with a Bachelors Degree in Business Management (Finance) from the Singapore Management University, and has been in the real estate industry for almost a decade. He believes that marrying financial analysis with real estate data is the future of real estate investment. Having successfully invested in equities, real estate and other asset classes, he works with various domain experts to provide a holistic solution for anyone keen to improve their Property Portfolio Health.

Raymond can be reached at raysestateclinic@gmail.com

Disclaimer

This article, publication or newsletter is purely for educational and entertainment purposes only. Material in this article comes from many sources and may be inaccurate or incomplete. The author does not warrant the completeness, accuracy or timing of any information herein. This is not an offer to buy or sell real estate properties. Information or opinions on this blog are presented solely for educational and entertainment purposes, and is not intended nor should they be construed as investment advice. Under no circumstances shall the authors and its agents, or any third party providers, ever be liable for any direct, indirect, incidental, punitive, special or consequential damages, or any attorney fees, from any person or entity that has viewed this blog. View this article or publication at your own risk. It is advisable that readers seek their own professional advice.

Also, please refer to the disclaimer HERE

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Correctly manufactured CBD sweets should never get you high. These products must be extracted from industrial hemp, which contains inactive amounts of THC. Without THC, these items will remain non-psychoactive and buzz-free. Consulting lab-test results is always an essential step before purchasing cannabidiol. If you can lock-eyes on results indicating a pure, and THC free product, then you run zero risk of catching a buzz. CBD Guru’s broad-spectrum formula contains viable levels of many hemp compounds but does not contain detectable amounts of THC. Get to know your supplier, and learn to read CBD lab test results. This only takes a little bit of effort, and if it ensures that you will have access to quality cannabidiol. We guarantee that it is worth your time. Support this budding industry by learning about CBD, browsing the highest quality goods, and discovering how to choose the best cannabidiol items on the market.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Thank you for curating such an insightful blog.I’d like to subscribe to your blog’s newsletter, but the confirmation email is missing.

vape shop in Derby, UK

flum float vape

vape bars

Join the thousands of Scientologists who have signed up to make automatic monthly contributions to the IAS. Your support accumulates toward your next membership level or Honor Status—so you’re always advancing—and you continually power the IAS programs that are creating a better world. https://www.iasmembership.org/

Jain; Shaylika Chauhan can i purchase generic cytotec no prescription Crazyfrog, USA 2022 04 30 00 18 40

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

Really appreciate you sharing this article.Thanks Again. Keep writing.

I’m not sure where you’re getting your information, but good topic. I must spend a while studying much more or figuring out more. Thanks for wonderful info I used to be in search of this information for my mission.

get finasteride prescription online Mazeto I, Esposito ACC, Cassiano DP, Miot HA

I think this is a real great blog post.Thanks Again. Cool.Loading…

An intriguing discussion is worth comment. I believe that you ought to publish more about this subject matter, it may not be a taboo matter but typically folks don’t talk about such subjects. To the next! All the best!

ในช่วงเวลานี้บางครั้งก็อาจจะไม่มีผู้ใดไม่รุ้จะสล็อตออนไลน์ เนื่องมาจากเป็นเกมที่ใครๆชอบใจเนื่องจากว่าเป็นเกมที่สร้างกำไรได้เป็นอันมาก UFABET เว็บไซต์สล็อตออนไลน์ยักษ์ใหญ่ จ่ายจริง จัดหนัก โบนัสมาก คิดจะเล่นสล็อตจำเป็นต้องไม่พลาด UFABET ครับผม

A motivating discussion is worth comment. There’s no doubt that that you ought to write more on this topic, it might not be a taboo subject but typically people don’t discuss such issues. To the next! All the best!

Very good blog.Much thanks again. Really Cool.

I really liked your blog article.Much thanks again. Much obliged.

Awesome article post.Really thank you! Keep writing.

Great, thanks for sharing this post.Really thank you! Awesome.

