Ernest’s market outlook 28 Sep 15

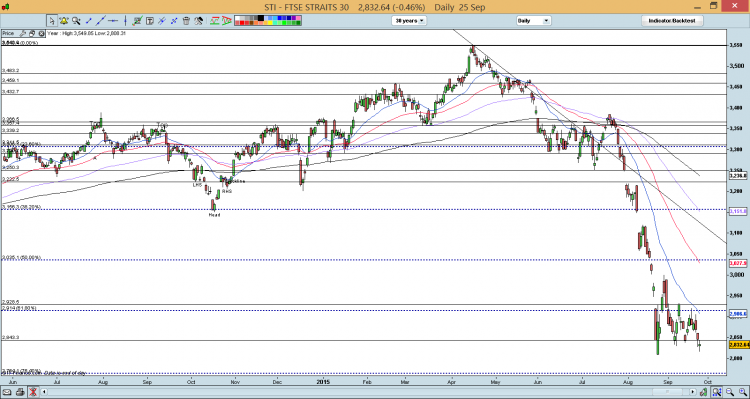

Dear readers, The past two weeks have been eventful with the conclusion of the FOMC meeting on 18 Sep with no rate hike, amid concerns on an uncertain outlook for global growth, recent financial-market turmoil and low inflation. However, during Fed Chair Yellen’s speech at the University of Massachusetts at Amherst on 25 Sep morning (Singapore time), she said that the Fed is on track to raise interest rates in 2015, barring unforeseen economic surprises. Markets have whipsawed as they try to determine the timing of the rate hike (the first in almost a decade) and its impact on the […]