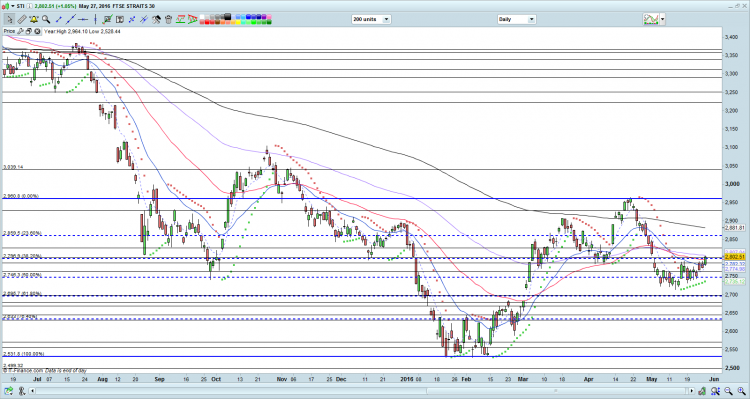

Ernest’s market outlook (27 May 16)

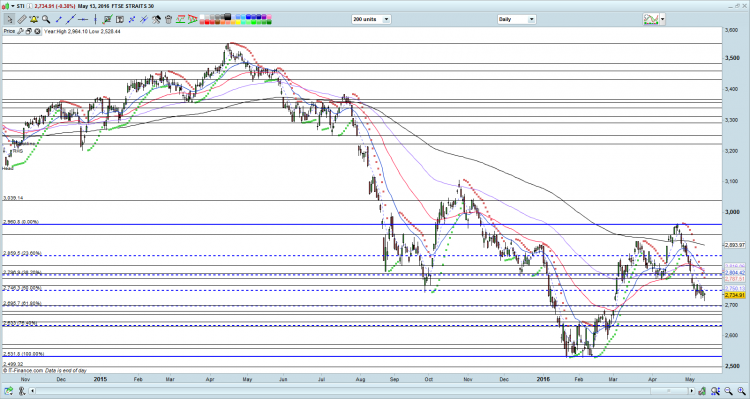

Dear readers, Two weeks ago, I mentioned that although I am cautious on the overall market in the next couple of months, I have spotted at least two companies which I may accumulate on weakness. I have since increased my percentage invested from around 36% to 80% by accumulating on one stock on weakness. About half of my portfolio (i.e. approximately 40%) is invested in one stock. Notwithstanding some specific stocks, I remain cautious on the general market. Read on to find out why. S&P500 Index Just to recap what I have mentioned on 13 May 2016 (see here), […]