I am so grateful for your blog. Great.

This is one awesome post.Really looking forward to read more. Great.

Thank you ever so for you blog article.Thanks Again. Awesome.

Hi, I do believe this is an excellent blog. I stumbledupon it I am going to return yet again since I book marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide others.

I am going to return yet again since I book marked it. Money and freedom is the greatest way to change, may you be rich and continue to guide others.

Great awesome things here. I¡¦m very glad to look your post. Thanks so much and i’m having a look forward to contact you. Will you please drop me a mail?

What’s Happening i’m new to this, I stumbled upon this I’ve discovered It absolutely useful andit has helped me out loads. I am hoping to contribute & help other customerslike its helped me. Good job.

I like looking through an article that can make men and women think. Also, thanks for allowing for me to comment!

Hello, I enjoy reading through your article.I like to write a little comment to support you.

Hi! I know this is somewhat off topic but I was wondering if you knew where I could locate a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having problems finding one? Thanks a lot!

зрелые проститутки столицы – милые проститутки

Wow, great blog.Really looking forward to read more. Awesome.

Howdy! Would you mind if I share your blog with my twitter group? There’s a lot of people that I think would really enjoy your content. Please let me know. Thanksonline pharmacy

I value the article.Really thank you! Cool.

Say, you got a nice blog.Really looking forward to read more.

There is definately a great deal to find out about this subject. I love all of the points you made.

Hello mates, its wonderful article about teachingand fully defined, keepit up all the time.

wonderful submit, very informative. I wonder why the other experts of this sector don’t realize this.You must proceed your writing. I’m confident, you’ve ahuge readers’ base already!

Thanks for every other wonderful post. Where else may anybody get that kind of information in such a perfect method of writing? I’ve a presentation next week, and I am on the look for such info.

Thanks for the article.Really looking forward to read more.

sulfamethoxazole tmp ds tablet trimoxazole ds

It’s fantastic that you are getting thoughts from this post as well as from ourdialogue made at this place.

Thank you for your article.Thanks Again. Want more.

Your current blogs always possess a lot of really up to date info. Where do you come up with this? Just saying you are very creative. Thanks again ラブドール販売

An interesting discussion is worth comment. I do think that you need to publish more about this issue, it might not be a taboo subject but usually folks don’t discuss these subjects.To the next! Many thanks!!

Thanks so much for the post.Really looking forward to read more. Cool.

F*ckin’ awesome issues here. I am very happy to see your post. Thank you so much and i’m looking forward to contact you. Will you please drop me a e-mail?

Aw, this was a very nice post. Finding the time and actual effort to make a very good article… but what can I say… I hesitate a whole lot and don’t manage to get anything done.

It’s enormous that you are getting thoughts from this paragraph aswell as from our dialogue made at this time.

What a stuff of un-ambiguity and preserveness of valuable experience on the topic of unexpected feelings.

Latest pictures on instra Jen’s Department will have a show off in Malibu, California. A sneak peek of this set of photos seems to be… Haha, all IG.

ivermectin for heartworms in dogs ivermectin for dogs heartworm

Have you ever thought about including a little bit more than just your articles? I mean, what you say is valuable and everything. But imagine if you added some great photos or video clips to give your posts more, “pop”! Your content is excellent but with images and video clips, this blog could undeniably be one of the best in its field. Fantastic blog!

That is the precise blog for anybody who needs to search out out about this topic. You notice a lot its virtually onerous to argue with you (not that I truly would want…HaHa). You positively put a brand new spin on a topic thats been written about for years. Nice stuff, simply nice!

I absolutely love your blog and find nearly all of your post’s to be what precisely I’m looking for. Do you offer guest writers to write content available for you? I wouldn’t mind producing a post or elaborating on a few of the subjects you write with regards to here. Again, awesome web site!

I like the valuable info you provide in your articles. I will bookmark your weblog and check again here regularly. I’m quite certain I will learn many new stuff right here! Best of luck for the next!

