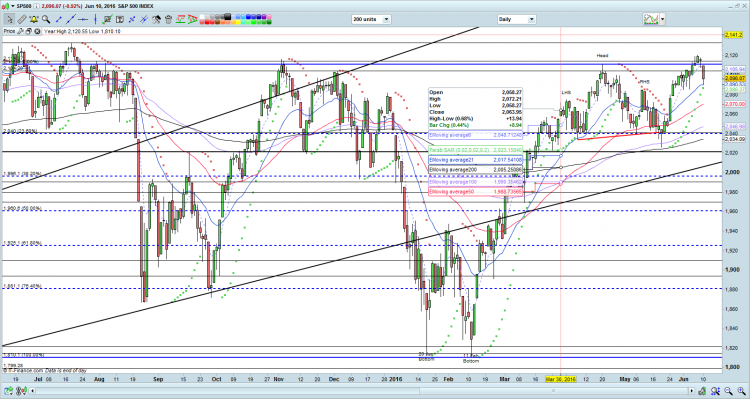

My interview on Mediacorp Ch 8, 9am, Morning Express 晨光第一线 (24 Jun 2016)

Dear all, I am pleased to say that I have appeared on Mediacorp Ch 8, 9am, Morning Express 晨光第一线 on 24 Jun 2016. Readers who wish to know my market outlook on Morning Express 晨光第一线 can click the link indicated below. Please scroll the time bar to 14:00 to view it. http://video.toggle.sg/en/tv-show/news/may-2016-morning-express/fri-27-may-2016/407281