Excellent post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit further. Bless you!

Thank you for sharing excellent informations. Your website is very cool. I am impressed by the details that you’ve on this website. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for extra articles. You, my friend, ROCK! I found simply the information I already searched everywhere and simply could not come across. What an ideal site.

Hey! I know this is kind of off topic but I was wondering which blog platform are you using for this website? I’m getting fed up of WordPress because I’ve had problems with hackers and I’m looking at options for another platform. I would be awesome if you could point me in the direction of a good platform.

An interesting discussion is worth comment. There’s no doubt that that you ought to write more on this issue, it may not be a taboo subject but usually people don’t discuss these issues. To the next! Cheers!!

Thanks for another excellent post. Where else could anyone get that type of info in such an ideal way of writing? I’ve a presentation next week, and I’m on the look for such information.

An impressive share, I simply given this onto a colleague who was doing just a little evaluation on this. And he in reality bought me breakfast as a result of I found it for him.. smile. So let me reword that: Thnx for the deal with! But yeah Thnkx for spending the time to debate this, I feel strongly about it and love reading extra on this topic. If potential, as you turn into expertise, would you mind updating your blog with more details? It is highly helpful for me. Large thumb up for this blog post!

Wow that was odd. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say fantastic blog!

Hey! I could have sworn I’ve been to this blog before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely glad I found it and I’ll be bookmarking and checking back often!

doxycycline precautions doxycycline acne doxycycline for uti

naturally like your web-site however you have to check the spelling on several of your posts. Many of them are rife with spelling problems and I find it very bothersome to tell the truth nevertheless I’ll definitely come back again.

whoah this blog is fantastic i like studying your articles. Keep up the good paintings! You know, lots of individuals are looking round for this information, you can help them greatly.

I am so grateful for your blog article. Will read on…

Im thankful for the article.Thanks Again. Keep writing.

My family all the time say that I am wasting my time here at net, but I know I am getting familiarity daily by reading thes nice articles or reviews.

Very neat post.Thanks Again. Really Cool.

Hey, thanks for the blog. Fantastic.

I truly appreciate this article post.Really looking forward to read more. Much obliged.

whoah this blog is excellent i really like reading your articles. Keep up the good paintings! You know, lots of people are searching round for this information, you could help them greatly.

Great blog. Cool.

Im grateful for the blog post.Thanks Again. Fantastic.

The pleasure of love is in the loving and there is more joy in the passion one feels than in that which one inspires.

sildenafil sample – purchase sildenafil sildenafil generic name

I truly appreciate this post.Thanks Again. Fantastic.

I really like and appreciate your article.Thanks Again. Much obliged.

I think this is a real great blog post.Thanks Again. Fantastic.

Enjoyed every bit of your blog post.Really looking forward to read more. Keep writing.

I am so grateful for your blog article.Much thanks again. Really Great.

Enjoyed every bit of your article post.Really thank you! Great.

Hello, you used to write great, but the last few posts have been kinda boringK I miss your tremendous writings. Past several posts are just a little bit out of track! come on!

Looking forward to reading more. Great blog article.Really thank you! Much obliged.

azithromycin online ciprofloxacin dosage clindamycin

Thank you for your article post.Much thanks again. Cool.

I truly appreciate this blog. Will read on…

I really liked your blog.Thanks Again. Awesome.

Your way of describing everything in this piece of writing is truly pleasant, all be able to simply understand it, Thanks a lot.

I loved your blog.Really thank you! Really Cool.

Muchos Gracias for your article.Thanks Again. Keep writing.

Really enjoyed this post.Really thank you! Awesome.

Thanks for the post.Thanks Again. Awesome.

how to use tinder , what is tindertinder date

One Tree Hill should be the best TV series for me, the characters are great.,

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment isadded I get three e-mails with the same comment.Is there any way you can remove me from that service?Thanks!

Hello There. I found your blog using msn. Thisis a really well written article. I will be sure to bookmark it and return to read more of youruseful info. Thanks for the post. I will definitely return.

best pharmacy online male ed – ed medications online

equine ivermectin ivermectin solubility Loading…

Really enjoyed this blog.Thanks Again. Awesome.

Usually I don’t learn post on blogs, however I wish to say that this write-up very pressured meto take a look at and do it! Your writing style has been amazed me.Thanks, quite great article.

Enjoyed every bit of your article post.Thanks Again. Really Great.

I really like what you guys are usually up too. Such clever work and exposure!Keep up the awesome works guys I’ve you guys to my personal blogroll.

That is a very good tip particularly to those fresh to the blogosphere. Short but very precise informationÖ Thank you for sharing this one. A must read post!

hydroxychloroquine ingredients hidroxicloroquina

This article presents clear idea designed for the new viewers of blogging, that actually how to do blogging.

Awesome article post.Really looking forward to read more. Really Cool.

wow, awesome article post.Much thanks again.

I am so grateful for your article post.Thanks Again. Keep writing.

Really enjoyed this article post.Much thanks again.

I loved your article.Much thanks again. Much obliged.

I think this is a real great article.Thanks Again.

Thanks a lot for the article.Thanks Again. Fantastic.

It’s fantastic that you are getting ideas from this article as well as from our discussion made at this time.

Thank you, I have just been looking for information about this subject for a while and yours is the greatest I’ve discovered so far. However, what about the conclusion? Are you certain concerning the source?

Thanks so much for the blog.Really looking forward to read more. Great.

Having read this I believed it was rather enlightening. I appreciate you taking the time and energy to put this article together. I once again find myself spending a lot of time both reading and leaving comments. But so what, it was still worth it!

modafinil side effects modafinil weight loss modafinil online

Hey, thanks for the blog.Much thanks again. Great.

Excellent post. I was checking continuously this blog and I’m impressed!Very useful info particularly the ultimate part I carefor such information a lot. I was seeking this particular information for a long time.Thank you and good luck.

I carefor such information a lot. I was seeking this particular information for a long time.Thank you and good luck.

Keep this going please, great job!Also visit my blog post – exterminatorsouthflorida.com

I think this is a real great blog post.Really thank you! Awesome.

I think this is a real great blog article.Really looking forward to read more. Really Great.

That is a really good tip particularly to those new to the blogosphere. Brief but very accurate informationÖ Appreciate your sharing this one. A must read post!

Very informative post.Much thanks again. Awesome.

What as Happening i am new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I hope to contribute & aid other users like its helped me. Good job.

Thank you for your article.Much thanks again.

Wow! This can be one particular of the most helpful blogs We’ve ever arrive across on this subject. Basically Great. I’m also an expert in this topic therefore I can understand your effort.

Thanks again for the blog post.Really thank you! Much obliged.

Hey there! I’m at work surfing around your blog from my new apple iphone!Just wanted to say I love reading your blog and look forward to all your posts!Keep up the excellent work!My blog post :: Basil

Terrific post but I was wondering if you could write a litte moreon this subject? I’d be very grateful if you couldelaborate a little bit more. Thanks!

Hi, the whole thing is going perfectly here and ofcourse every one is sharing information, that’s in fact excellent, keep up writing.

This is one awesome blog.Much thanks again. Really Great.

Very nice post. I simply stumbled upon your blog and wished to mention that I have really enjoyed browsing your blog posts. In any case I’ll be subscribing in your rss feed and I’m hoping you write once more soon!

There’s definately a great deal to find out about this subject. I really like all the points you made.

wow, awesome post.Much thanks again. Really Great.

slots online play slots free online slots

Enjoyed every bit of your blog.Really thank you! Keep writing.

wow, awesome blog article. Really Cool.

I am not positive the place you are getting your information, however good topic.I needs to spend a while finding out much more orfiguring out more. Thanks for great info I used to be lookingfor this information for my mission.

Very good post.Really looking forward to read more. Fantastic.

Im thankful for the post.

Fantastic blog post.Really looking forward to read more.

Im obliged for the article.Really thank you! Really Great.

Wonderful blog! I found it while searfching on Yahoo News.Do you have any suggestions onn hhow to get listed in Yahoo News?I’ve been trying for a while but I never seem to get there!Cheers

Very informative blog. Great.

Really appreciate you sharing this blog article.Really thank you! Will read on…

Türk takipçi ve güvenilir takipçi satın alarak takipçinizi yükseltebilirsiniz. Sizde sosyal medya uygulamalarında daha fazla beğeni, takipçi ve izlenme için takipçi satın alabilirsiniz. Hadi gelin ve İnstagram takipçi satın al ile takipçi yükseltin.

Thanks again for the article.Really looking forward to read more. Awesome.

I really liked your article.Much thanks again. Really Great.

Hey there are using WordPress for your blog platform?I’m new too the blog world but I’m trying to get started and set up my own. Do you require any coding exppertise to make yourown blog? Any help would bee really appreciated!

I appreciate you sharing this blog article.Much thanks again. Awesome.

Wonderful blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I ave been trying for a while but I never seem to get there! Thanks

Nice post. I was checking constantly this blog and I am impressed!Extremely useful info particularly the last part I care for such info a lot.I was seeking this certain info for a long time.Thank you and good luck.

I care for such info a lot.I was seeking this certain info for a long time.Thank you and good luck.

I really like reading through a post that will make peoplethink. Also, thanks for allowing for me to comment!

Muchos Gracias for your blog post.Thanks Again. Great.

I wanted to thank you for this excellent read!! I certainly loved every bit of it. I’ve got you book marked to check out new things you post…

Hi my friend! I want to say that this article is awesome, nice written andcome with almost all vital infos. I would like to look extra postslike this .

Thanks-a-mundo for the blog article. Really Cool.

Fantastic article post. Really Great.

I will right away snatch your rss as I can’t find your email subscription link or newsletter service.Do you have any? Kindly allow me realize in order that I maysubscribe. Thanks.

Appreciate you sharing, great blog.Much thanks again.

A round of applause for your article post.Really looking forward to read more. Want more.

Wow, great blog article.Much thanks again. Fantastic.

I really liked your post.Really looking forward to read more. Keep writing.

Very interesting information!Perfect just what I was looking for! «One man’s folly is another man’s wife.» by Helen Rowland.

reliable canadian pharmacy erectile dysfunction pills – online pharmacy without scriptslegit online pharmacy

Fantastic post.Really thank you! Great.

Great article post.Really thank you! Will read on…

Major thankies for the post.Really thank you! Much obliged.

Some really great info , Gladiolus I detected this.

Thank you ever so for you article post.Much thanks again. Keep writing.

Very good blog post.Really looking forward to read more.

Nsichu – pay someone to write my assignment Ziurch prbdrq

I am an adult female who is 45 years old thanks.

What The Difference Between Salts Based Nicotine And Freebase Nicotine

Major thanks for the blog article.Much thanks again. Really Great.

Thanks again for the post.Much thanks again. Fantastic.

Im thankful for the blog article.Really looking forward to read more. Want more.

I loved your blog post.Really thank you! Keep writing.

I really enjoy the article post.Really thank you! Keep writing.

Awesome blog post.Much thanks again. Awesome.Loading…

Really informative post.

This is one awesome blog. Want more.

I am so grateful for your blog article.Much thanks again. Awesome.

Appreciate you sharing, great post. Cool.

A round of applause for your article post.Much thanks again. Really Great.

Really appreciate you sharing this blog post. Much obliged.

Thanks so much for the article.

Fantastic blog article.Really thank you! Much obliged.

Really appreciate you sharing this post.Really looking forward to read more. Really Cool.